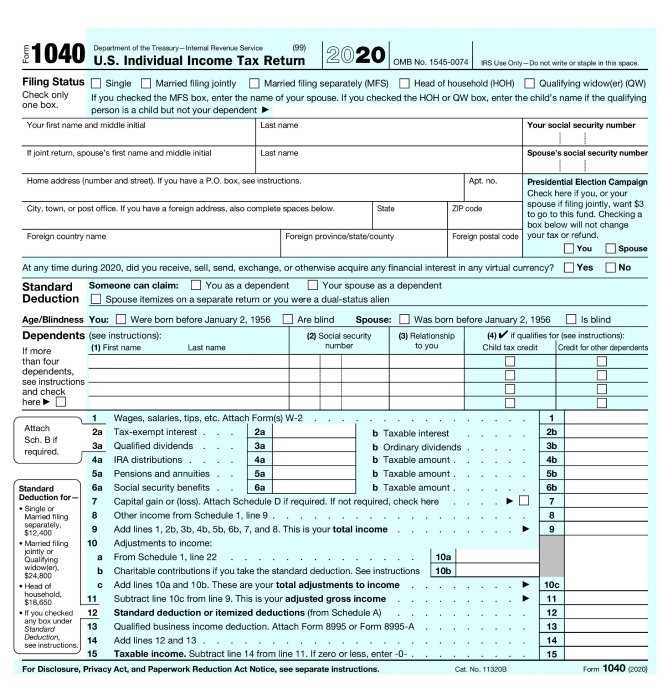

Understanding the Discontinuation of Form 1040EZ and Its Implications

Overview of Form 1040EZ Discontinuation The discontinuation of Form 1040EZ has significant implications for taxpayers and tax professionals alike. This form was designed to streamline the tax filing process for individuals with straightforward tax situations, such as those who have no dependents and earn income from wages, salaries, tips, and … …