The Guarantee Company: Definition And Mechanism

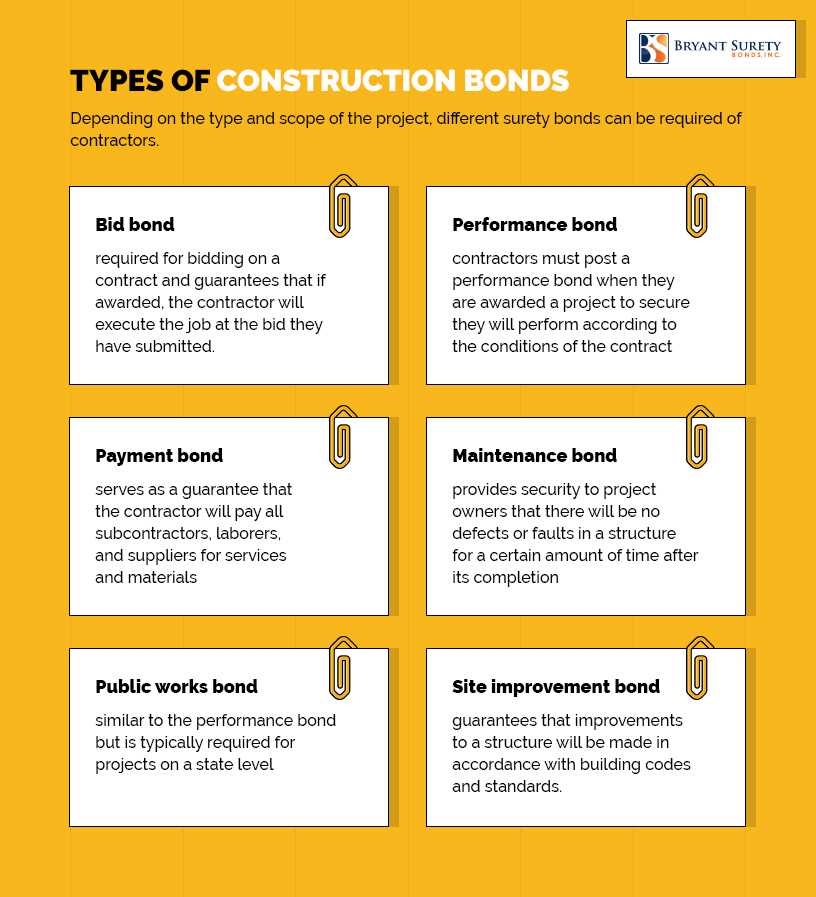

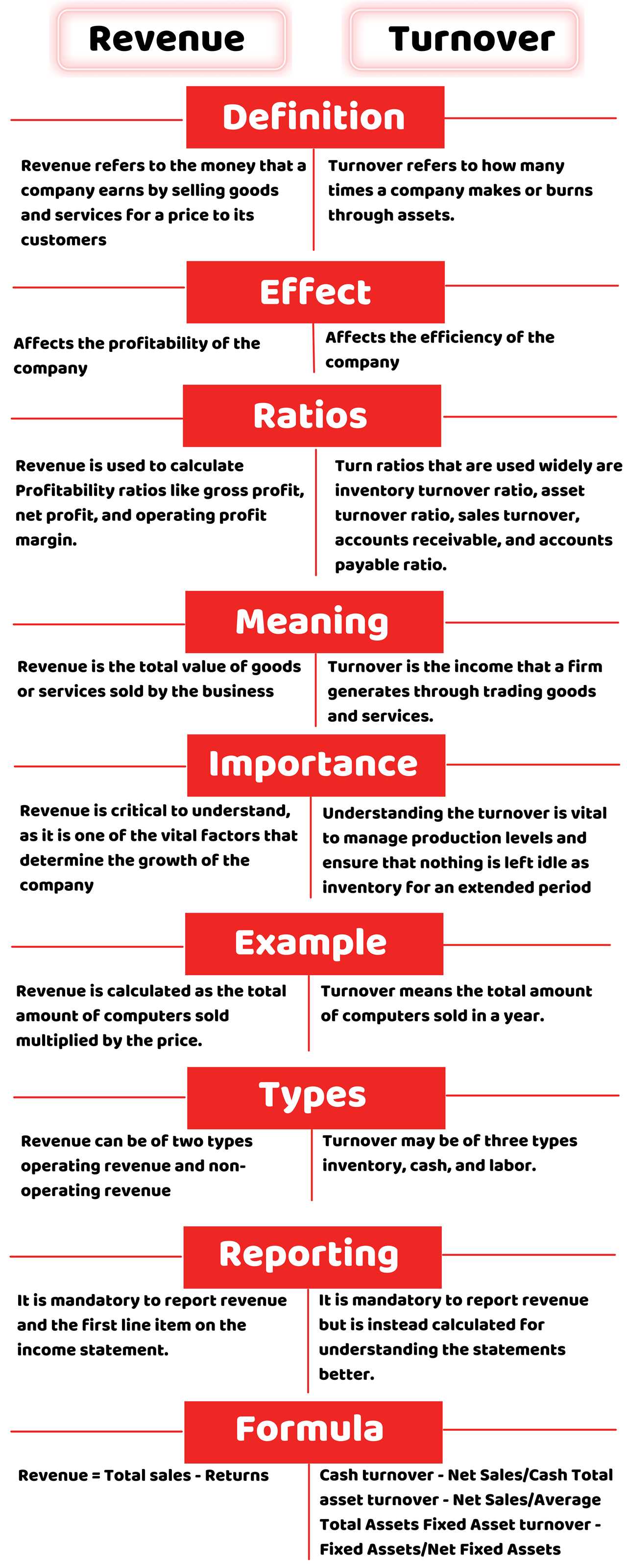

Definition of Guarantee Company Unlike traditional insurance companies, guarantee companies do not provide insurance coverage for specific risks. Instead, they act as a third party that assumes the financial responsibility for the obligations of their clients. This can include guaranteeing the payment of debts, the performance of contracts, or the … …