Undisclosed Reserves And Their Functionality

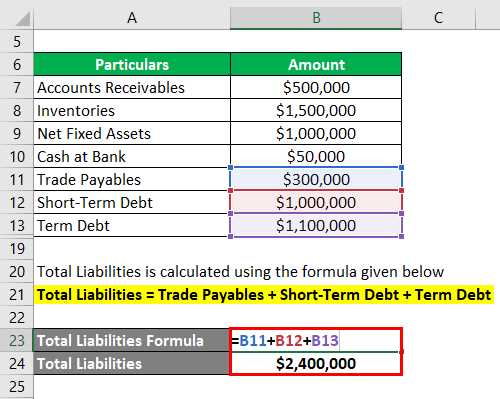

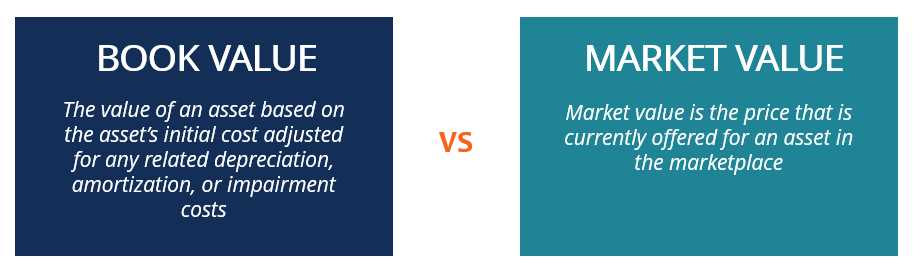

Exploring the Concept and Importance of Undisclosed Reserves Undisclosed reserves are an integral part of a company’s financial management strategy. These reserves refer to the portion of profits that a company sets aside without disclosing them to the public or shareholders. While undisclosed reserves are not reported on the balance … …