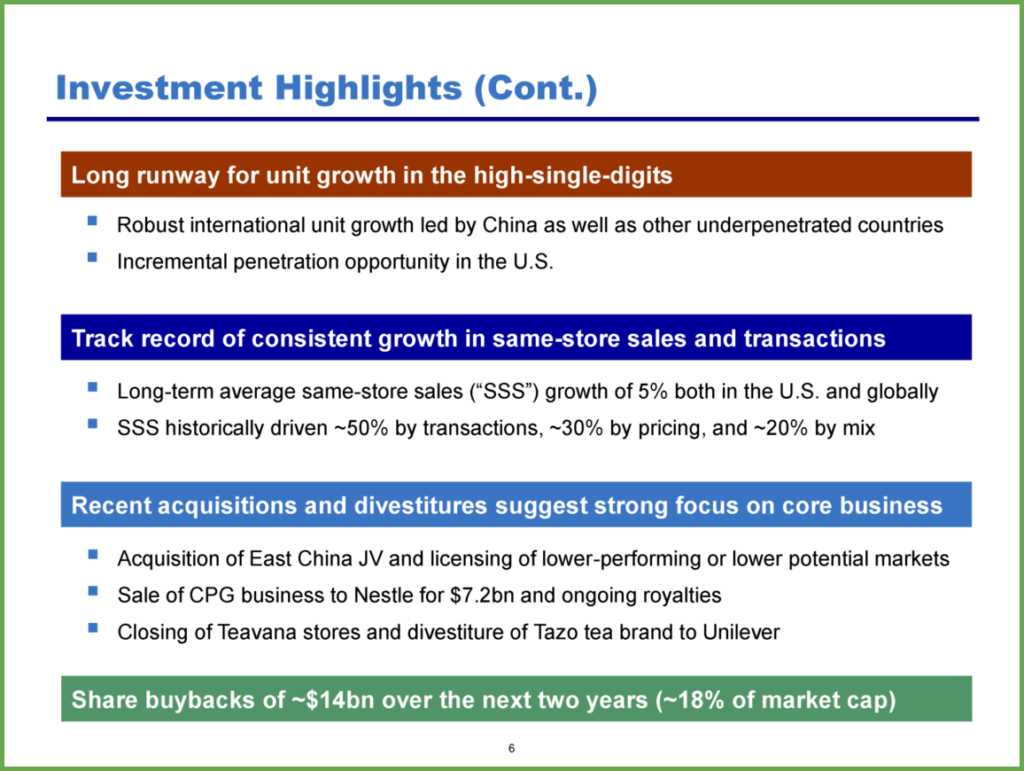

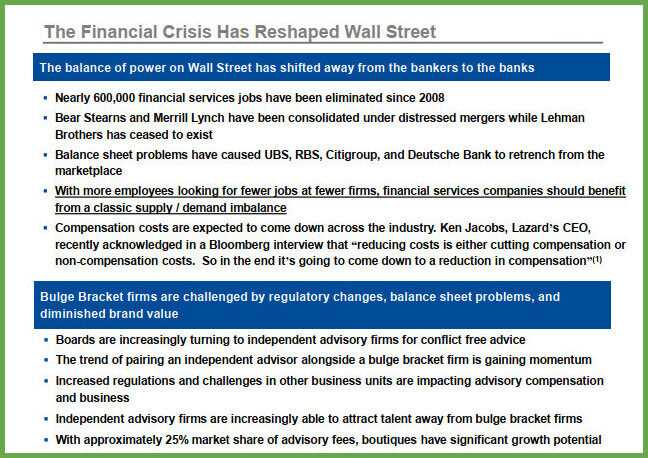

Investment Thesis: Supporting Arguments for Investment Decisions

When making investment decisions, it is crucial to have a clear investment thesis supported by strong arguments. An investment thesis serves as a guiding principle that helps investors make informed decisions and stay focused on their goals.

There are several supporting arguments that can strengthen an investment thesis:

- Market Opportunity: One of the key factors to consider is the market opportunity. Investors should analyze the size and growth potential of the market in which they plan to invest. A large and growing market indicates a higher potential for returns.

- Competitive Advantage: A company with a competitive advantage is more likely to succeed in the market. This advantage can be in the form of unique products or services, strong brand recognition, or proprietary technology. Investors should look for companies that have a sustainable competitive advantage.

- Financial Performance: Examining a company’s financial performance is essential in evaluating its investment potential. Investors should analyze key financial metrics such as revenue growth, profitability, and cash flow. Consistent and positive financial performance is a good indication of a company’s ability to generate returns.

- Management Team: The management team plays a crucial role in the success of a company. Investors should assess the experience, track record, and leadership skills of the management team. A strong and capable management team is more likely to make sound business decisions and drive the company towards success.

- Risk Assessment: Every investment carries some level of risk. Investors should conduct a thorough risk assessment to identify potential risks and develop strategies to mitigate them. This can include analyzing industry trends, regulatory changes, and competitive landscape.

By considering these supporting arguments, investors can develop a well-rounded investment thesis that takes into account various factors influencing the investment decision. It is important to note that an investment thesis should be flexible and adaptable to changing market conditions.

