What is Accrued Income?

Accrued income refers to the money that has been earned but not yet received. It is a concept in accounting that recognizes revenue when it is earned, regardless of when the payment is received. This means that even if the payment has not been received, the income is still recognized and recorded in the books of accounts.

Accrued income can arise in various situations. For example, if a company provides services to a customer but has not yet received the payment, the revenue from those services would be considered as accrued income. Similarly, if a company rents out a property but has not yet received the rent, the rental income would be classified as accrued income.

Recognition of Accrued Income

The recognition of accrued income is important because it ensures that revenue is recorded in the correct accounting period. By recognizing the income when it is earned, financial statements provide a more accurate representation of a company’s financial performance.

Accrued income is typically recorded as an asset on the balance sheet and as revenue on the income statement. It is important for businesses to properly account for accrued income to ensure accurate financial reporting and to comply with accounting standards.

Conclusion

Accrued income is an important concept in accounting that recognizes revenue when it is earned, regardless of when the payment is received. By properly accounting for accrued income, businesses can provide a more accurate representation of their financial performance and comply with accounting standards.

Importance of Accrued Income

Accrued income plays a crucial role in accounting and financial reporting. It is important for businesses to recognize and account for income that has been earned but not yet received. Here are some reasons why accrued income is important:

1. Accurate Financial Statements

Accrued income ensures that financial statements accurately reflect the financial position and performance of a business. By recognizing income that has been earned but not yet received, businesses can provide a more complete and accurate picture of their financial health.

2. Matching Principle

The matching principle is a fundamental concept in accounting that requires businesses to match revenues with the expenses incurred to generate those revenues. Accrued income helps in adhering to this principle by recognizing income in the period it is earned, even if it is not received until a later date.

For example, if a company provides services to a customer in December but does not receive payment until January, the accrued income for December is recognized, allowing for a more accurate matching of revenue and expenses.

3. Decision Making

Accurate and timely recognition of accrued income allows businesses to make informed decisions based on their current financial position. It provides a more comprehensive view of the company’s revenue stream and can help in evaluating the performance of different business segments or projects.

4. Tax Reporting

Accrued income is also important for tax reporting purposes. In many jurisdictions, businesses are required to report income based on the accrual method of accounting, which recognizes income when it is earned, regardless of when it is received. By properly accounting for accrued income, businesses can ensure compliance with tax regulations and avoid penalties or audits.

| Benefits of Accrued Income | Summary |

|---|---|

| Accurate financial statements | Accrued income ensures accurate financial statements by recognizing income that has been earned but not yet received. |

| Matching principle | Accrued income helps in adhering to the matching principle by recognizing income in the period it is earned, even if it is not received until a later date. |

| Decision making | Accurate recognition of accrued income allows for informed decision making based on the company’s current financial position. |

| Tax reporting | Accrued income is important for tax reporting purposes, ensuring compliance with tax regulations and avoiding penalties or audits. |

Overall, accrued income is an essential concept in accounting that helps businesses provide accurate financial statements, adhere to the matching principle, make informed decisions, and comply with tax regulations. It is crucial for businesses to properly account for and recognize accrued income to maintain transparency and financial integrity.

Accounting for Accrued Income

Accrued income is an important concept in accounting that refers to the revenue earned but not yet received by a business. It represents the amount of money that a company has earned from its operations but has not yet received in cash or other forms of payment.

Accounting for accrued income is crucial for businesses as it helps in accurately reporting their financial performance and ensuring that revenue is recognized in the appropriate accounting period. It also helps in matching revenue with the expenses incurred to generate that revenue, providing a more accurate picture of the company’s profitability.

When accounting for accrued income, businesses typically record the amount as accounts receivable in their financial statements. Accounts receivable represents the amount of money owed to the company by its customers or clients for goods or services provided. It is considered an asset on the company’s balance sheet.

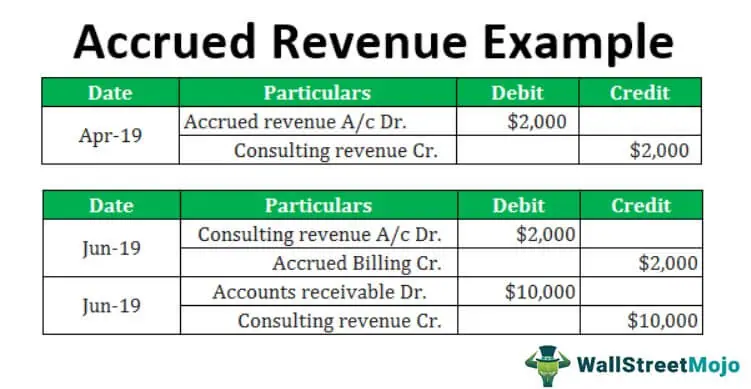

To account for accrued income, businesses usually follow a two-step process:

| Step | Description |

|---|---|

| 1 | Recognition of revenue |

| 2 | Recording of accounts receivable |

In the first step, the company recognizes the revenue earned by debiting the revenue account and crediting the accrued income account. This entry reflects the increase in the company’s earnings and the corresponding increase in the amount of revenue yet to be received.

In the second step, the company records the accounts receivable by debiting the accounts receivable account and crediting the accrued income account. This entry reflects the increase in the amount of money owed to the company by its customers or clients.

Accounting for accrued income requires careful attention to detail and adherence to accounting principles and standards. It is essential for businesses to accurately record and report their accrued income to maintain transparency and ensure compliance with financial regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.