Nationalization in the Oil Industry and the U.S. Government & Policy

The oil industry has always been a crucial sector for the United States, playing a significant role in its economy and national security. Throughout history, the U.S. government has implemented various policies and regulations to ensure the stability and growth of the oil industry. One such policy that has been a topic of debate is nationalization.

Nationalization refers to the process of a government taking control and ownership of private assets, such as oil companies, in order to exert greater control over the industry. The idea behind nationalization is to ensure that the country’s resources are utilized in the best interest of the nation as a whole.

One of the most notable instances of nationalization in the U.S. oil industry occurred during World War II. The government took control of several oil companies to ensure a stable supply of oil for the war effort. This move was seen as necessary to protect national security and ensure the country’s ability to defend itself.

Since then, the debate on nationalization in the U.S. oil industry has continued. Proponents argue that nationalization can lead to greater control over oil prices, ensure fair distribution of resources, and promote domestic energy independence. They believe that the government can effectively manage the industry and make decisions in the best interest of the nation.

On the other hand, opponents of nationalization argue that it can stifle innovation, discourage private investment, and lead to inefficiencies in the industry. They believe that the free market should determine the direction of the oil industry and that government intervention can have unintended consequences.

Currently, the debate on nationalization in the U.S. oil industry is ongoing. With the increasing importance of renewable energy sources and the need to address climate change, the role of the government in the oil industry is being reevaluated. The future of nationalization in the U.S. oil industry remains uncertain, but it is clear that it will continue to be a topic of discussion and debate.

| Pros of Nationalization | Cons of Nationalization |

|---|---|

| Greater control over oil prices | Stifles innovation |

| Fair distribution of resources | Discourages private investment |

| Promotes domestic energy independence | Inefficiencies in the industry |

The History of Nationalization

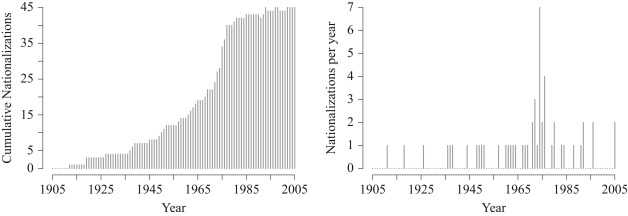

Nationalization in the oil industry has a long and complex history that dates back to the early 20th century. It is a process by which a government takes control of privately owned oil companies and resources, often with the aim of ensuring national security, economic stability, and fair distribution of wealth.

The roots of nationalization can be traced back to the oil boom of the late 19th and early 20th centuries, when major oil discoveries were made in countries like the United States, Mexico, and Venezuela. These discoveries led to the rise of powerful oil companies, such as Standard Oil, which controlled a significant portion of the global oil market.

The first major nationalization of the oil industry occurred in Mexico in 1938, when President Lazaro Cardenas expropriated foreign-owned oil companies and created the state-owned oil company, Petroleos Mexicanos (Pemex). This move was seen as a way to regain control over the country’s natural resources and to ensure that the benefits of the oil industry were shared by the Mexican people.

Following Mexico’s lead, other countries in Latin America, such as Venezuela and Brazil, also nationalized their oil industries in the mid-20th century. These nationalizations were driven by similar motives of economic sovereignty and the desire to use oil revenues for social and economic development.

In the Middle East, nationalization of the oil industry gained momentum in the 1970s during the OPEC oil crisis. OPEC member countries, including Saudi Arabia, Iran, and Iraq, took control of their oil resources and formed national oil companies. This allowed them to have greater control over oil prices and to use oil revenues to fund domestic development projects.

Nationalization in the oil industry has not been limited to developing countries. In the 1970s, the United Kingdom nationalized its oil industry, creating the British National Oil Corporation (BNOC) to oversee the exploration and production of oil in the North Sea. This move was driven by concerns about the country’s energy security and the need to maximize the economic benefits of the North Sea oil reserves.

Overall, the history of nationalization in the oil industry is a complex and varied one. It has been driven by a range of factors, including concerns about monopoly power, resource exploitation, and economic sovereignty. While nationalization can have its benefits, such as ensuring fair distribution of wealth and promoting domestic development, it also carries risks, such as political interference and inefficiency. The debate over the merits of nationalization continues to this day, with different countries and regions taking different approaches based on their unique circumstances and priorities.

Impact of Nationalization on the U.S. Oil Industry

Nationalization in the oil industry refers to the process of a government taking control of privately owned oil companies and assets within its jurisdiction. This can have significant impacts on the U.S. oil industry, both positive and negative.

One of the main impacts of nationalization is the potential disruption of the market. When the government takes control of oil companies, it can lead to uncertainty and instability in the industry. Private investors may be hesitant to invest in a nationalized industry, which can result in a decrease in production and exploration activities. This, in turn, can lead to a decline in oil reserves and a decrease in the overall output of the U.S. oil industry.

On the other hand, nationalization can also provide benefits to the U.S. oil industry. By taking control of oil companies, the government can ensure that the industry is regulated and managed in a way that aligns with national interests. This can include implementing policies to promote domestic production, ensuring fair pricing for consumers, and protecting the environment.

Additionally, nationalization can lead to increased government revenue. When the government takes control of oil companies, it gains direct access to the profits generated by the industry. This can provide a significant source of income that can be used for public services, infrastructure development, and other national priorities.

However, it is important to note that nationalization can also have negative consequences. It can lead to a decrease in foreign investment, as international companies may be wary of investing in a nationalized industry. This can result in a lack of technology transfer and innovation, which can hinder the growth and competitiveness of the U.S. oil industry.

Furthermore, nationalization can also lead to inefficiencies and corruption. When the government takes control of oil companies, there is a risk of mismanagement and lack of transparency. This can result in inefficiencies in production and distribution, as well as opportunities for corruption and rent-seeking behavior.

Current Debate on Nationalization

The topic of nationalization in the oil industry has been a subject of intense debate and discussion in recent years. Advocates argue that nationalization can lead to greater control over resources, increased revenue for the government, and the ability to implement policies that prioritize the needs of the country. On the other hand, opponents argue that nationalization can stifle innovation, discourage foreign investment, and lead to inefficiencies in the industry.

One of the key arguments in favor of nationalization is the potential for increased revenue for the government. Proponents argue that by nationalizing the oil industry, the government can capture a larger share of the profits and use it to fund social programs, infrastructure development, and other public services. They believe that this can lead to greater economic equality and improved living standards for the population as a whole.

Another argument in favor of nationalization is the ability to implement policies that prioritize the needs of the country. Advocates argue that when the oil industry is in private hands, the primary goal is often profit maximization, which may not align with the long-term interests of the country. By nationalizing the industry, the government can set priorities such as environmental sustainability, energy independence, and job creation, which can have broader benefits for society.

Opponents of nationalization, on the other hand, argue that it can lead to inefficiencies in the industry. They claim that when the government takes control of the oil industry, it may lack the expertise and efficiency of private companies, leading to decreased productivity and higher costs. They also argue that nationalization can discourage foreign investment, as investors may be wary of investing in a sector that is controlled by the government.

Furthermore, opponents argue that nationalization can stifle innovation. They claim that private companies are often more motivated to invest in research and development to stay competitive and find new sources of oil. When the industry is nationalized, the incentive for innovation may decrease, leading to a stagnation in technological advancements.

The debate on nationalization in the oil industry is complex and multifaceted. Both sides present valid arguments, and the outcome of the debate ultimately depends on the specific context and goals of each country. It is essential to carefully consider the potential benefits and drawbacks of nationalization before making any decisions that could have far-reaching consequences for the oil industry and the country as a whole.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.