Understanding Interest-Rate Derivatives: Definition and Examples

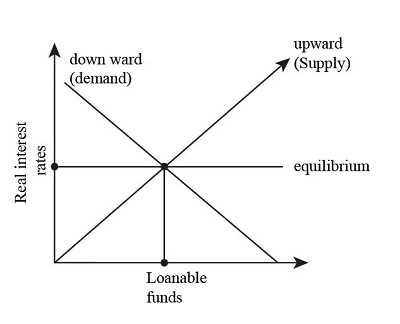

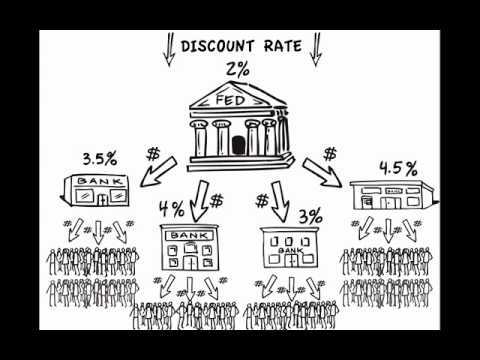

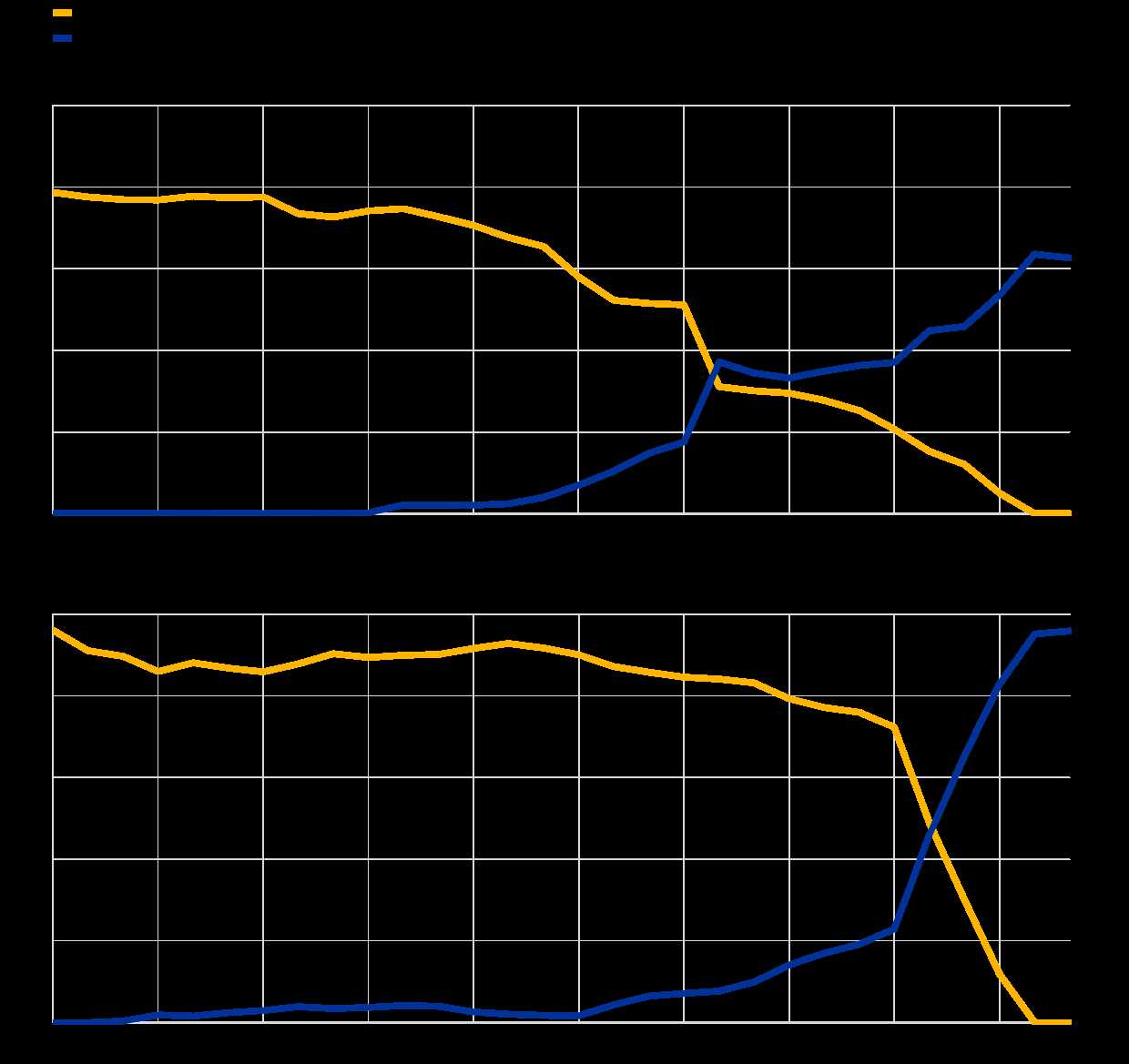

What are Interest-Rate Derivatives? Interest-rate derivatives are financial instruments that derive their value from changes in interest rates. These derivatives are used by individuals, companies, and financial institutions to manage their exposure to interest rate fluctuations and to speculate on future interest rate movements. Definition and Overview Interest-rate derivatives are … …