What is a Greenshoe Option and How Does it Work?

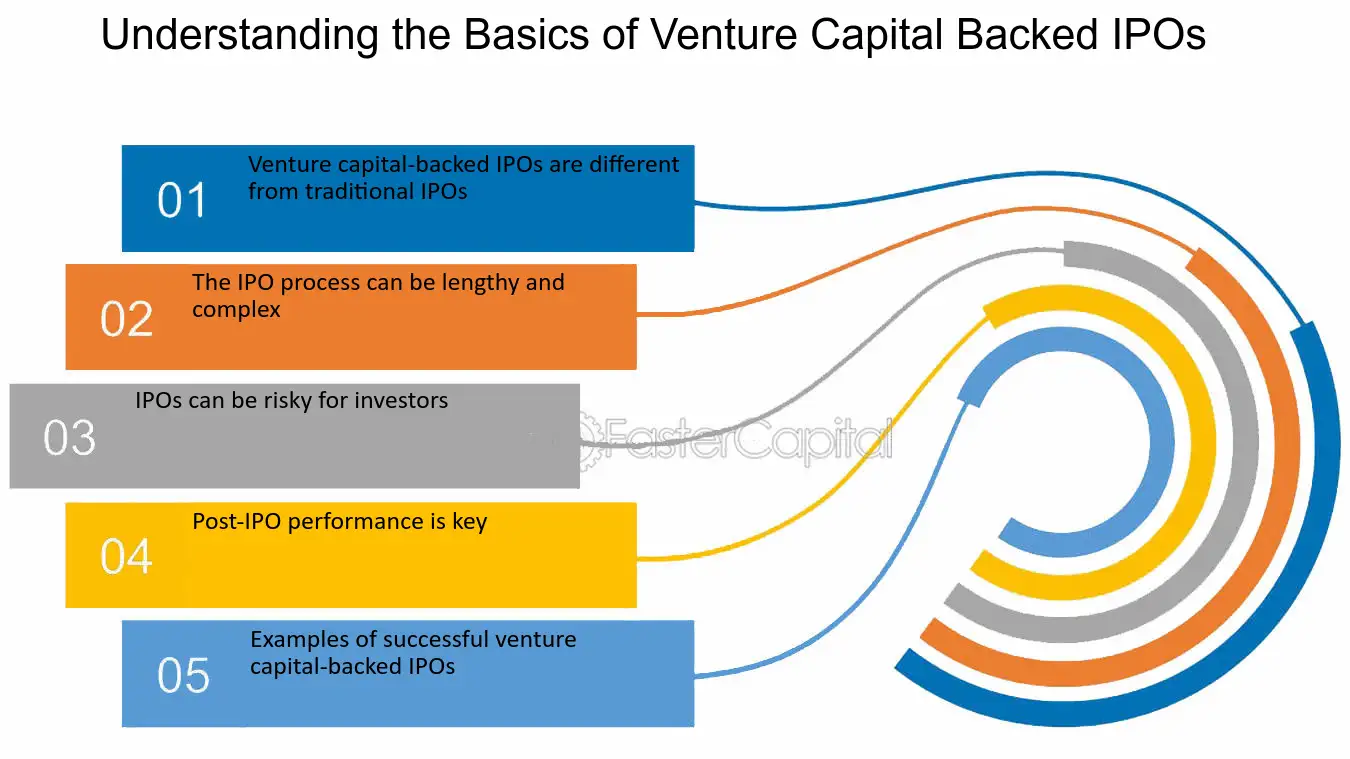

What is a Greenshoe Option? When a company decides to go public and issue shares through an IPO, it usually hires an underwriting syndicate to help with the process. The underwriters are responsible for purchasing the shares from the company and reselling them to investors. The Greenshoe Option is included … …