Understanding the On-The-Run Treasury Yield Curve and Its Functionality

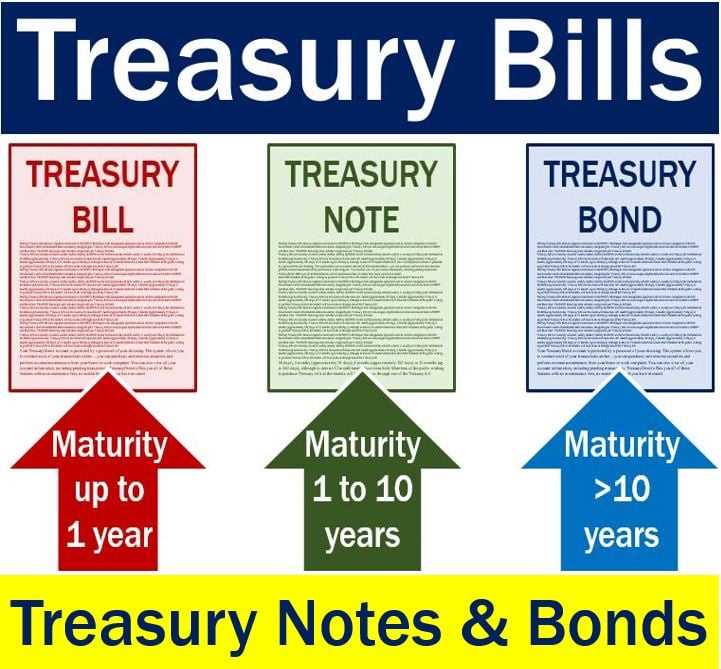

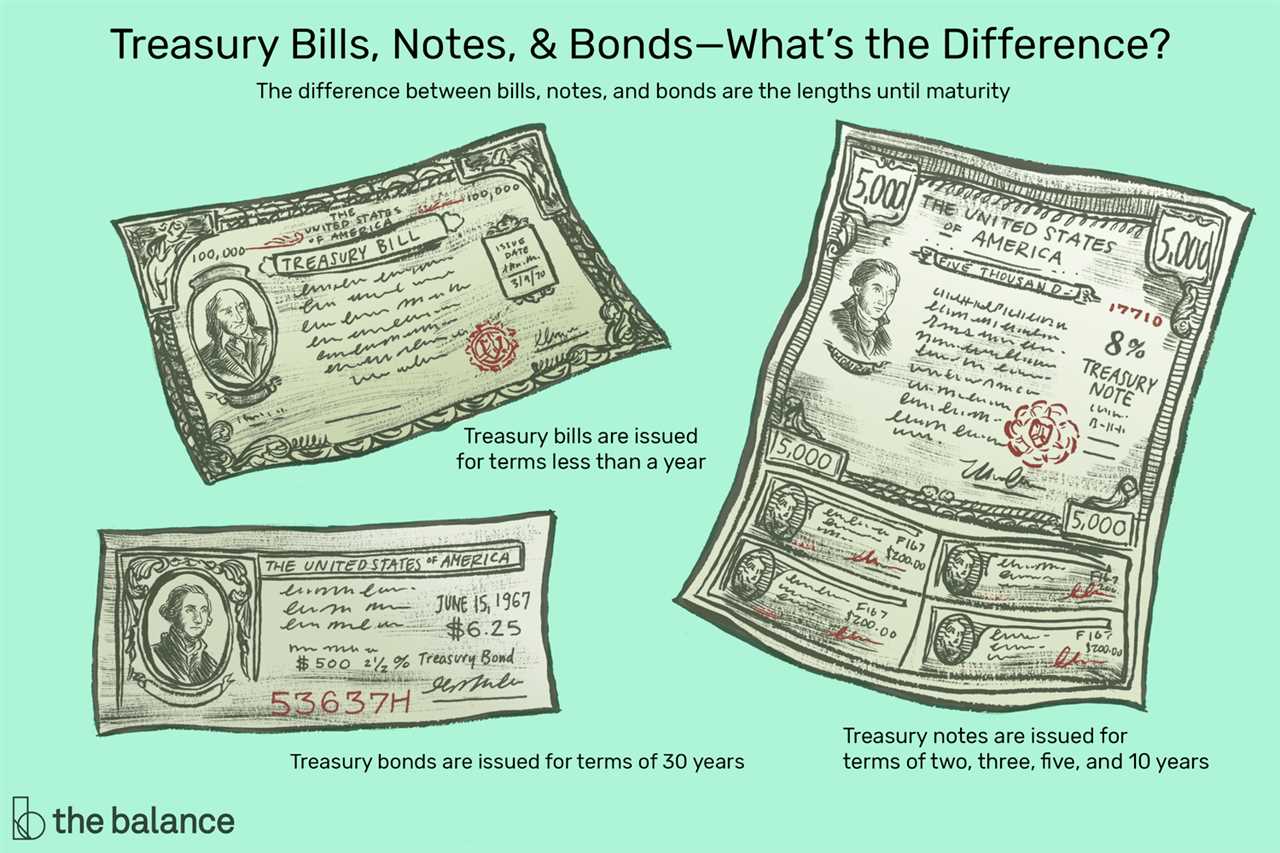

Overview of Treasury Bonds Types of Treasury Bonds There are two main types of Treasury bonds: On-The-Run Treasury Bonds: These are the most recently issued Treasury bonds and are actively traded in the secondary market. They are considered to be the benchmark for pricing other fixed-income securities. Off-The-Run Treasury Bonds: … …