Capitalization Table: How to Create and Maintain One

Creating and maintaining an accurate capitalization table is essential for various reasons. It helps companies understand their ownership structure, determine the dilution of shares, and make informed decisions regarding equity financing, mergers, acquisitions, or stock options grants.

Here are the key steps to create and maintain a capitalization table:

1. Gather all relevant information: Start by collecting all the necessary information, including the names of shareholders, the number and type of securities they hold, the date of issuance, and any additional terms or conditions associated with the securities.

2. Organize the data: Input the gathered information into a spreadsheet or specialized cap table software. Create columns to record the shareholder names, security types, number of shares held, purchase price, and any other relevant details.

3. Calculate ownership percentages: Determine the ownership percentages for each shareholder by dividing the number of shares they hold by the total number of outstanding shares. This calculation will help you understand the distribution of ownership in the company.

4. Update the cap table regularly: As new securities are issued or existing ones are transferred or sold, make sure to update the cap table accordingly. This will ensure that the table remains accurate and reflects the current ownership structure.

5. Include all types of securities: In addition to common shares, include other types of securities such as preferred shares, stock options, convertible notes, or warrants. Each security should have its own row in the cap table, with the relevant details filled in.

6. Seek professional assistance if needed: If you are unsure about creating or maintaining a capitalization table, consider seeking assistance from a financial professional or using specialized cap table software. They can provide guidance and ensure accuracy.

Note: It is important to consult with legal and financial professionals to ensure compliance with applicable laws and regulations when creating and maintaining a capitalization table.

The purpose of a capitalization table is to track and manage the ownership and value of a company over time. It is an essential tool for financial analysis and decision-making, as it helps stakeholders understand the current ownership structure and the potential impact of future financing rounds or equity transactions.

By analyzing a capitalization table, stakeholders can gain insights into the ownership dynamics of a company. They can see how ownership is distributed among different shareholders and how it may change over time. This information is crucial for making informed decisions regarding equity issuances, stock options, mergers and acquisitions, and other financial transactions.

Furthermore, a capitalization table can help determine the value of a company and its equity. By considering the ownership stakes and the current market value of shares, stakeholders can estimate the overall worth of the company and assess the potential returns on investment.

Importance of Capitalization Tables in Financial Analysis

One of the primary reasons why capitalization tables are important in financial analysis is that they help determine the company’s valuation. By knowing the ownership percentages and equity stakes of each shareholder, investors can assess the value of their investments and make informed decisions about the company’s potential for growth and profitability.

Additionally, capitalization tables play a vital role in fundraising efforts. When a company seeks to raise capital, whether through equity financing or debt financing, potential investors will often request to review the cap table. This allows them to evaluate the company’s ownership structure and assess the potential risks and returns associated with their investment.

Furthermore, capitalization tables provide transparency and accountability within a company. By maintaining an accurate and up-to-date cap table, companies can ensure that all shareholders are aware of their ownership stakes and any changes that may occur. This helps prevent disputes and conflicts among shareholders and promotes a healthy and efficient decision-making process.

Another important aspect of capitalization tables is their role in mergers and acquisitions. When a company is involved in a merger or acquisition, the cap table becomes a critical tool for determining the value of the company and negotiating the terms of the deal. It allows both parties to understand the ownership structure and make informed decisions about the transaction.

Key Components of a Capitalization Table

Here are the key components typically found in a capitalization table:

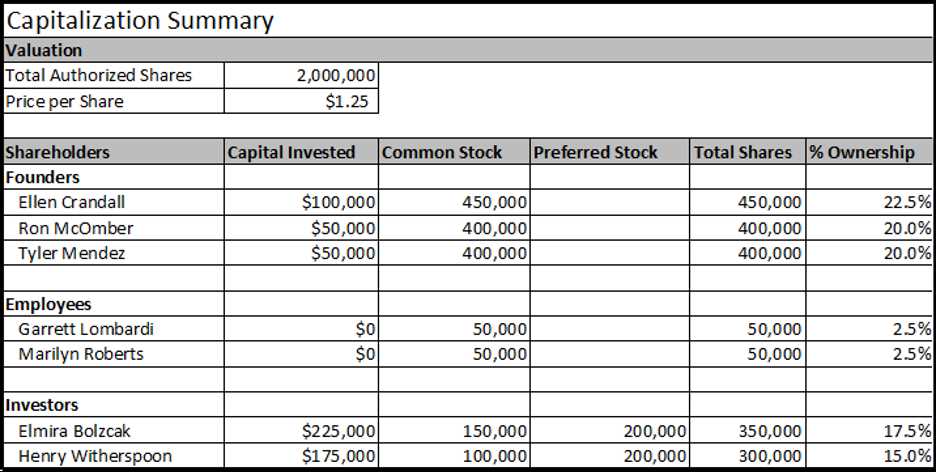

- Shareholder Information: This section includes the names of the shareholders and their ownership percentages. It provides a clear picture of who owns how much of the company.

