Unit Sales: Definition, Calculation, and Example

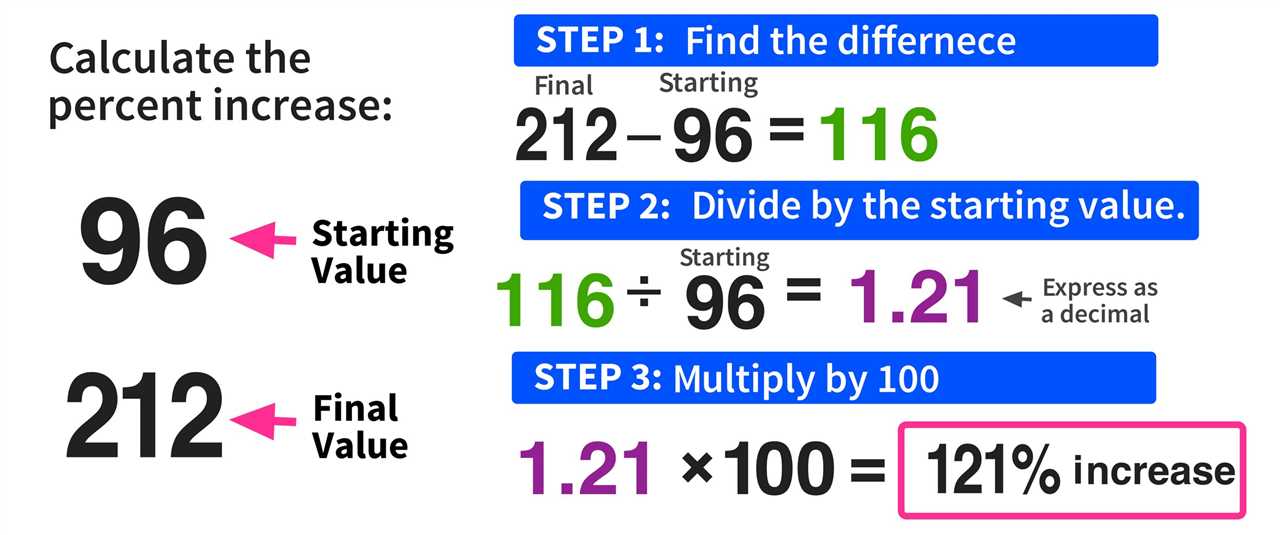

Unit Sales: Definition, Calculation, and Example Unit sales refer to the total number of units of a product or service that are sold within a specific period of time. It is an important metric used in financial analysis to evaluate the performance and profitability of a business. By tracking unit … …