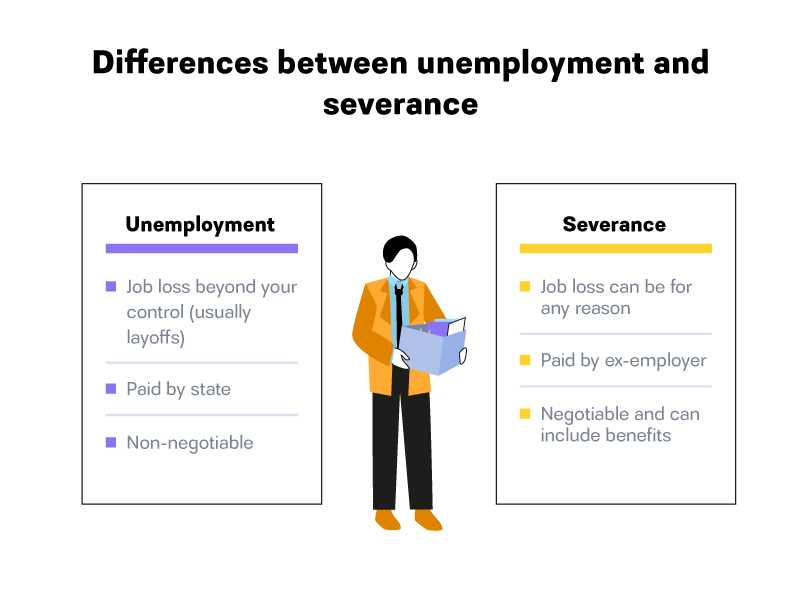

Unemployment Compensation Definition Requirements and Example

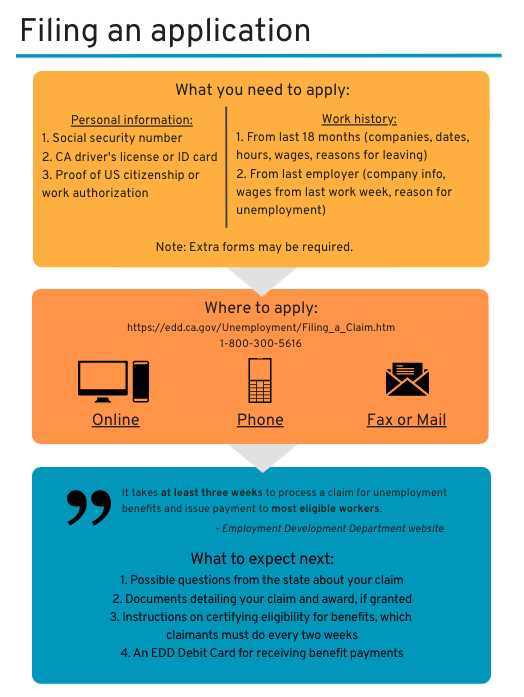

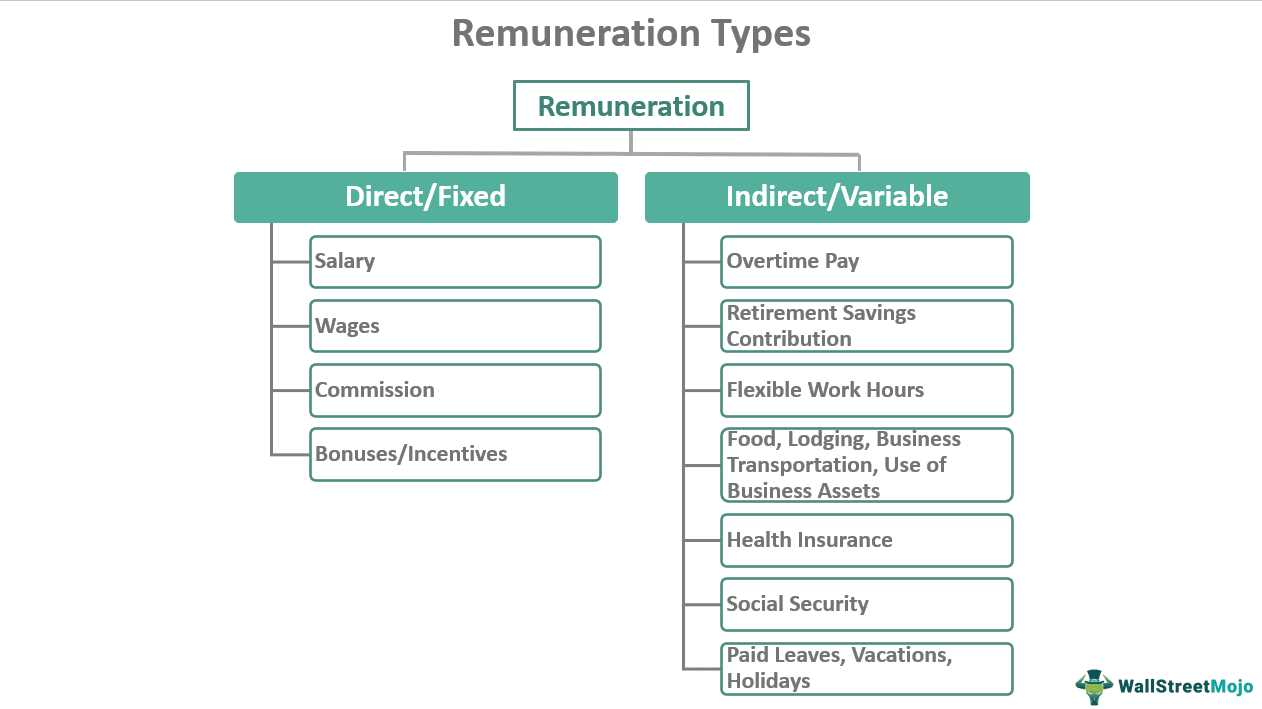

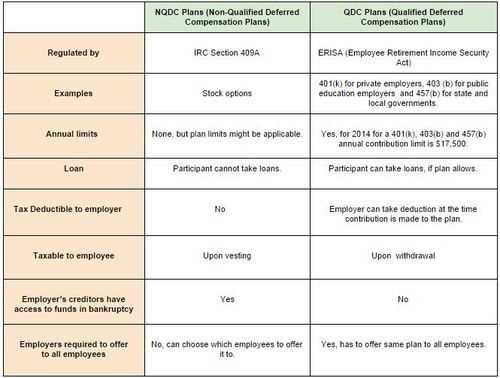

Unemployment Compensation: Definition, Requirements, and Example Unemployment compensation is a financial assistance program designed to provide temporary financial support to individuals who have lost their jobs. It is a form of social insurance that aims to help unemployed individuals meet their basic needs while they search for new employment opportunities. … …