Venture Philanthropy: The Concept, Mechanisms, And Origins

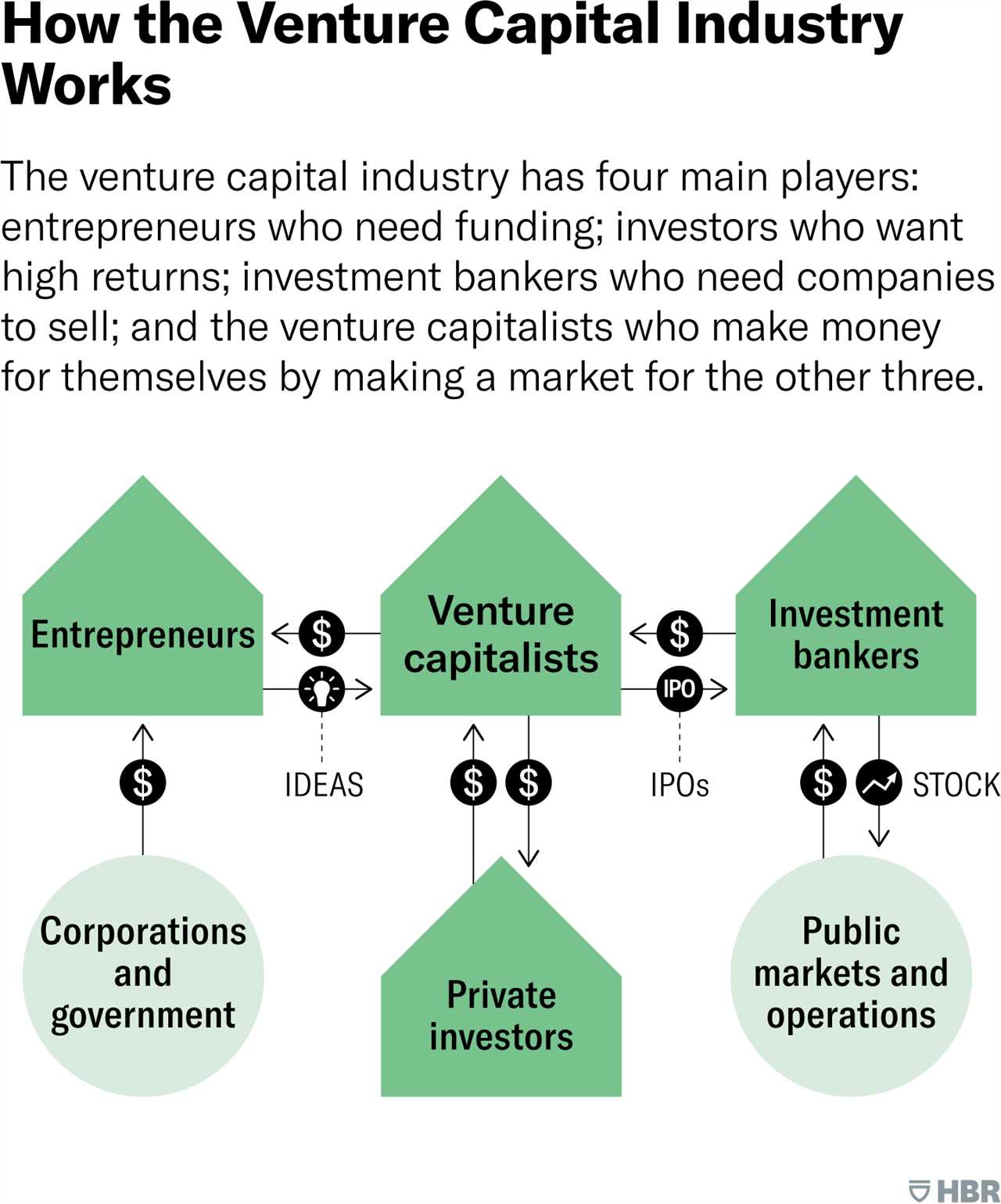

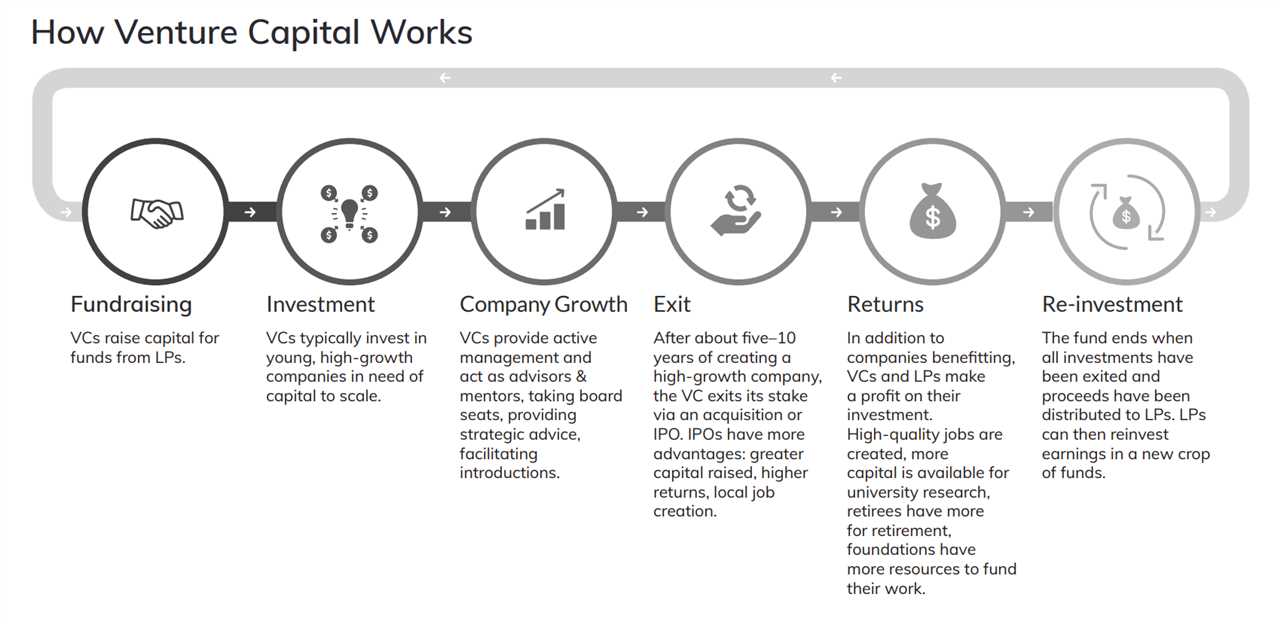

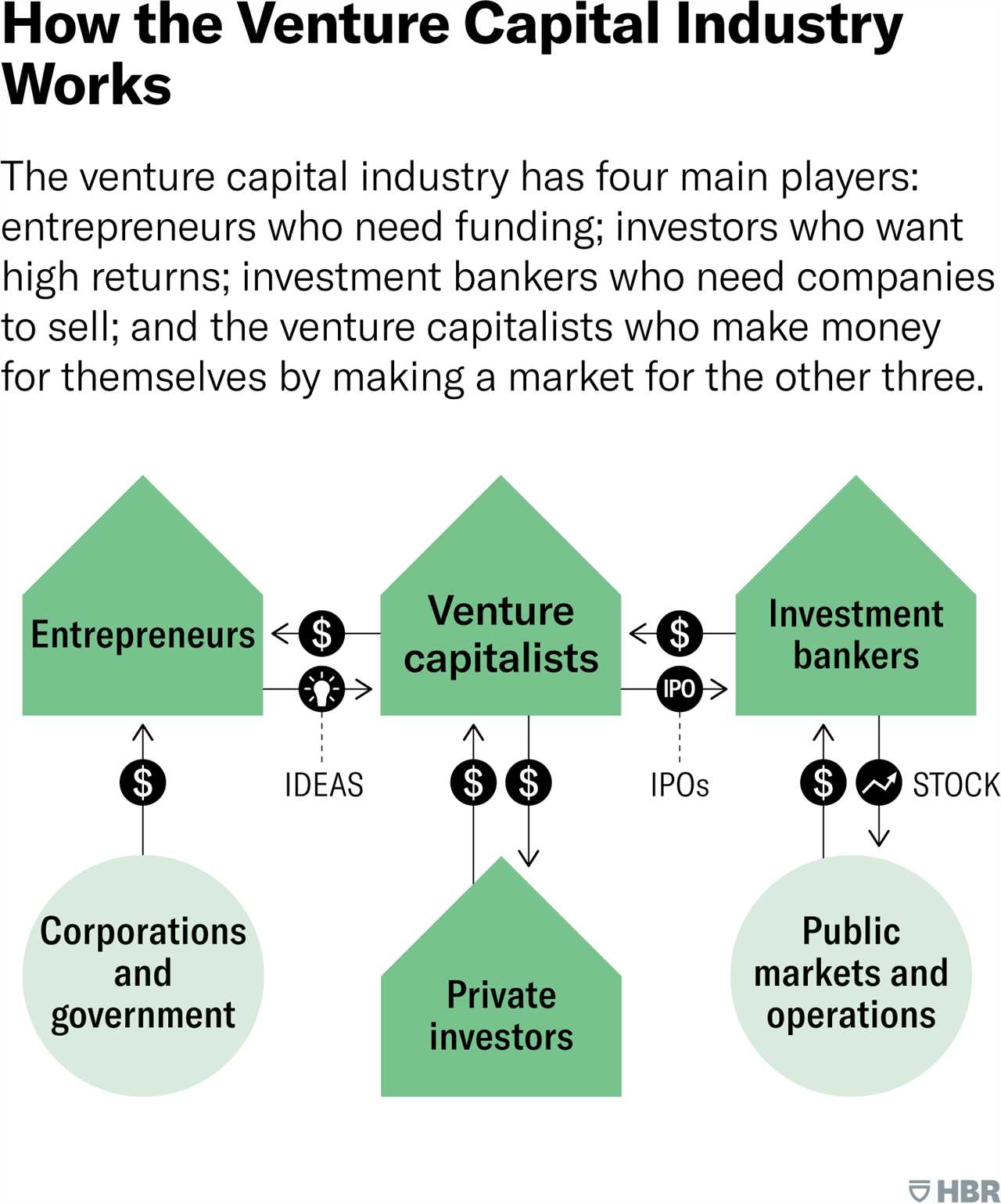

What is Venture Philanthropy? Venture philanthropy is a concept that combines the principles of venture capital and philanthropy to create a new approach to social investment. It involves applying business strategies and practices to achieve social impact and sustainability. Unlike traditional philanthropy, which often involves making grants to nonprofit organizations, … …