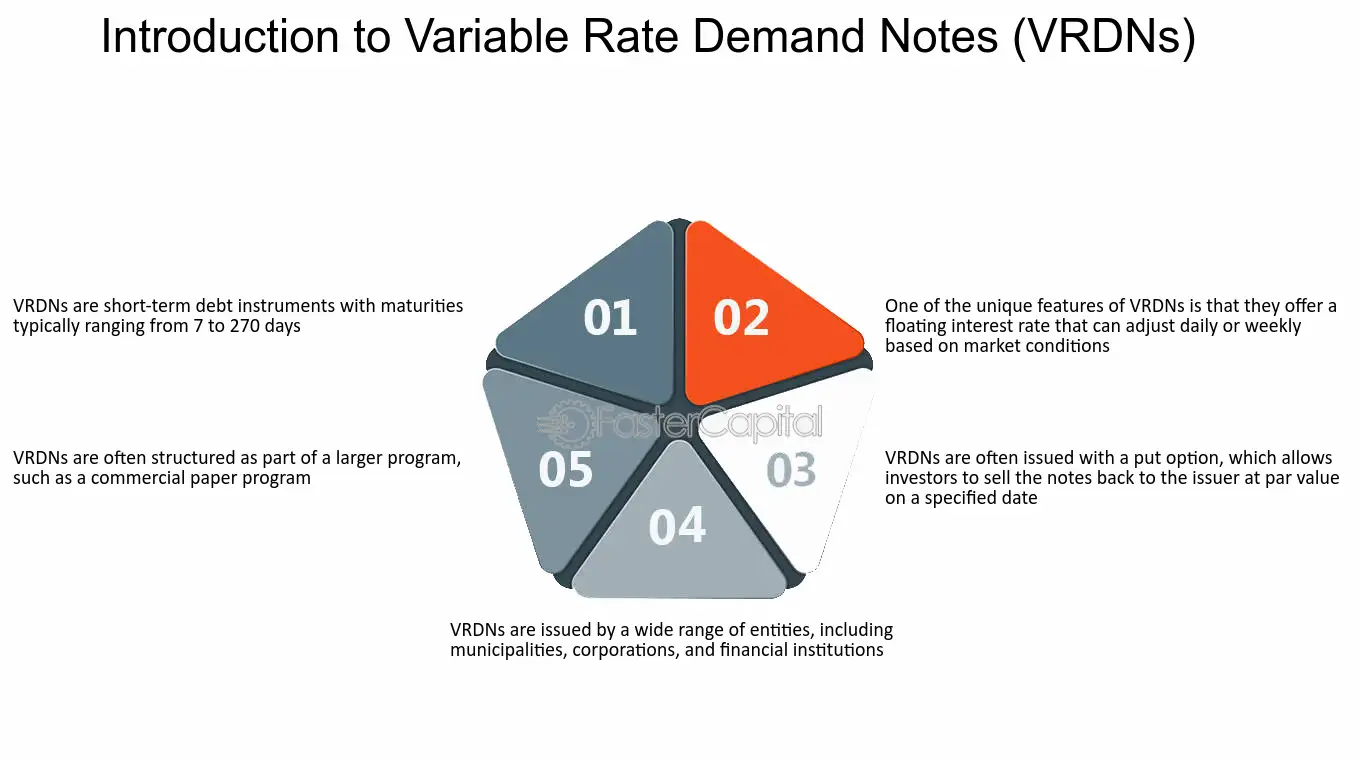

Variable Rate Demand Note Explained

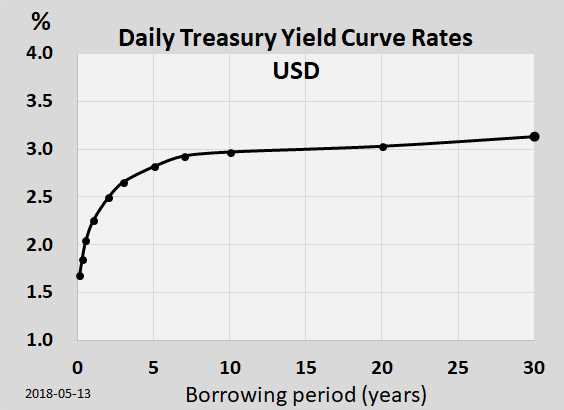

Exploring the Fixed Income Trading Strategy & Education Variable rate demand notes are a unique type of debt security that offers investors the flexibility of adjustable interest rates. Unlike traditional fixed-rate bonds, VRDNs have interest rates that change periodically based on market conditions. Investing in VRDNs can be a smart … …