The Process and Mechanics of Loss Development in Corporate Insurance

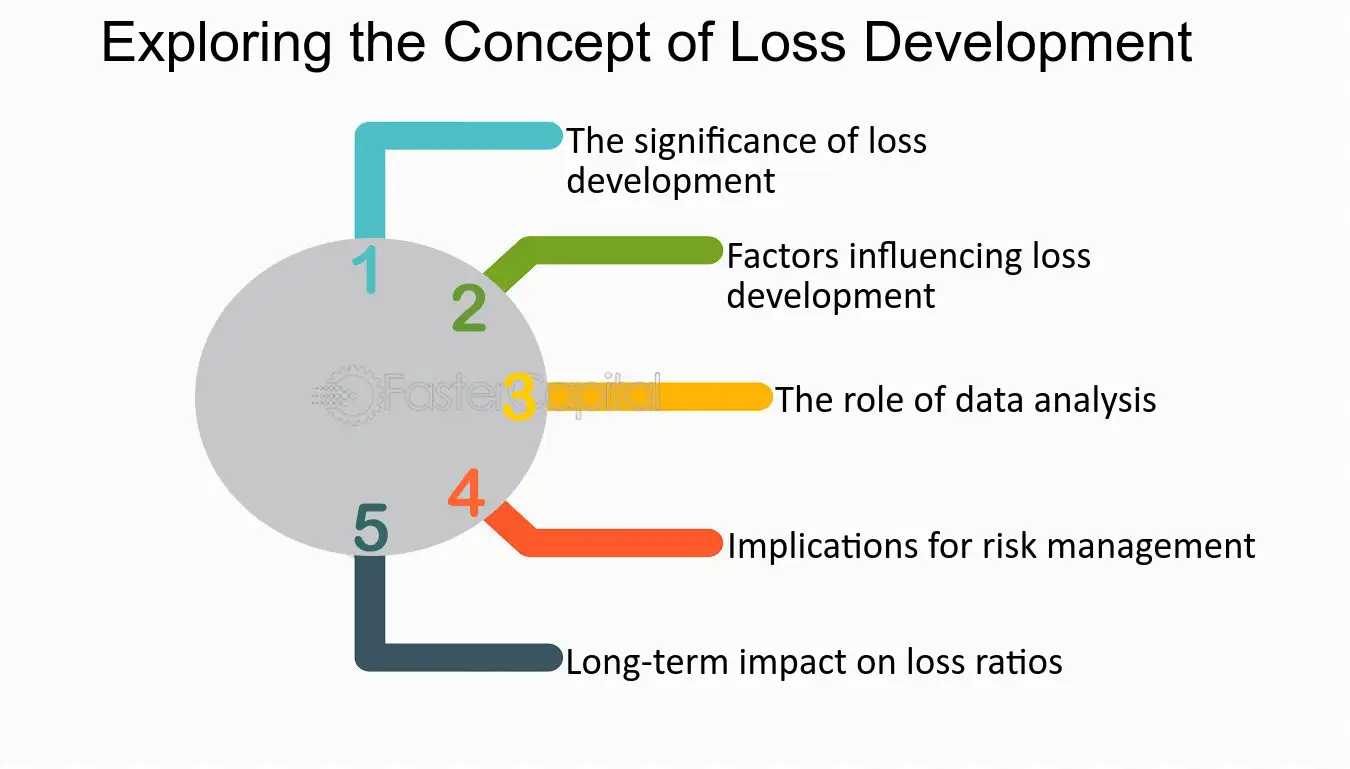

In the world of corporate insurance, loss development is a crucial aspect that insurers and risk managers need to understand. Loss development refers to the changes in the estimated cost of a claim over time. It is a dynamic process that involves several factors and can have a significant impact on the financial stability of an insurance company.

Loss development occurs due to various reasons, including changes in the severity of claims, inflation, and changes in legal and regulatory environments. Insurers use historical data and statistical models to estimate the ultimate cost of a claim. However, these estimates are subject to change as new information becomes available and the claim progresses.

The mechanics of loss development involve various statistical techniques and models. Insurers use techniques such as chain-ladder method, Bornhuetter-Ferguson method, and frequency-severity modeling to analyze historical data and predict future losses. These models consider factors such as claim severity, claim frequency, and policy limits to estimate the ultimate cost of a claim.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.