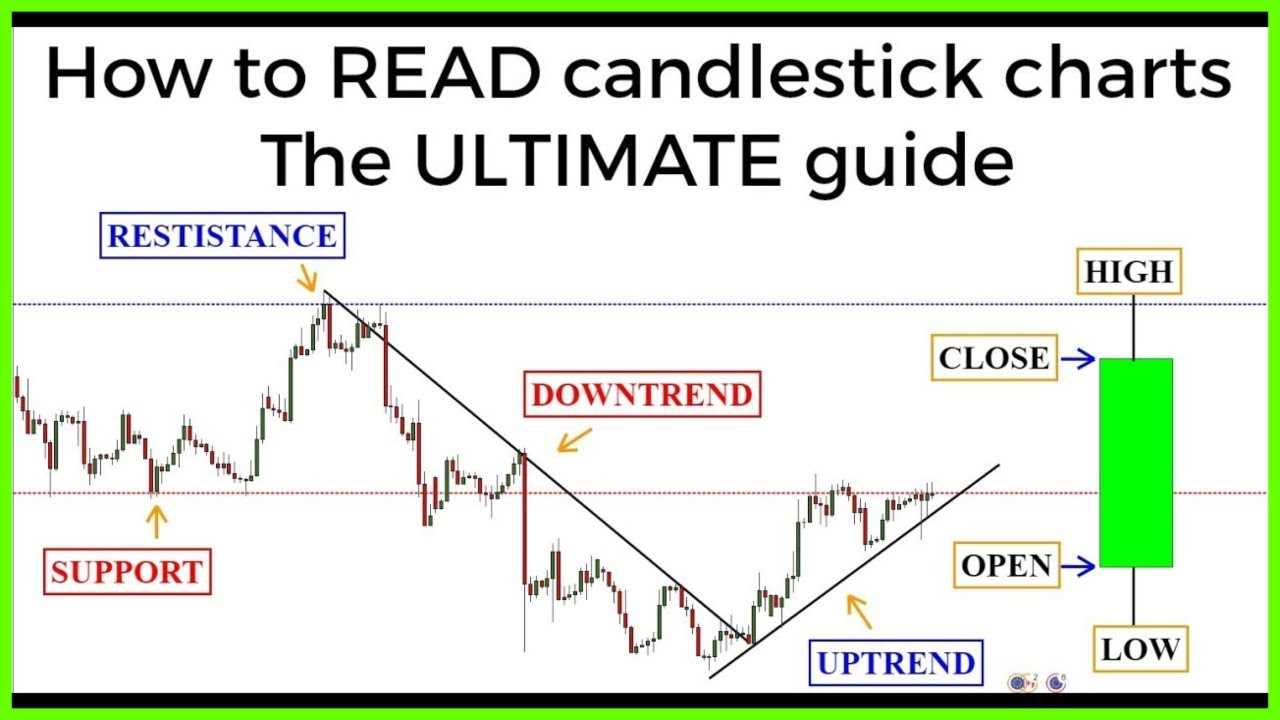

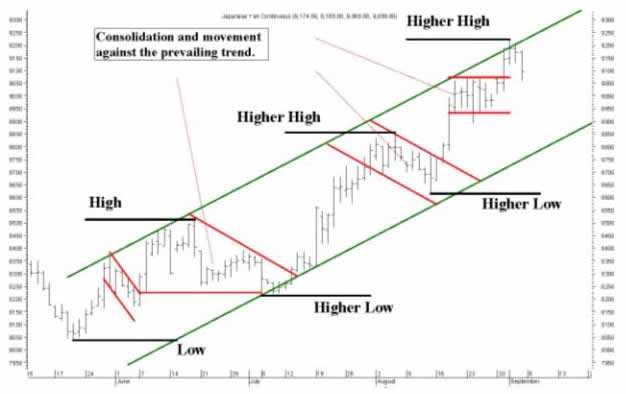

Understanding Stock Support Levels and Trading Strategies

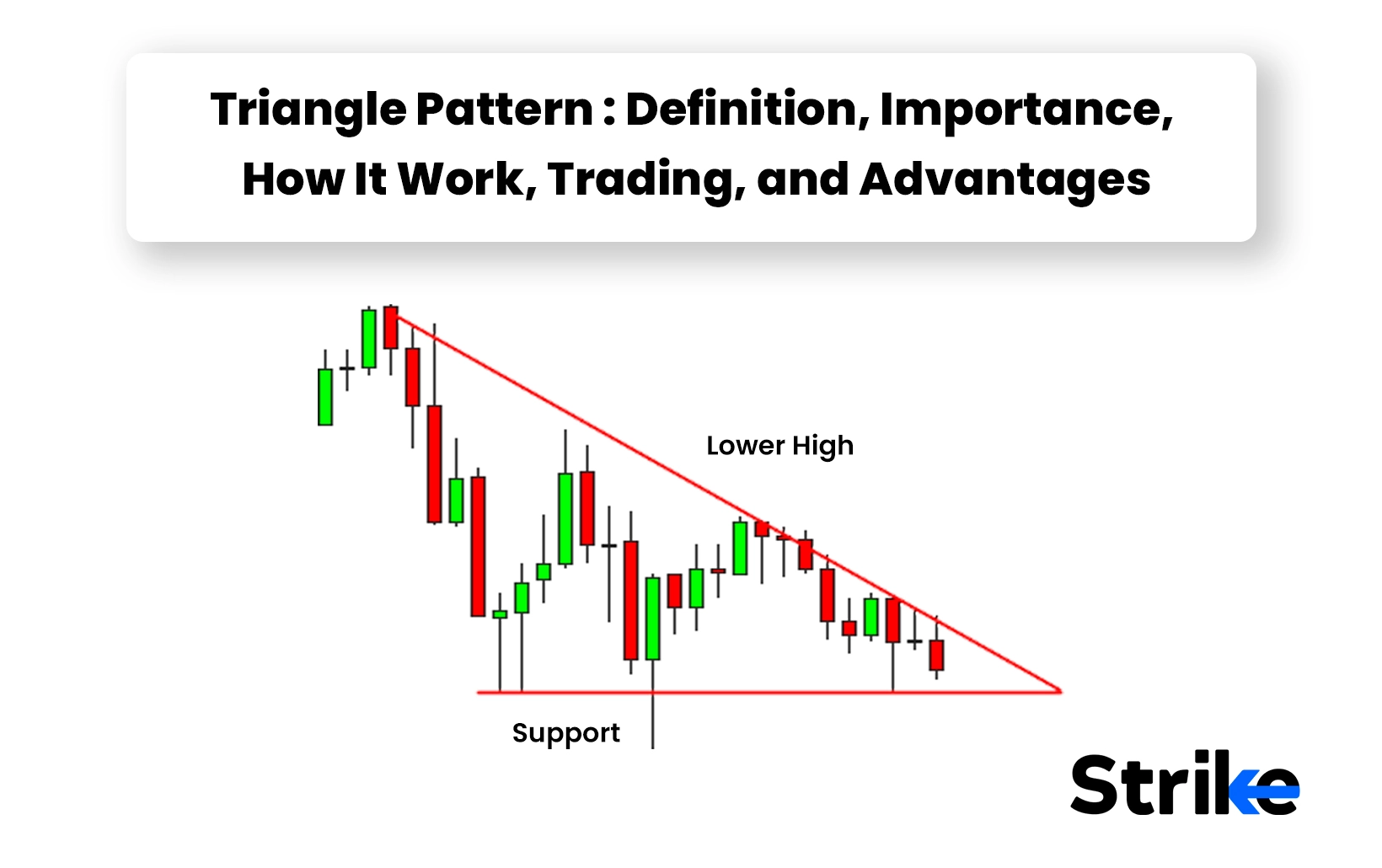

What are Stock Support Levels? Importance of Stock Support Levels Support levels can also be used to set stop-loss orders, which are orders placed to automatically sell a stock if it falls below a certain price. By setting a stop-loss order just below a support level, traders can limit their … …