Overall, a strong investment thesis supported by sound arguments can help investors make informed decisions, minimize risks, and maximize returns.

Portfolio Management: Importance and Strategies

Importance of Portfolio Management

Portfolio management plays a vital role in achieving long-term financial success. Here are some key reasons why it is important:

- Diversification: Portfolio management allows investors to diversify their investments across different asset classes, sectors, and geographic regions. Diversification helps reduce the impact of any single investment on the overall portfolio, thereby lowering the risk.

- Risk Management: By carefully selecting and monitoring investments, portfolio managers can effectively manage risk. They analyze market trends, economic indicators, and company-specific factors to make informed investment decisions and minimize potential losses.

- Optimal Allocation: Portfolio managers aim to allocate investments in a way that maximizes returns while considering the investor’s risk tolerance and financial goals. They balance the portfolio by adjusting the allocation of assets based on market conditions and investment performance.

- Performance Monitoring: Portfolio management involves continuous monitoring of the portfolio’s performance. By tracking the performance of individual investments and the overall portfolio, managers can identify underperforming assets and make necessary adjustments to improve returns.

Strategies for Portfolio Management

There are various strategies that portfolio managers employ to achieve optimal portfolio performance. Some common strategies include:

- Asset Allocation: This strategy involves allocating investments across different asset classes, such as stocks, bonds, and commodities, based on their expected returns and risks. The goal is to create a balanced portfolio that can weather market fluctuations.

- Rebalancing: Portfolio managers regularly review and rebalance the portfolio to maintain the desired asset allocation. This involves selling overperforming assets and buying underperforming ones to bring the portfolio back in line with the target allocation.

- Active Management: Some portfolio managers actively trade securities and make frequent adjustments to the portfolio based on market conditions and investment opportunities. This strategy aims to outperform the market by taking advantage of short-term fluctuations.

Analyzing Market Trends and Economic Indicators

When making investment decisions, it is crucial to analyze market trends and economic indicators. These factors provide valuable insights into the current state of the economy and can help investors identify potential opportunities and risks.

One way to analyze market trends is by studying price movements. Technical analysis, for example, focuses on chart patterns and indicators to identify trends and predict future price movements. Fundamental analysis, on the other hand, examines the underlying factors that drive market trends, such as economic data, industry performance, and company financials.

Another important aspect of analyzing market trends is studying investor sentiment. Investor sentiment reflects the overall attitude and confidence of investors towards a particular market or asset class. High levels of optimism may indicate a bullish trend, while pessimism can signal a bearish trend.

Evaluating Economic Indicators

Economic indicators are statistics that provide information about the overall health and performance of an economy. These indicators can help investors assess the current and future prospects of different sectors and industries.

Some commonly used economic indicators include gross domestic product (GDP), inflation rate, unemployment rate, consumer spending, and interest rates. By analyzing these indicators, investors can gain insights into the strength of the economy, the level of consumer demand, and the potential impact on businesses and investments.

For example, a high GDP growth rate may indicate a robust economy, which could lead to increased business activity and higher corporate profits. On the other hand, a high unemployment rate may suggest a weaker economy, which could negatively affect consumer spending and business performance.

It is important to note that economic indicators are not standalone measures but should be analyzed in conjunction with other factors. For instance, a positive GDP growth rate may be overshadowed by high inflation, which could erode the purchasing power of consumers.

By carefully analyzing market trends and economic indicators, investors can make more informed investment decisions. This analysis can help identify potential investment opportunities, assess the level of risk, and develop appropriate strategies for portfolio management.

Risk Assessment and Diversification Strategies

Risk Assessment:

Before making any investment, it is important to assess the level of risk involved. This involves evaluating various factors such as market volatility, economic conditions, and industry-specific risks. By analyzing these factors, investors can determine the potential downside and upside of an investment.

One common method of risk assessment is conducting a thorough analysis of historical data and trends. This can provide insights into how an investment has performed in different market conditions and help predict its future performance. Additionally, investors can use various financial ratios and indicators to assess the financial health and stability of a company.

Diversification Strategies:

Diversification is a risk management strategy that involves spreading investments across different asset classes, industries, and geographic regions. The goal of diversification is to reduce the impact of any single investment on the overall portfolio. By diversifying, investors can potentially minimize losses and maximize returns.

There are several ways to achieve diversification. One approach is to invest in different asset classes such as stocks, bonds, and real estate. This helps to spread risk across different types of investments that may perform differently under various market conditions.

Another diversification strategy is to invest in different industries or sectors. This helps to reduce the impact of industry-specific risks. For example, if one industry is experiencing a downturn, investments in other industries may help offset the losses.

Geographic diversification is also important. Investing in different countries or regions can help protect against risks associated with a specific market or economy. By spreading investments globally, investors can take advantage of opportunities in different markets and reduce the impact of any single market’s performance on the overall portfolio.

Conclusion:

Risk assessment and diversification strategies are essential components of successful investing. By thoroughly assessing the risks associated with an investment and implementing diversification strategies, investors can minimize losses and maximize returns. It is important to regularly review and adjust investment portfolios to ensure they remain well-diversified and aligned with investment goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.