Void Transaction: How It Works, Examples, vs Refund

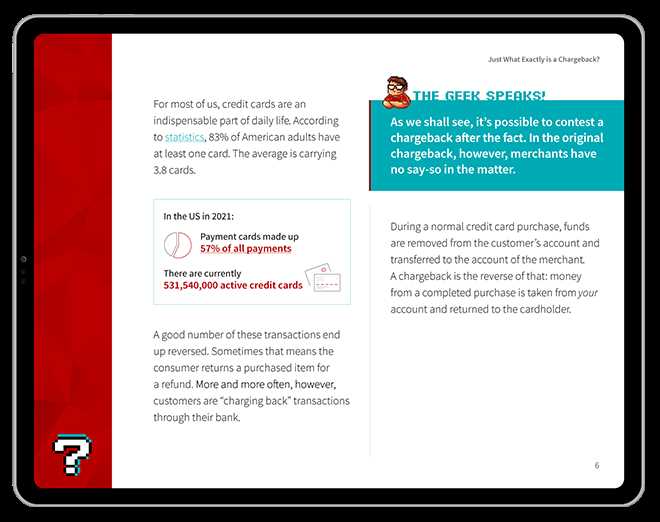

Void Transaction: How It Works A void transaction is a type of transaction that is cancelled before it is completed. It is different from a refund, as a refund occurs after a transaction has been completed. Voiding a transaction essentially erases it from the record, as if it never happened. … …