What Are Other Current Liabilities?

Other current liabilities are a category of liabilities that a company owes and expects to settle within one year or the normal operating cycle, whichever is longer. These liabilities are different from current liabilities, which include items like accounts payable, accrued expenses, and short-term debt.

Other current liabilities can include a wide range of obligations that a company has to fulfill in the short term. They can arise from various sources, such as legal settlements, customer deposits, taxes payable, and deferred revenue.

Examples of Other Current Liabilities

Here are some examples of other current liabilities:

- Unearned revenue: This is the money received in advance for goods or services that have not yet been delivered or performed.

- Customer deposits: These are payments made by customers in advance to secure a future purchase or service.

- Accrued expenses: These are expenses that have been incurred but not yet paid, such as salaries, utilities, and rent.

- Income taxes payable: This is the amount of income tax that a company owes to the government for the current year.

- Legal settlements: These are payments that a company is required to make as a result of a legal dispute or settlement.

Accounting for Other Current Liabilities

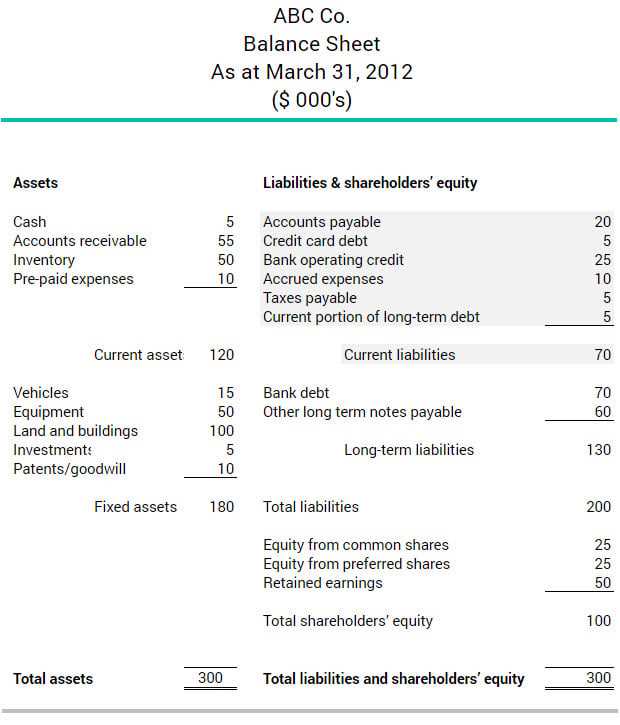

Other current liabilities are recorded on a company’s balance sheet as a separate category under current liabilities. They are usually reported at their estimated settlement amount, which is the amount the company expects to pay to fulfill its obligations.

When a liability is settled or paid off, it is removed from the other current liabilities category and recorded as an expense or reduction in cash, depending on the nature of the liability.

Importance of Other Current Liabilities in Corporate Finance

By properly managing and monitoring other current liabilities, companies can ensure that they have enough resources to meet their short-term obligations and maintain a healthy financial position. Failure to do so can lead to cash flow problems, increased borrowing costs, and potential financial distress.

Definition of Other Current Liabilities

Other current liabilities are financial obligations that a company is expected to settle within one year or its normal operating cycle, whichever is longer. These liabilities are not classified as accounts payable or short-term debt, but rather represent a broad category of obligations that do not fit into other specific categories.

