Workers’ Compensation Coverage A Overview Example FAQ

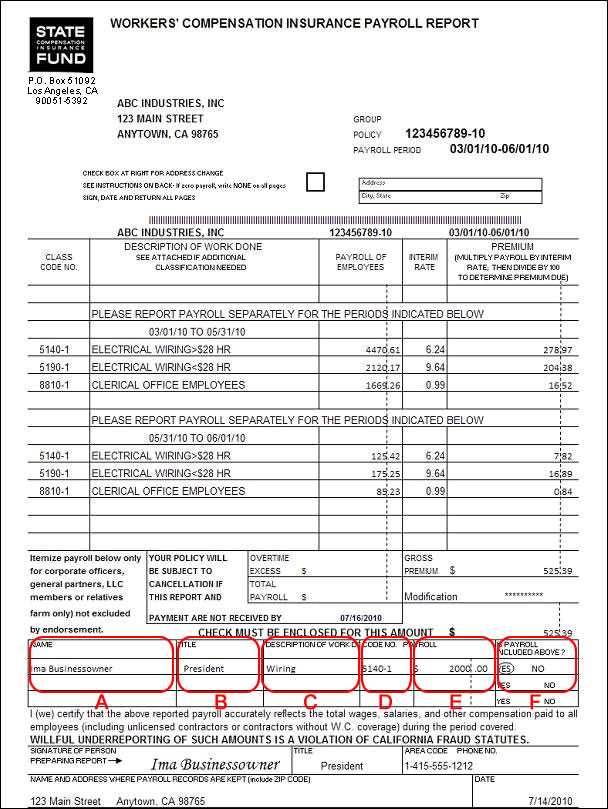

Workers’ Compensation Coverage: An Overview Workers’ Compensation Coverage is a type of insurance that provides benefits to employees who are injured or become ill as a result of their work. It is a crucial protection for both employees and employers, as it helps to cover medical expenses, lost wages, and … …