What Is a Maturity Date Definition and Classifications

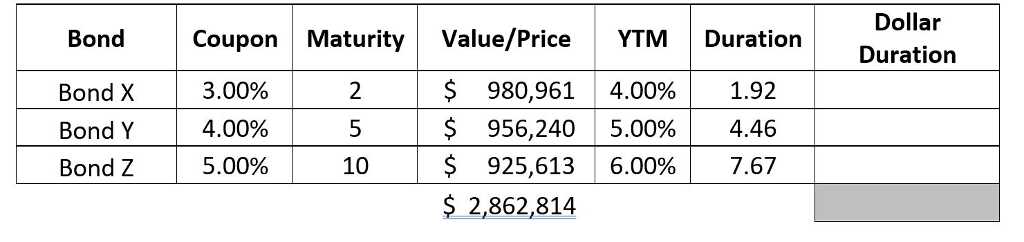

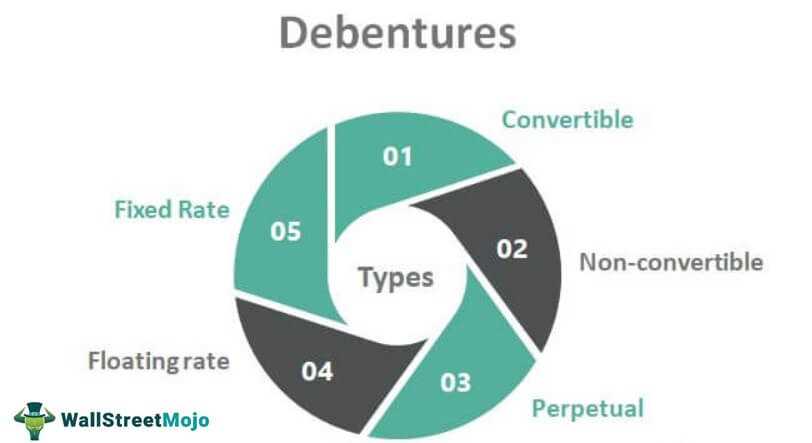

What Is a Maturity Date: Definition and Classifications Definition of Maturity Date The maturity date of a fixed income security is the date on which the issuer of the security agrees to repay the principal amount to the investor. This date is specified at the time of issuance and is … …