Ordinary Income And Its Tax Implications

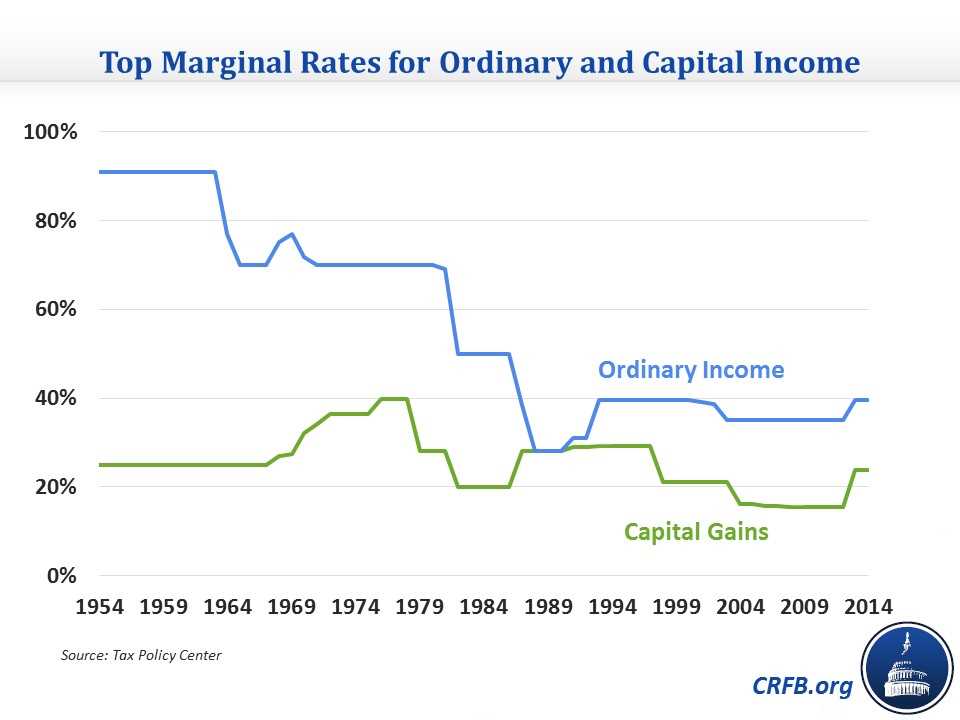

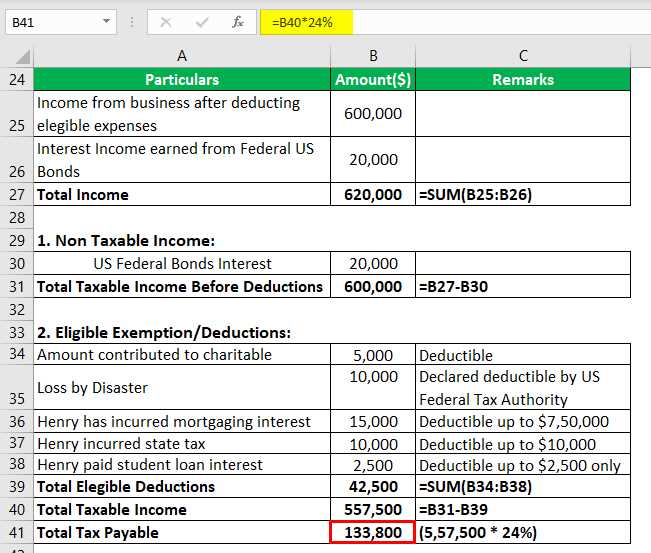

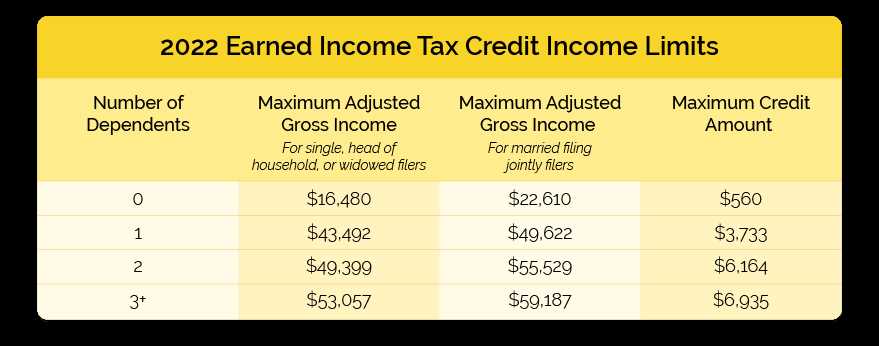

What is Ordinary Income? Ordinary income refers to the regular income that individuals or businesses earn through their everyday activities. It includes wages, salaries, commissions, bonuses, tips, and self-employment income. Ordinary income is different from capital gains, which are the profits made from the sale of investments or assets. Ordinary … …