Account Balances: A Comprehensive Guide

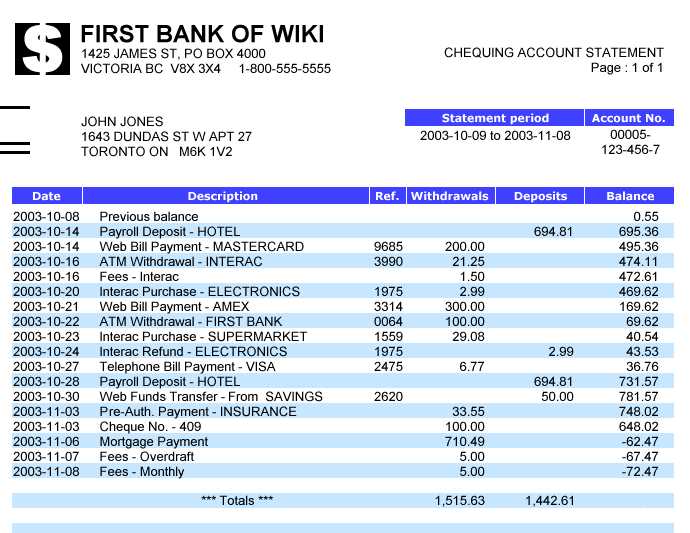

What are Account Balances? Account balances are typically displayed as a numerical value, indicating the current amount of funds available in the account. This balance takes into account various factors, such as deposits, withdrawals, interest earned, and fees charged. It provides a snapshot of your financial position and helps you … …