What is Attribution Analysis and How It’s Used for Portfolios

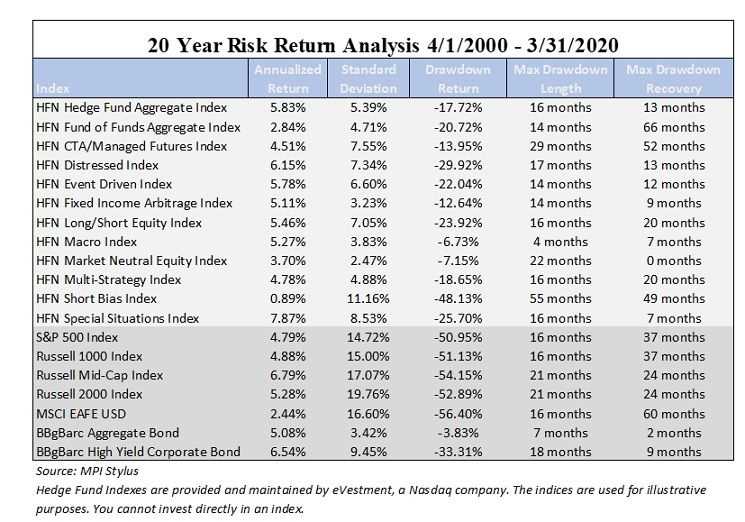

What is Attribution Analysis? Attribution analysis is a method used in finance to evaluate the performance of a portfolio or investment strategy by breaking down the sources of returns. It helps investors and fund managers understand the factors that contribute to the overall performance of their investments. The concept of … …