What Is Naked Short Selling, How Does It Work, and Is It Legal?

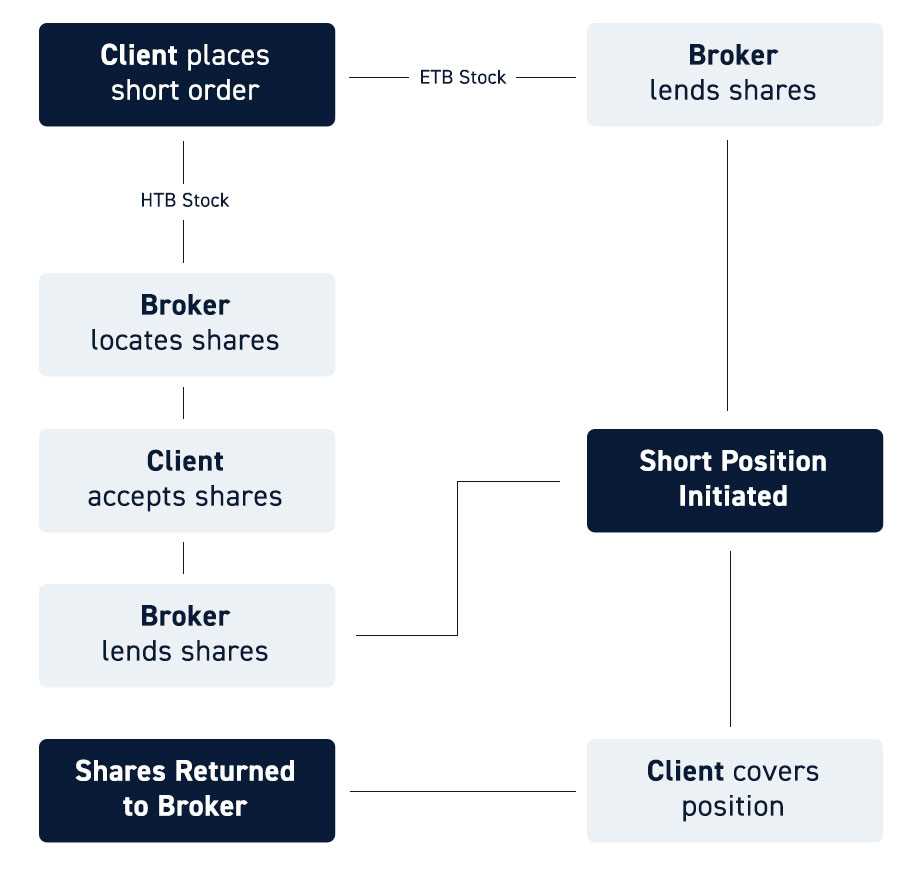

What Is Naked Short Selling? Naked short selling is a controversial practice in the world of stock trading. It involves selling shares of a stock that the seller does not actually own. In a traditional short sale, an investor borrows shares from a broker and sells them with the expectation … …