Tax-Loss Harvesting: Definition and Example

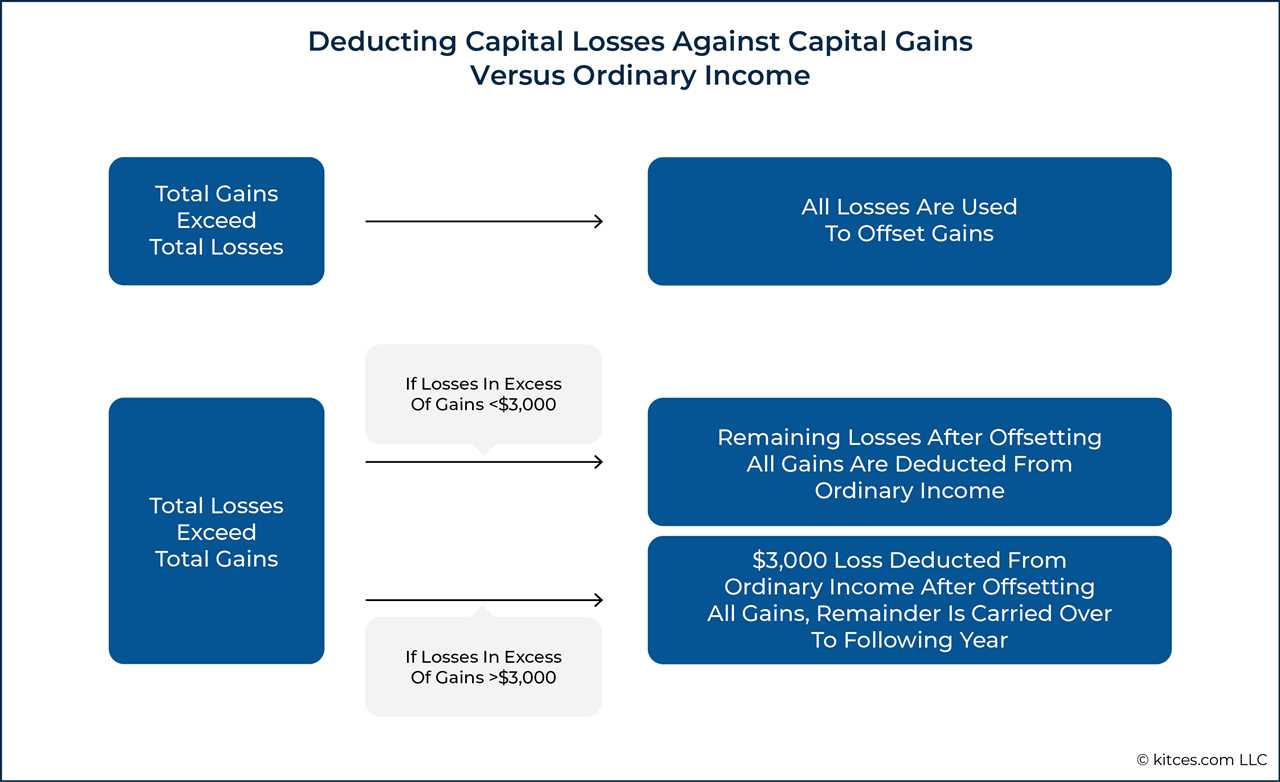

Tax-Loss Harvesting: Definition and Example Tax-loss harvesting is a strategy used by investors to minimize their tax liability by selling investments that have experienced a loss. This allows them to offset capital gains and reduce their overall taxable income. When an investor sells an investment at a loss, they can … …