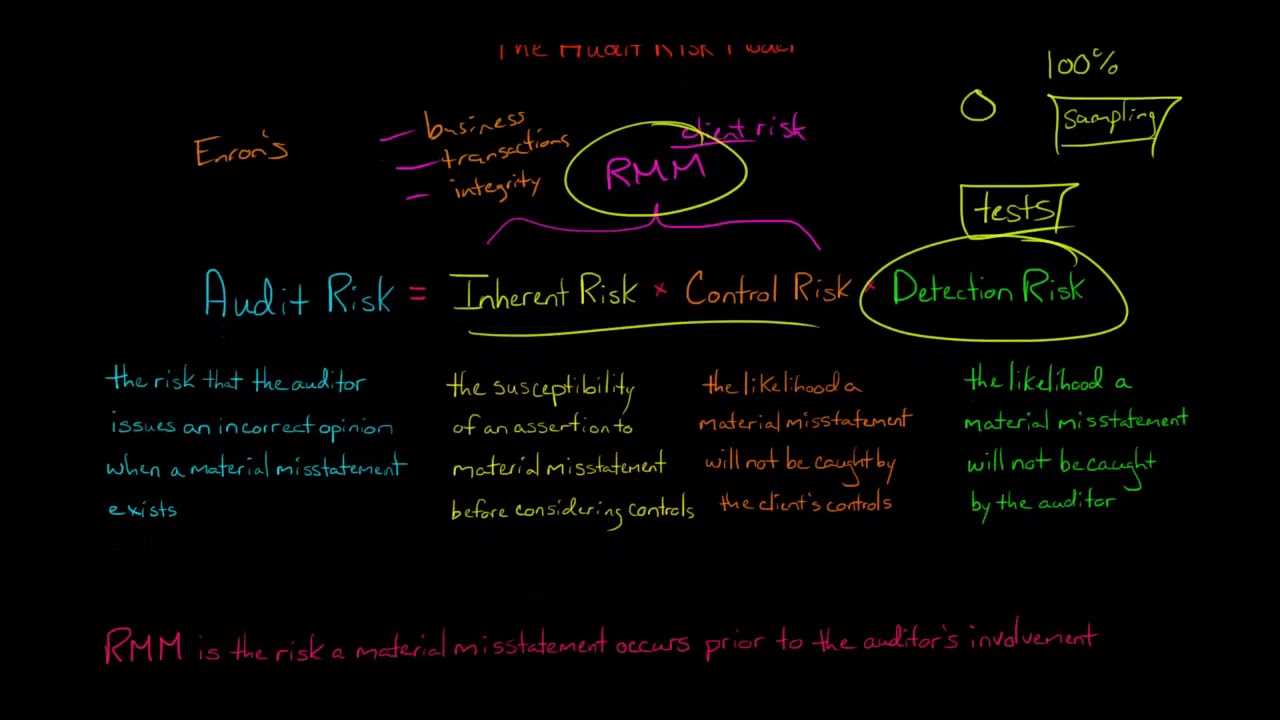

Components of Audit Risk Model

The audit risk model is a crucial tool used by auditors to assess the risk associated with an audit engagement. It helps auditors understand the various components that contribute to the overall audit risk. By evaluating these components, auditors can determine the level of risk and plan their audit procedures accordingly.

Inherent Risk

Auditors assess inherent risk by considering the nature of the client’s business, the industry in which it operates, and any unique risks associated with the client’s operations. For example, a company operating in a highly regulated industry may have a higher inherent risk due to the complexity of compliance requirements.

Control Risk

The second component of the audit risk model is control risk. Control risk refers to the risk that a material misstatement could occur in a financial statement assertion and not be prevented or detected on a timely basis by the client’s internal controls. It is influenced by the effectiveness of the client’s internal control environment.

Detection Risk

The third component of the audit risk model is detection risk. Detection risk refers to the risk that the auditor will fail to detect a material misstatement in a financial statement assertion. It is influenced by the nature, timing, and extent of the audit procedures performed by the auditor.

Evaluating and Assessing Risk

There are several factors that auditors consider when evaluating and assessing risk:

1. Internal Controls

One important aspect of risk assessment is evaluating the effectiveness of a company’s internal controls. Internal controls are policies and procedures implemented by management to safeguard assets, ensure the accuracy of financial records, and prevent fraud. Auditors assess the design and implementation of these controls to determine their reliability and effectiveness in mitigating risk.

2. Industry and Economic Factors

3. Financial Statement Analysis

Another important aspect of risk assessment is analyzing the company’s financial statements. Auditors review the financial statements to identify any unusual or unexpected trends, transactions, or balances. They also compare the financial statements to industry benchmarks and prior periods to identify any significant deviations. By conducting a thorough analysis of the financial statements, auditors can identify potential risks and areas that require further investigation.

Based on the evaluation and assessment of risk, auditors develop an audit plan that outlines the procedures and tests they will perform to gather sufficient and appropriate audit evidence. This plan is tailored to address the specific risks identified during the risk assessment process.

Importance of Risk Assessment in Corporate Finance

Risk assessment plays a crucial role in the field of corporate finance. It is a process that helps organizations identify, evaluate, and manage potential risks that could impact their financial performance and overall success. By conducting a comprehensive risk assessment, companies can make informed decisions, develop effective strategies, and protect their assets.

1. Identifying Risks

The first step in risk assessment is to identify potential risks that a company may face. These risks can be internal or external and can include factors such as market volatility, economic downturns, regulatory changes, technological advancements, and operational inefficiencies. By identifying these risks, companies can better understand the potential threats they face and take proactive measures to mitigate them.

2. Evaluating Risks

Once risks are identified, the next step is to evaluate their potential impact on the organization. This involves assessing the likelihood of each risk occurring and estimating the magnitude of its consequences. By quantifying risks, companies can prioritize them based on their potential impact and allocate resources accordingly. This helps organizations focus their efforts on managing the most significant risks and minimizing their potential negative effects.

Furthermore, evaluating risks allows companies to assess their risk appetite and tolerance levels. It helps them determine the level of risk they are willing to accept and the appropriate risk management strategies to implement. This ensures that companies strike a balance between risk and reward, maximizing their chances of achieving their financial objectives while minimizing potential losses.

3. Managing Risks

Once risks are identified and evaluated, the next step is to develop and implement risk management strategies. These strategies can include various measures such as diversification, hedging, insurance, contingency planning, and internal controls. By implementing these strategies, companies can reduce the likelihood and impact of risks, enhancing their ability to navigate uncertain and challenging business environments.

Effective risk management also helps companies build trust and confidence among stakeholders, including investors, lenders, and regulators. By demonstrating a robust risk management framework, companies can attract investment, secure financing, and comply with regulatory requirements. This can contribute to the overall stability and sustainability of the organization.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.