What is a High Beta Index and How Does it Impact Your Investments?

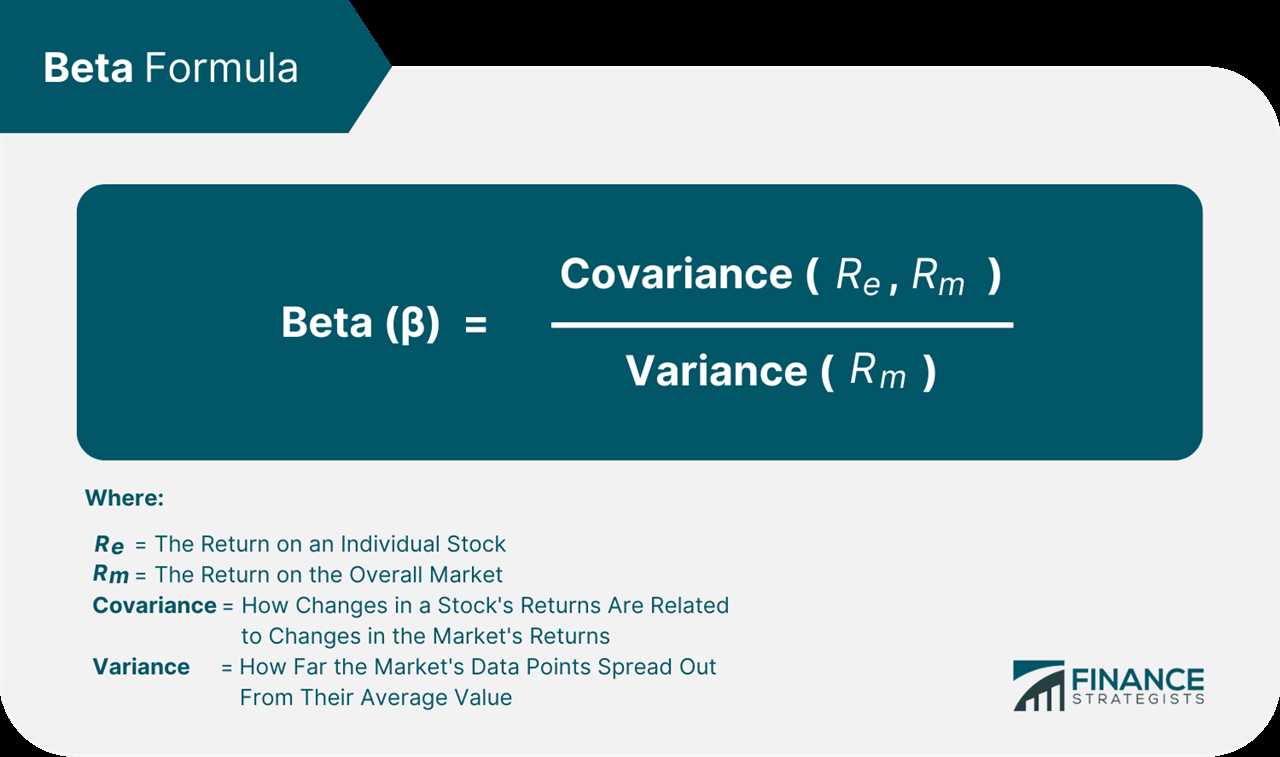

Importance of High Beta Index By measuring the sensitivity of an investment to market movements, the High Beta Index helps investors gauge the potential upsides and downsides of their investments. A high beta value indicates that the investment is likely to experience larger price swings compared to the market, while … …