What are Money Center Banks?

Money Center Banks are large commercial banks that play a crucial role in the global financial system. These banks are typically located in major financial centers such as New York, London, and Tokyo, and they provide a wide range of financial services to both domestic and international clients.

One of the key characteristics of Money Center Banks is their ability to facilitate large-scale financial transactions. They have the infrastructure, expertise, and resources to handle complex financial transactions, including mergers and acquisitions, syndicated loans, and foreign exchange transactions.

These banks also play a crucial role in the global economy by providing liquidity to financial markets. They act as intermediaries between borrowers and lenders, facilitating the flow of funds in the economy. Money Center Banks also play a vital role in the international trade by providing trade finance services, such as letters of credit and export financing.

In addition to their financial services, Money Center Banks also play a significant role in shaping monetary policy. Central banks often rely on these banks to implement monetary policy measures, such as open market operations and reserve requirements.

Overall, Money Center Banks are an essential component of the global financial system. They provide critical financial services, facilitate large-scale transactions, and play a vital role in the functioning of the economy.

Definition and Meaning

These banks offer a variety of services, including deposit-taking, lending, foreign exchange, investment banking, and wealth management. They also play a crucial role in facilitating international trade and providing liquidity to the financial markets.

Money Center Banks are closely regulated by government authorities to ensure the stability and integrity of the financial system. They are subject to strict capital requirements, risk management guidelines, and reporting standards.

In summary, Money Center Banks are essential institutions in the global financial system. They provide a wide range of financial services, contribute to economic growth, and play a vital role in maintaining the stability of the financial markets.

Overview of Money Center Banks

Money Center Banks are large commercial banks that play a crucial role in the global financial system. These banks are usually located in major financial centers, such as New York, London, and Tokyo, and they provide a wide range of financial services to both individuals and corporations.

One of the key characteristics of Money Center Banks is their ability to handle large-scale transactions and provide financial services to multinational corporations and governments. These banks have the infrastructure and expertise to facilitate international trade and investment, making them essential players in the global economy.

Money Center Banks also play a crucial role in the interbank market, where they lend and borrow funds from other banks. This helps to ensure the stability of the financial system and allows for the smooth functioning of the economy.

Key Features of Money Center Banks:

1. Global Presence: Money Center Banks have a significant presence in major financial centers around the world, allowing them to serve customers from different countries and facilitate international transactions.

2. Financial Expertise: These banks have a team of financial experts who provide advice and assistance to clients regarding their financial needs, including investment strategies, risk management, and capital raising.

3. Diversified Services: Money Center Banks offer a wide range of financial services, including commercial banking, investment banking, asset management, and wealth management. This allows them to cater to the diverse needs of their clients.

Benefits of Banking with Money Center Banks:

1. Global Reach: Banking with Money Center Banks gives individuals and businesses access to a global network of branches and ATMs, making it convenient to manage their finances wherever they are.

2. Financial Stability: Money Center Banks are subject to strict regulatory oversight, which helps to ensure their financial stability. This gives customers peace of mind knowing that their deposits and investments are safe.

3. Expertise and Resources: Money Center Banks have the expertise and resources to provide customized financial solutions to meet the unique needs of their clients. Whether it’s financing a business expansion or planning for retirement, these banks can offer tailored advice and solutions.

| Services Provided by Money Center Banks: | Role of Money Center Banks in the Economy: |

|---|---|

| – Checking and savings accounts | – Facilitating international trade and investment |

| – Loans and credit cards | – Providing liquidity to the financial system |

| – Investment services | – Supporting economic growth and development |

| – Foreign exchange services | – Managing risk in the financial markets |

| – Trade finance | – Promoting financial stability |

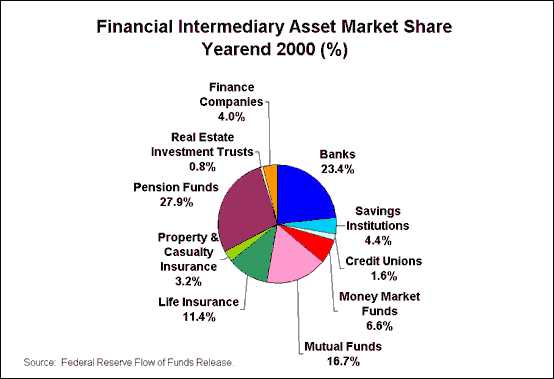

Size and Importance

Money Center Banks are some of the largest and most influential financial institutions in the world. They play a crucial role in the global economy and have a significant impact on the financial markets.