- Equity Types: The capitalization table lists different types of equity, such as common stock, preferred stock, and options. Each equity type represents a different class of ownership with its own rights and privileges.

- Shares Outstanding: This component shows the total number of shares issued by the company. It includes both the shares held by shareholders and the shares reserved for future issuance.

- Convertible Securities: Convertible securities, such as convertible notes or convertible preferred stock, are included in the capitalization table. These securities can be converted into common stock at a predetermined price and have an impact on the ownership structure.

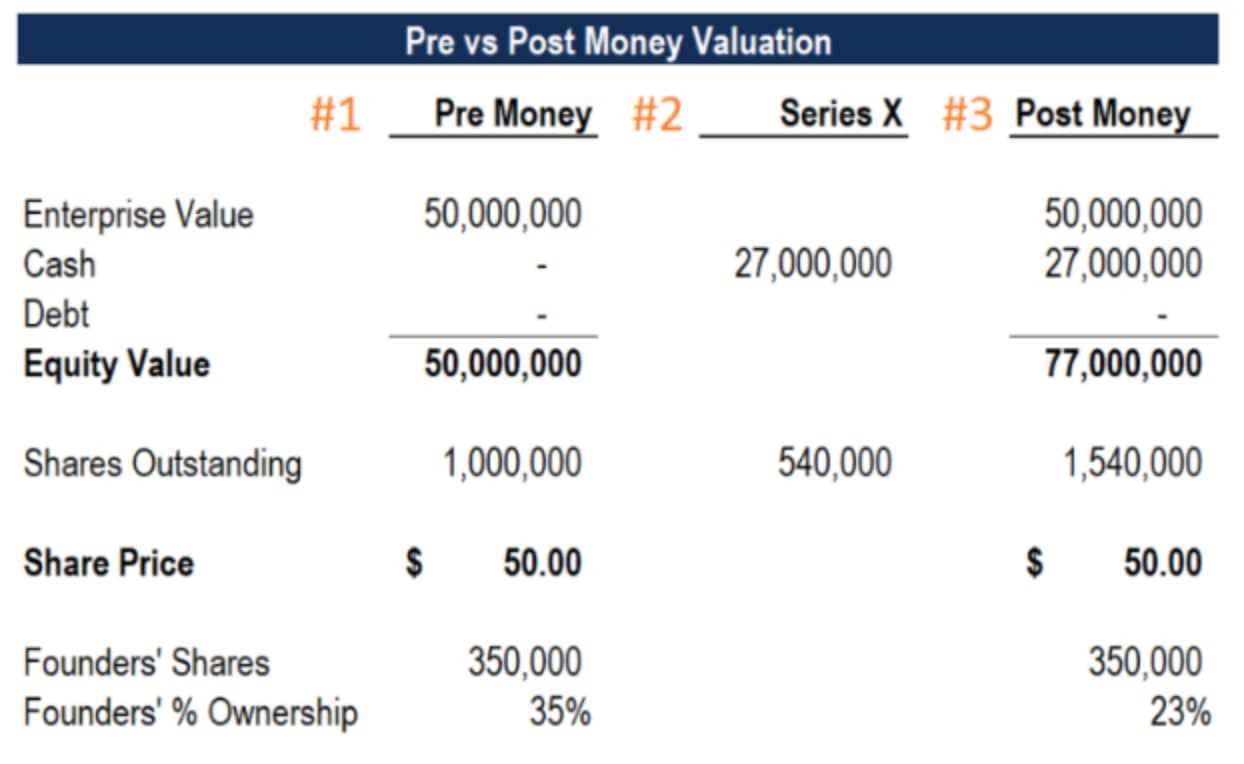

- Valuation: The valuation section of the cap table provides the value of the company at different stages, such as pre-money valuation and post-money valuation. It helps in determining the worth of each ownership stake.