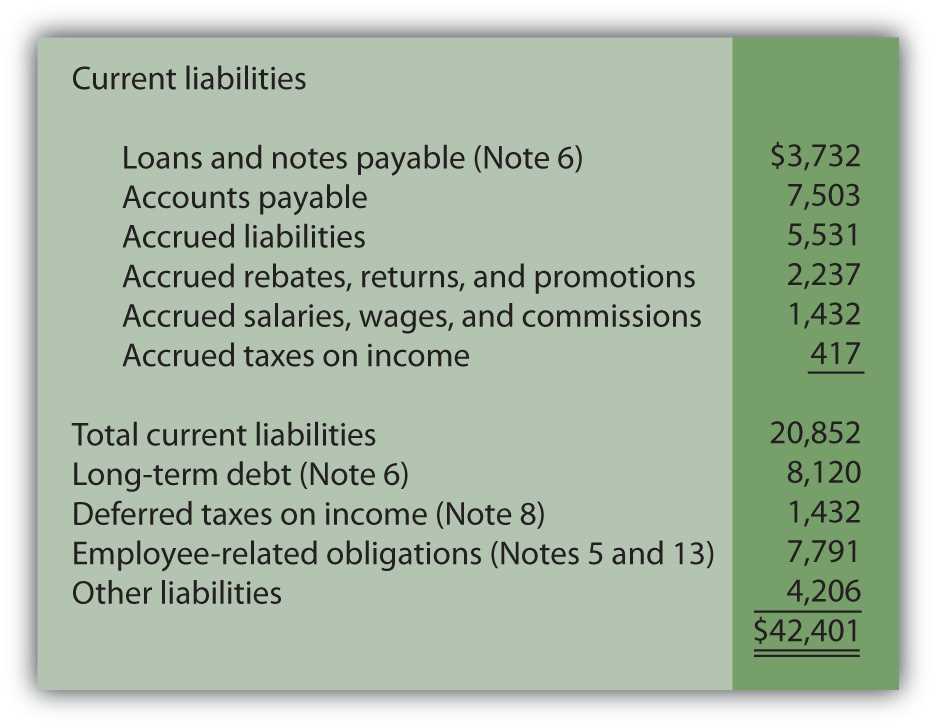

Other current liabilities can include a variety of items, such as accrued expenses, deferred revenue, customer deposits, and taxes payable. Accrued expenses are costs that have been incurred but not yet paid, such as salaries, utilities, and rent. Deferred revenue represents payments received in advance for goods or services that have not yet been delivered or performed. Customer deposits are funds received from customers as a guarantee of future purchases or services. Taxes payable are amounts owed to government authorities for income taxes, sales taxes, or other types of taxes.

Classification and Presentation

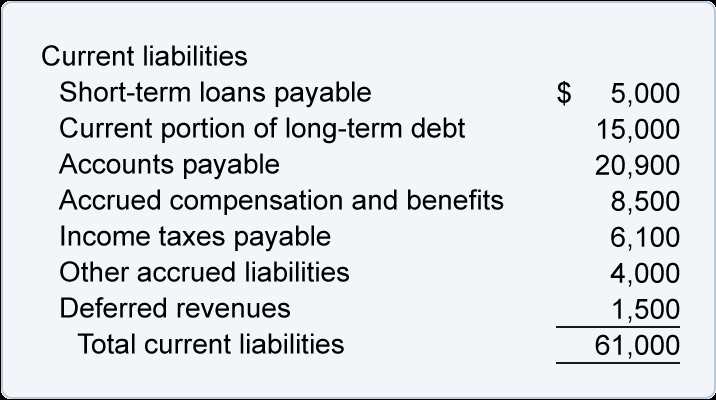

Other current liabilities are typically reported on a company’s balance sheet under the liabilities section. They are usually listed after accounts payable and short-term debt. It is common for companies to provide a separate line item for other current liabilities to distinguish them from more specific categories of liabilities.

Within the other current liabilities category, individual items may be further classified based on their nature or timing of settlement. For example, accrued expenses may be broken down into separate line items for salaries payable, rent payable, and utilities payable. This level of detail helps users of financial statements better understand the nature and magnitude of a company’s short-term obligations.

Importance in Financial Analysis

Other current liabilities play a crucial role in financial analysis and decision-making. They provide valuable information about a company’s short-term financial health and its ability to meet its obligations in the near future.

By analyzing the composition and trends of other current liabilities, investors and creditors can assess a company’s liquidity position and its ability to generate sufficient cash flow to cover its short-term obligations. High levels of other current liabilities relative to a company’s assets or equity may indicate financial stress or potential liquidity issues.

Additionally, changes in other current liabilities over time can provide insights into a company’s financial performance and management’s effectiveness in managing working capital. For example, a significant increase in deferred revenue may suggest strong sales growth, while a sharp rise in accrued expenses may indicate poor expense management or cash flow problems.

Examples of Other Current Liabilities

Other current liabilities are a category of short-term obligations that a company owes to its creditors and must be settled within one year. These liabilities are not classified as accounts payable or short-term debt, but rather represent a diverse range of financial obligations that do not fit into other specific categories.

1. Accrued Expenses

Accrued expenses are costs that a company has incurred but has not yet paid for. These expenses can include salaries and wages, interest on loans, rent, utilities, and other operating costs. For example, if a company has a monthly rent expense of $1,000 and the rent payment is due at the end of each month, the company will have an accrued rent expense of $1,000 until the payment is made.

