Wage Assignment And How It Functions

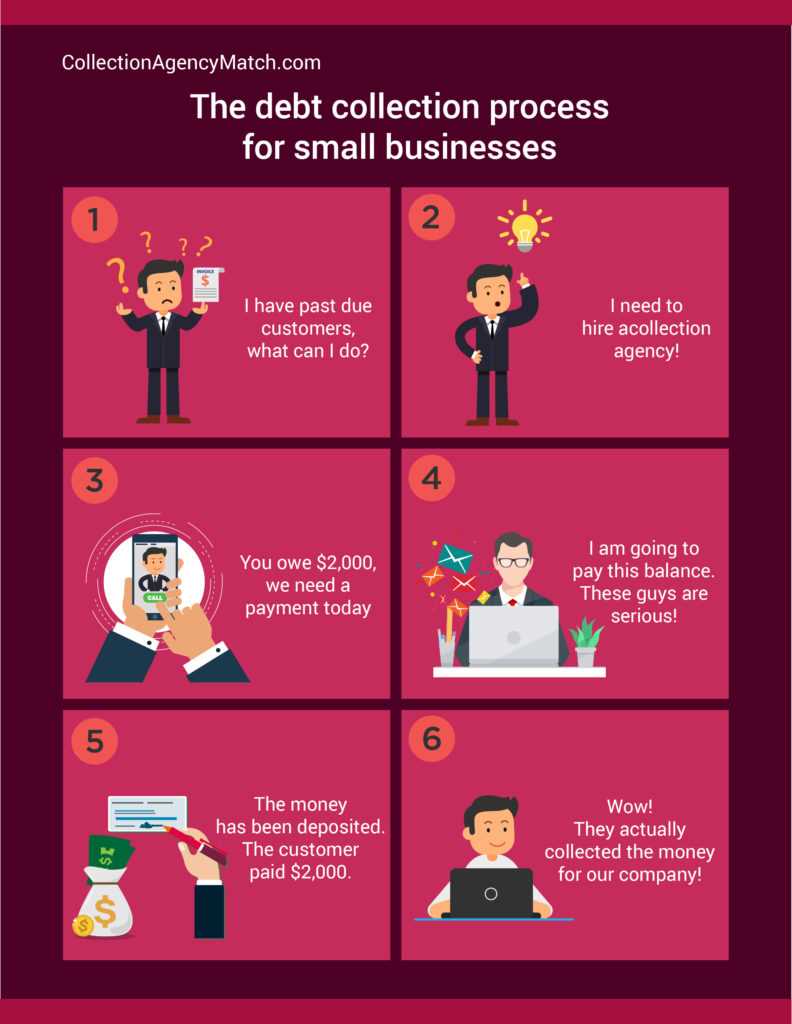

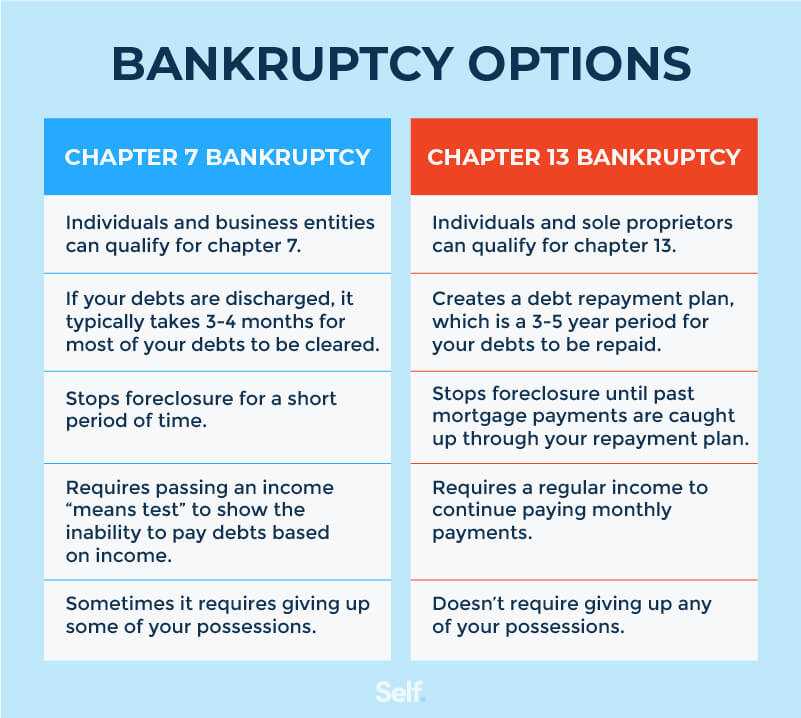

What is Wage Assignment? Wage assignment is a legal process that allows a creditor to garnish a portion of an employee’s wages in order to satisfy a debt. It is typically used as a last resort when other collection methods have failed. When a wage assignment is in place, the … …