- Investment Rounds: A capitalization table tracks the different investment rounds the company has gone through. It includes details about the investors, the amount invested, and the valuation of the company at each round.

- Options and Warrants: If the company has issued stock options or warrants to employees or investors, these are included in the cap table. It shows the number of options/warrants outstanding and their exercise price.

- Exit Scenarios: The cap table may also include projections of potential exit scenarios, such as an acquisition or an initial public offering (IPO). These projections help in estimating the potential returns for the shareholders.

Having a well-maintained and accurate capitalization table is essential for making informed financial decisions and attracting potential investors. It provides transparency and clarity regarding the ownership structure and the value of the company. Therefore, it is crucial for companies to regularly update and maintain their cap tables to reflect any changes in ownership or financing.

Steps to Create a Capitalization Table

Creating a capitalization table is an essential step in managing the ownership structure of a company. It provides a clear overview of the ownership percentages and the value of each shareholder’s stake. Here are the steps to create a capitalization table:

- Gather necessary information: Start by collecting all the relevant information about the company’s ownership structure. This includes the names of shareholders, the number of shares they hold, the type of shares (common or preferred), and any special rights or restrictions associated with the shares.

- Calculate ownership percentages: Once you have gathered the necessary information, calculate the ownership percentages for each shareholder. Divide the number of shares held by a shareholder by the total number of outstanding shares to determine their ownership percentage.

- Calculate fully diluted ownership: To get a comprehensive view of the ownership structure, calculate the fully diluted ownership percentages. This includes taking into account the potential conversion of all convertible securities into common shares.

- Include vesting schedules: If there are any vesting schedules in place for certain shareholders, make sure to include them in the capitalization table. Vesting schedules determine when and how shares become fully owned by an individual, usually over a specified period of time or upon achieving certain milestones.

- Update the table regularly: A capitalization table is not a one-time document. It needs to be updated regularly to reflect any changes in the ownership structure, such as new issuances of shares, share transfers, or exercises of convertible securities. Make sure to keep the table accurate and up to date.

Creating and maintaining a capitalization table is crucial for financial analysis and decision-making. It provides transparency and clarity regarding the ownership structure of a company, which is essential for attracting investors, negotiating acquisitions, and planning future financing rounds.

Tips for Maintaining an Accurate Capitalization Table

Creating a capitalization table is an essential part of financial analysis for any company. However, it is equally important to maintain an accurate and up-to-date capitalization table to ensure its usefulness and reliability. Here are some tips for maintaining an accurate capitalization table:

1. Regularly Update the Table

It is crucial to update the capitalization table regularly to reflect any changes in the company’s ownership structure. This includes adding new shareholders, issuing new shares, and recording any transfers or sales of existing shares. By keeping the table up-to-date, you can ensure that it accurately reflects the current ownership distribution.

2. Document All Transactions

When making any changes to the capitalization table, it is essential to document all transactions and keep a record of supporting documents, such as share purchase agreements or stock option grants. This documentation will serve as evidence and help maintain the accuracy and integrity of the capitalization table.

3. Use a Reliable Software or Tool

Using a reliable software or tool specifically designed for maintaining capitalization tables can greatly simplify the process and reduce the chances of errors. These tools often offer features such as automatic calculations, real-time updates, and data security measures, ensuring the accuracy and integrity of the table.

4. Verify Data Accuracy

Regularly verify the accuracy of the data entered into the capitalization table. Double-check all numbers, calculations, and formulas to ensure that they are correct. This includes verifying the number of shares issued, the ownership percentages, and any dilution effects resulting from new issuances or conversions.

5. Seek Professional Assistance

If you are unsure about how to create or maintain a capitalization table accurately, it is advisable to seek professional assistance. Financial analysts or accounting professionals with experience in capitalization tables can provide guidance and ensure that the table is accurate and compliant with relevant regulations.

6. Educate Shareholders

Shareholders should be educated about the importance of maintaining an accurate capitalization table. They should understand the impact of their ownership on the company’s valuation, potential dilution effects, and the importance of keeping their information updated. Regular communication with shareholders can help ensure that the table remains accurate and reflects the current state of ownership.

Maintaining an accurate capitalization table is crucial for financial analysis and decision-making. By following these tips, you can ensure that your capitalization table remains reliable, accurate, and useful for various stakeholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.