2. Customer Deposits

Customer deposits are amounts paid by customers in advance for goods or services that will be provided in the future. These deposits are recorded as liabilities until the goods or services are delivered or the customer requests a refund. For example, if a customer pays a $500 deposit for a custom-made product, the company will record a liability of $500 until the product is completed and delivered.

3. Unearned Revenue

4. Income Taxes Payable

Income taxes payable represent the amount of income taxes that a company owes to the government but has not yet paid. These taxes are recorded as a liability until they are settled. For example, if a company has an estimated income tax liability of $10,000 for the current year, it will record a liability of $10,000 until the taxes are paid.

5. Dividends Payable

Dividends payable are amounts that a company owes to its shareholders as a result of declared dividends. These liabilities are recorded until the dividends are paid to the shareholders. For example, if a company declares a dividend of $0.50 per share and has 10,000 outstanding shares, it will record a liability of $5,000 until the dividends are distributed.

6. Short-Term Loans

Short-term loans are financial obligations that a company has borrowed and must repay within one year. These loans can include lines of credit, bank loans, and other forms of short-term financing. The principal amount of the loan is recorded as a liability, and any interest expense is also recorded separately. For example, if a company borrows $50,000 from a bank and agrees to repay the loan within six months with an interest rate of 5%, it will record a liability of $50,000 for the principal amount and a separate liability for the interest expense.

These are just a few examples of other current liabilities that a company may have. It is important for businesses to accurately record and manage these liabilities to ensure proper financial reporting and planning.

Accounting for Other Current Liabilities

Recognition and Measurement

The first step in accounting for other current liabilities is the recognition of these obligations. This involves identifying and recording the liabilities in the company’s books. Examples of other current liabilities include accrued expenses, deferred revenue, and short-term loans.

Once the liabilities are recognized, they need to be measured. This involves determining the amount of the liability and recording it in the financial statements. The measurement of other current liabilities is typically based on their fair value, which is the amount that would be paid to settle the obligation in an orderly transaction between market participants.

Reporting in Financial Statements

Other current liabilities are reported in the balance sheet as a separate category under current liabilities. This allows stakeholders to easily identify and assess the company’s short-term obligations. The balance sheet provides information on the amount of other current liabilities and their maturity dates, which indicates when the company is required to settle these obligations.

In addition to the balance sheet, other current liabilities may also be disclosed in the notes to the financial statements. This provides further details and explanations about the nature of these liabilities, their terms, and any significant events or changes that may affect their measurement or settlement.

Importance of Accurate Accounting

Accurate accounting for other current liabilities is crucial for several reasons. Firstly, it ensures compliance with accounting standards and regulations, which promotes transparency and comparability in financial reporting. Secondly, it provides stakeholders with reliable information to make informed decisions about the company’s financial health and performance.

Furthermore, accurate accounting for other current liabilities enables businesses to effectively manage their cash flow and working capital. By properly recognizing and measuring these obligations, companies can better plan and allocate their resources to meet their short-term obligations and avoid any potential liquidity issues.

Importance of Other Current Liabilities in Corporate Finance

Other current liabilities play a crucial role in the field of corporate finance. These liabilities represent the obligations that a company must fulfill within a short period, typically within one year. They are important because they reflect the company’s financial health and its ability to meet its short-term obligations.

One of the main reasons why other current liabilities are significant is that they provide insights into a company’s liquidity position. By analyzing the amount and nature of these liabilities, investors and creditors can assess whether a company has enough resources to cover its short-term debts. This information is crucial for making investment decisions and evaluating the financial stability of a company.

Moreover, other current liabilities also affect a company’s working capital management. Working capital is the difference between a company’s current assets and its current liabilities. By carefully managing other current liabilities, a company can optimize its working capital and ensure smooth operations. For example, if a company can negotiate favorable payment terms with its suppliers, it can extend its payment period and improve its cash flow.

Additionally, other current liabilities can impact a company’s creditworthiness. Lenders and creditors often consider a company’s other current liabilities when determining its creditworthiness and setting interest rates. A high level of other current liabilities may indicate a higher risk of default, leading to higher borrowing costs for the company.

Furthermore, other current liabilities are essential for financial statement analysis. They are reported on the balance sheet and provide valuable information about a company’s short-term obligations. By comparing the trends in other current liabilities over time, analysts can identify potential risks and opportunities. For example, a significant increase in other current liabilities may indicate aggressive borrowing or a decline in the company’s financial health.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.