Iceberg Orders: How To Spot And Identify Them

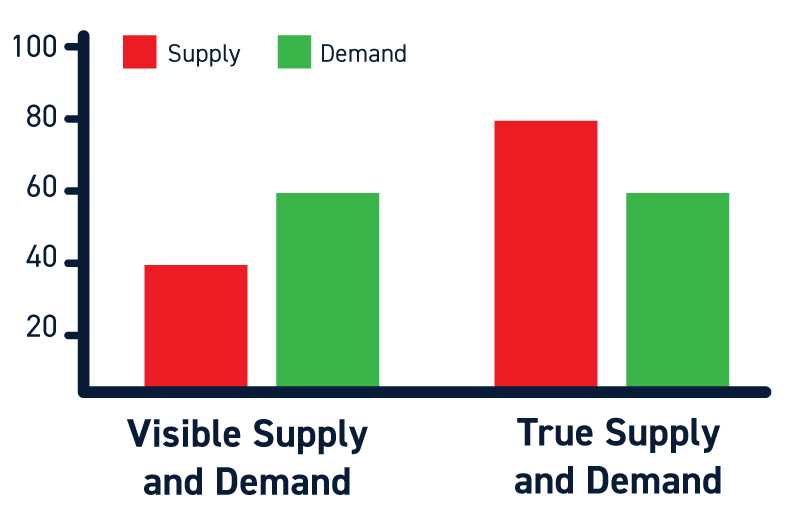

What are Iceberg Orders? An iceberg order is a type of trading order that is designed to conceal the full size of a large order. It is named after the analogy of an iceberg, where only a small portion is visible above the water while the majority remains hidden beneath … …