What Is a Bond ETF? Definition, Types, Examples, and How to Invest

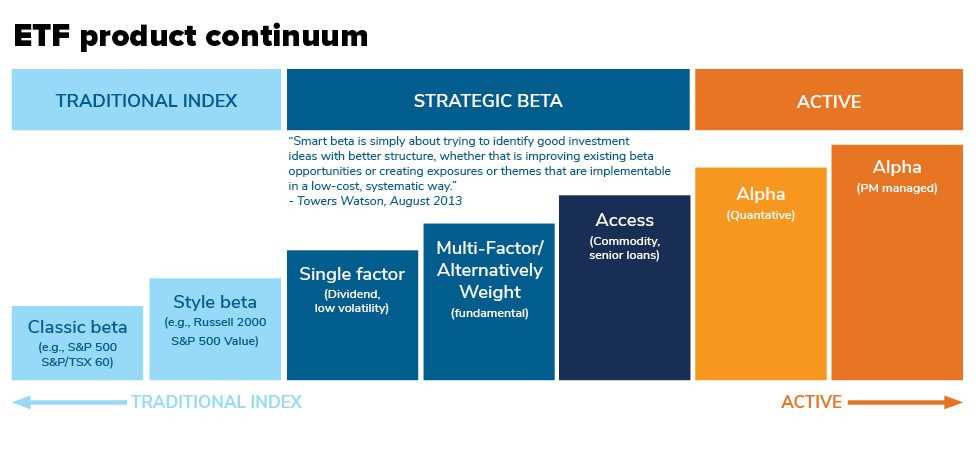

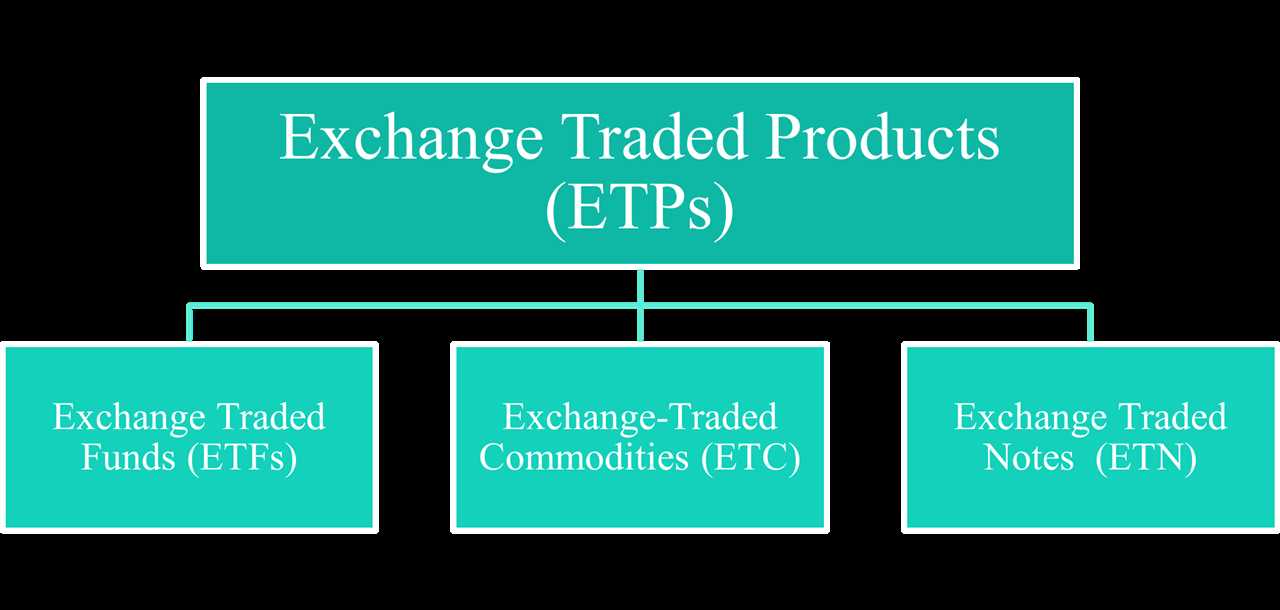

What Is a Bond ETF? A bond ETF, or exchange-traded fund, is a type of investment fund that trades on stock exchanges and aims to track the performance of a specific bond index or a portfolio of bonds. It is designed to provide investors with exposure to the bond market, … …