Understanding Whoops: Meaning, Mechanism, and Historical Background

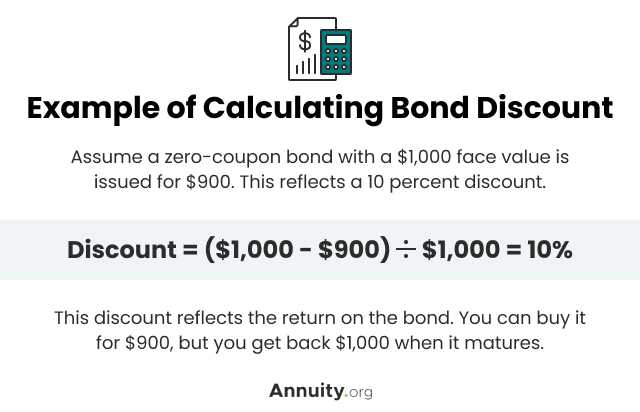

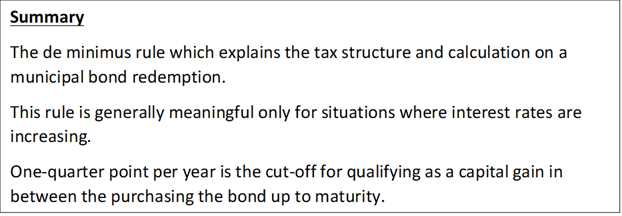

What is a Whoops? A “Whoops” is a term used to describe a sudden and significant decline in the value of a municipal bond. It is a type of financial event that can have serious consequences for investors and the overall stability of the bond market. Causes of Whoops There … …