Federal Funds: Definition, Loan Mechanics, And Interest Rates

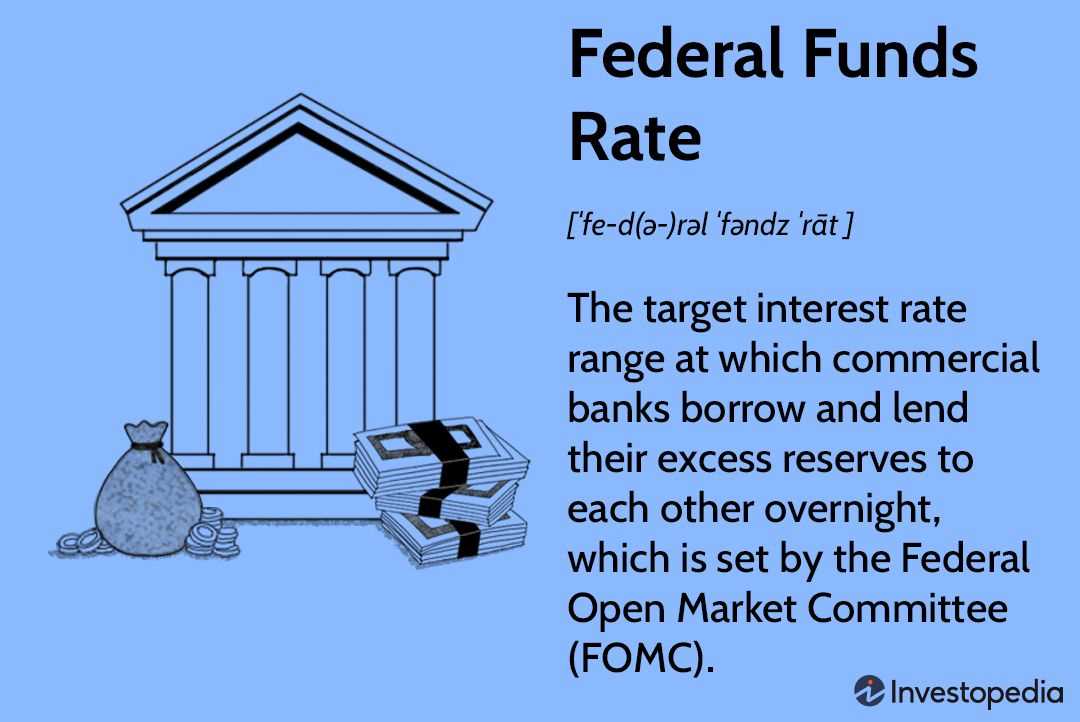

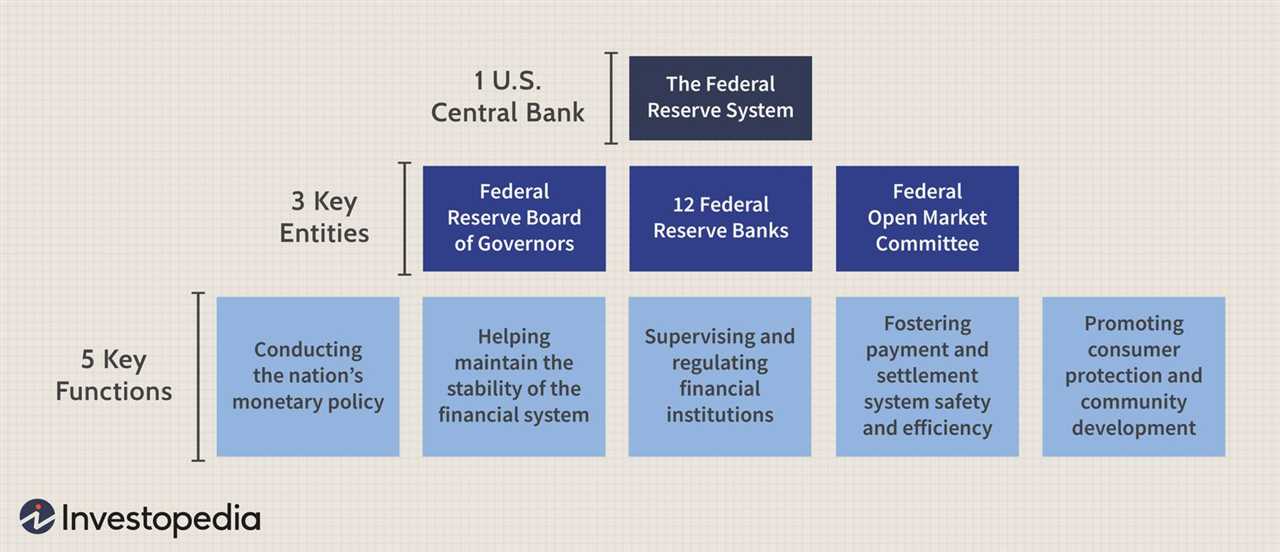

What are Federal Funds? Federal funds refer to the reserves that commercial banks hold at the Federal Reserve. These funds are used by banks to meet their reserve requirements and to lend to other banks overnight to maintain their required level of reserves. Federal funds are an essential tool for … …