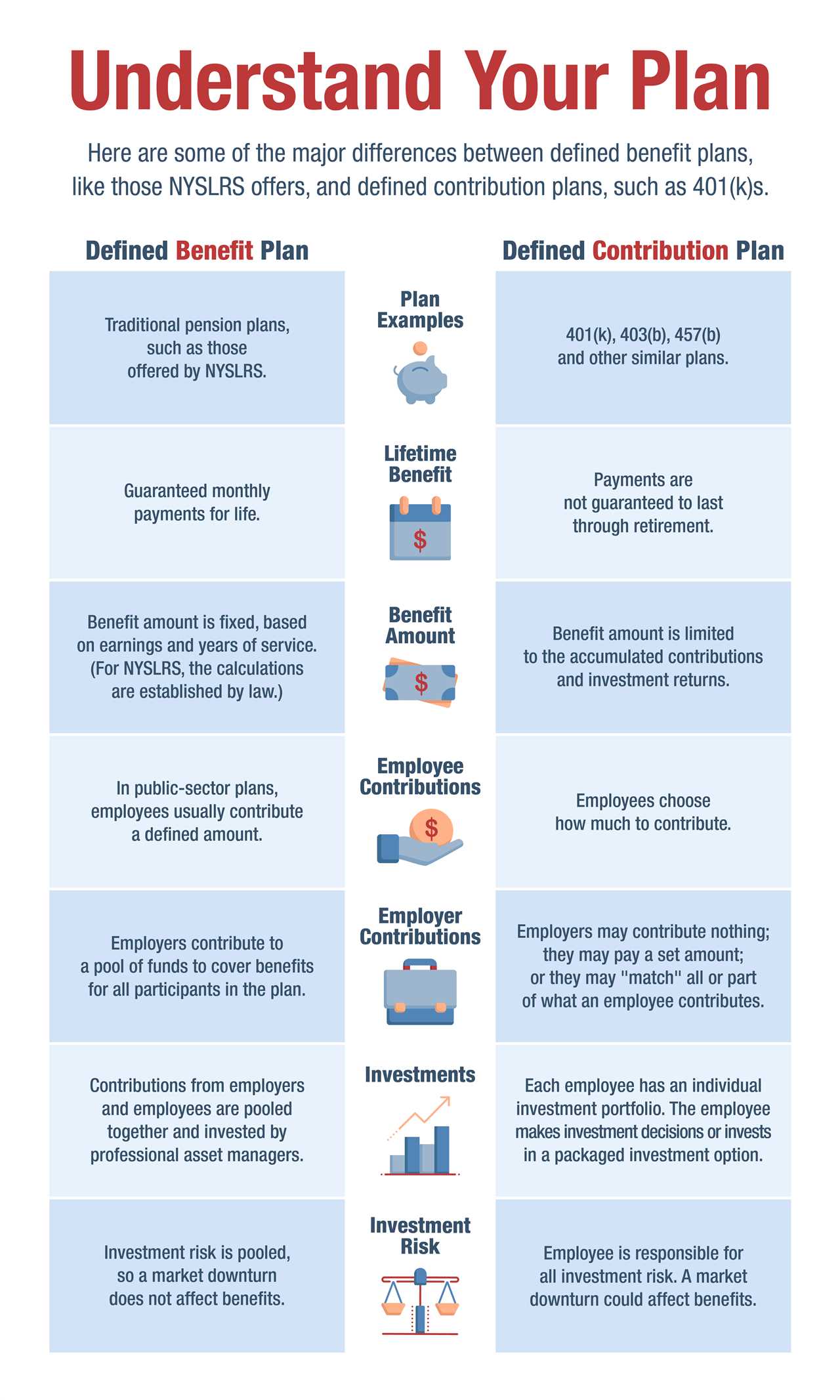

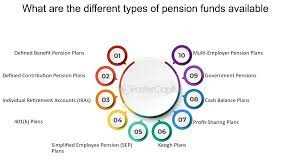

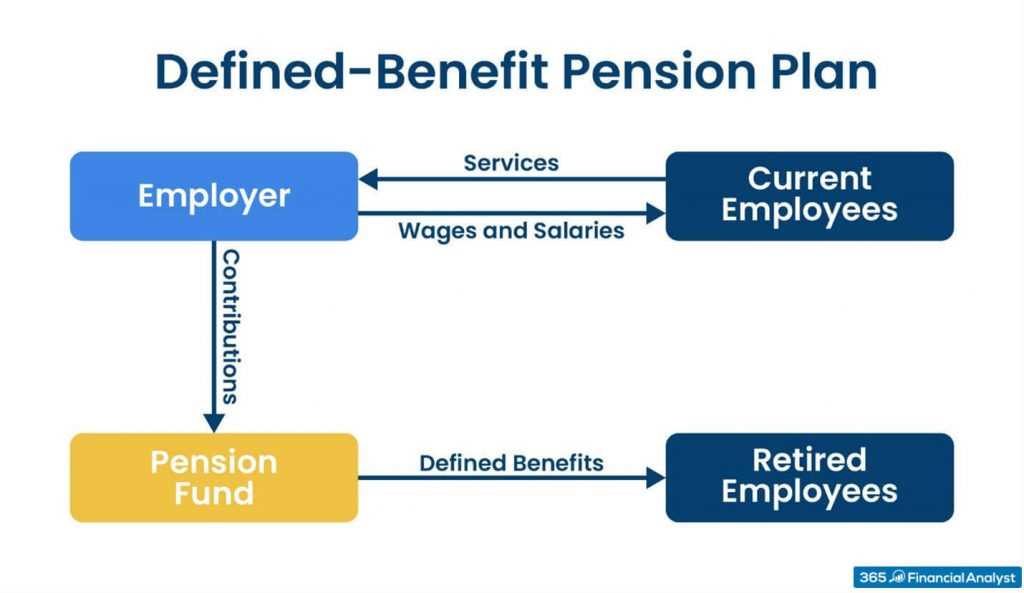

The Concept And Mechanics Of A Plan

Exploring the Mechanics of a Plan One of the key aspects of a plan is the identification of the target audience or beneficiaries. This involves determining who will benefit from the plan and how it will impact their lives. For example, in the case of a pension plan, the target … …