These banks are characterized by their large size, with assets in the billions or even trillions of dollars. They have a wide network of branches and offices, both domestically and internationally, which allows them to serve a diverse range of clients.

Money Center Banks are considered to be the backbone of the financial system, providing essential services to individuals, businesses, and governments. They offer a variety of financial products and services, such as loans, mortgages, credit cards, and investment banking services.

Due to their size and global reach, Money Center Banks have the ability to influence interest rates, currency exchange rates, and even the overall stability of the financial system. Their actions and decisions can have far-reaching consequences for the economy as a whole.

Furthermore, these banks often act as intermediaries in international transactions, facilitating trade and investment between countries. They provide financing and risk management services to multinational corporations, helping them navigate the complexities of the global marketplace.

Services Provided by Money Center Banks

Money Center Banks offer a wide range of services to individuals, businesses, and other financial institutions. These services include:

- Deposits: Money Center Banks provide various types of deposit accounts, such as savings accounts, checking accounts, and certificates of deposit. These accounts allow individuals and businesses to securely store their money and earn interest on their deposits.

- Lending: Money Center Banks offer loans and credit facilities to individuals and businesses. They provide mortgages, personal loans, business loans, and lines of credit to help meet the financial needs of their customers. These loans can be used for various purposes, such as purchasing a home, starting a business, or financing a major expense.

- Foreign Exchange: Money Center Banks facilitate currency exchange and provide foreign exchange services to their customers. They help individuals and businesses convert one currency into another, enabling them to engage in international trade and travel.

- Investment Banking: Money Center Banks offer investment banking services, including underwriting, mergers and acquisitions, and advisory services. They assist companies in raising capital through the issuance of stocks and bonds, facilitate corporate mergers and acquisitions, and provide financial advice to businesses.

- Asset Management: Money Center Banks provide asset management services, helping individuals and institutions manage their investments and portfolios. They offer investment products such as mutual funds, pension funds, and other investment vehicles to help clients achieve their financial goals.

- Treasury Services: Money Center Banks offer treasury services to corporations and financial institutions. These services include cash management, liquidity management, and risk management solutions. They help businesses optimize their cash flows, manage their financial risks, and ensure efficient treasury operations.

- Trade Finance: Money Center Banks provide trade finance services to facilitate international trade. They offer letters of credit, trade financing, and other trade-related services to importers and exporters. These services help businesses mitigate the risks associated with international trade and ensure smooth transactions.

Overall, Money Center Banks play a crucial role in the economy by providing a wide range of financial services that support individuals, businesses, and the overall functioning of the financial system.

Role of Money Center Banks in the Economy

Money Center Banks play a crucial role in the economy by providing various financial services and facilitating economic growth. They act as intermediaries between borrowers and lenders, helping to allocate capital efficiently and promote economic activity.

1. Financing

Money Center Banks provide financing to individuals, businesses, and governments. They offer loans for various purposes, such as home mortgages, business expansion, and infrastructure development. By providing access to capital, Money Center Banks support economic growth and job creation.

2. Depository Services

Money Center Banks also offer depository services, allowing individuals and businesses to deposit their money and earn interest. These deposits provide a stable source of funding for the banks, which they can then lend out to borrowers. Depository services help to promote savings and financial stability.

3. International Transactions

Money Center Banks play a vital role in facilitating international transactions. They provide services such as foreign exchange, trade finance, and international payment processing. These services enable businesses to engage in global trade and contribute to economic integration.

4. Risk Management

Money Center Banks help manage various risks in the economy. They offer insurance products, such as property and casualty insurance, to protect individuals and businesses against unexpected events. They also provide risk management services, such as hedging against fluctuations in interest rates and foreign exchange rates.

5. Financial Market Operations

Money Center Banks participate in financial market operations, such as buying and selling securities, underwriting new issuances, and providing liquidity. These activities help to ensure the smooth functioning of financial markets and promote investor confidence.

6. Economic Stability

Money Center Banks play a crucial role in maintaining economic stability. They work closely with central banks and regulatory authorities to implement monetary policy and ensure the stability of the financial system. They also provide insights and analysis on economic trends and conditions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.