Warrant Premium Meaning Calculation Example

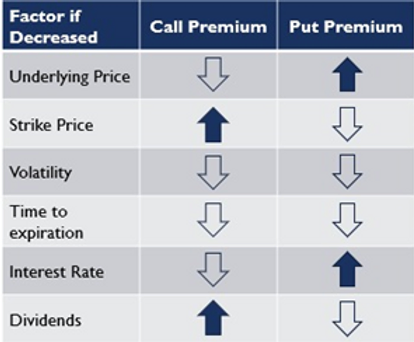

What is Warrant Premium? Warrant premium refers to the difference between the price at which a warrant is trading in the market and its intrinsic value. A warrant is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at … …