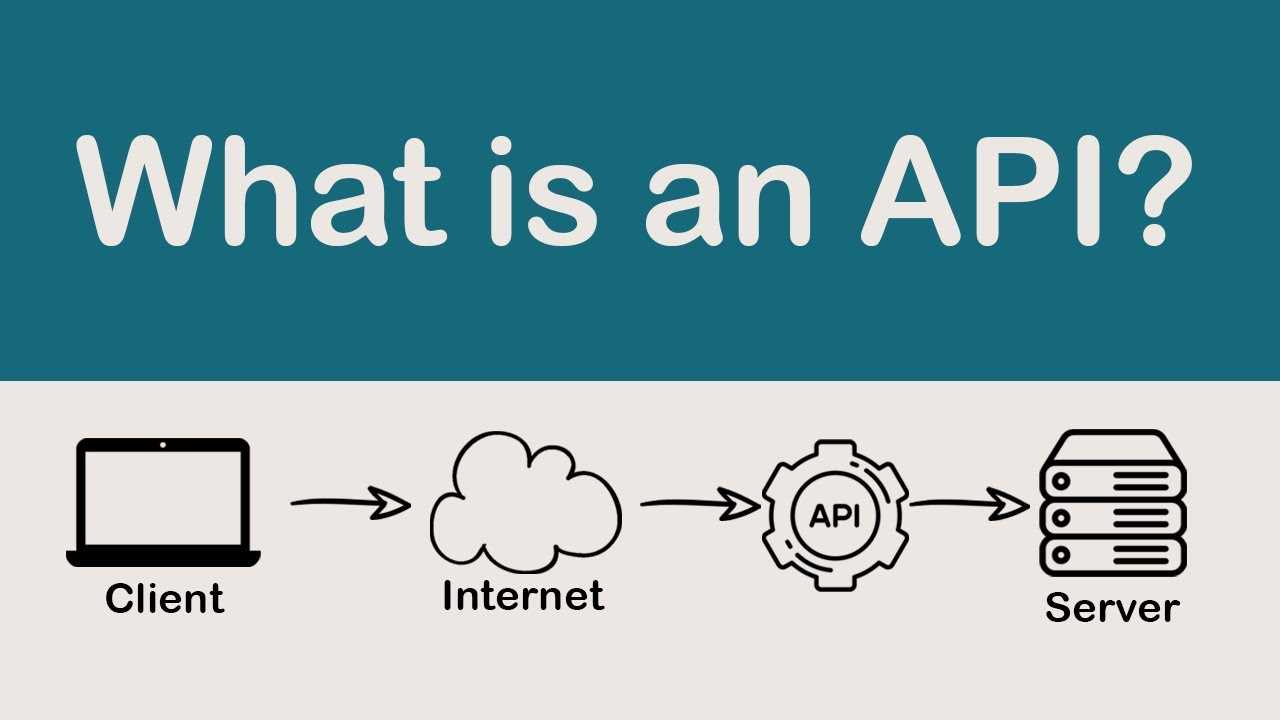

What is an API? Learn the Definition and Explore Examples

What is an API? An API, or Application Programming Interface, is a set of rules and protocols that allows different software applications to communicate with each other. It defines the methods and data formats that can be used to request and exchange information between applications. APIs are used to enable … …