Off-Balance Sheet Activities: Types and Examples

Off-balance sheet activities refer to the financial transactions and obligations that are not recorded on a company’s balance sheet but can still have a significant impact on its financial position. These activities are typically disclosed in the footnotes of financial statements and can provide valuable insights into a company’s overall financial health and risk profile.

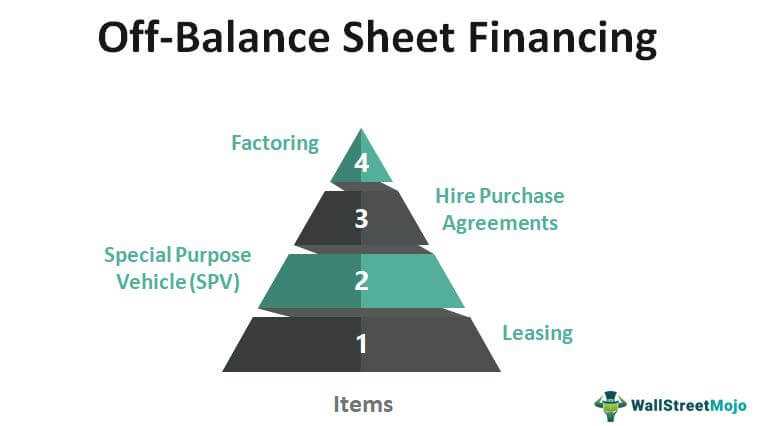

There are several types of off-balance sheet activities that companies engage in:

1. Operating Leases: Companies often lease assets such as buildings, equipment, or vehicles instead of purchasing them outright. These lease agreements are considered off-balance sheet activities because the leased assets and related liabilities are not recorded on the balance sheet. Instead, they are disclosed in the footnotes. Operating leases can provide companies with flexibility and cost savings, but they also come with certain risks.

2. Joint Ventures: Companies sometimes form joint ventures with other entities to pursue specific business opportunities. Joint ventures involve sharing resources, risks, and rewards. The financial impact of joint ventures is typically not recorded on the balance sheet, but the company’s share of the joint venture’s assets, liabilities, revenues, and expenses is disclosed in the footnotes.

3. Contingent Liabilities: Contingent liabilities are potential obligations that may arise in the future, depending on the outcome of certain events or circumstances. Examples of contingent liabilities include lawsuits, warranties, and guarantees. These liabilities are not recorded on the balance sheet but are disclosed in the footnotes. Contingent liabilities can have a significant impact on a company’s financial position if they materialize.

4. Derivatives: Derivatives are financial instruments whose value is derived from an underlying asset or benchmark. Companies use derivatives to manage various risks, such as interest rate risk, foreign exchange risk, or commodity price risk. The value of derivatives is typically not recorded on the balance sheet, but the associated rights and obligations are disclosed in the footnotes.

5. Special Purpose Entities: Special purpose entities (SPEs) are separate legal entities created by companies for specific purposes, such as financing a project or securitizing assets. SPEs are often used to keep certain assets or liabilities off the balance sheet. While SPEs can provide benefits such as tax advantages and risk isolation, they can also be used to manipulate financial statements and hide risks.

These are just a few examples of off-balance sheet activities that companies engage in. It is important for investors and stakeholders to carefully analyze the footnotes of financial statements to fully understand a company’s off-balance sheet activities and their potential impact on its financial position and risk profile.

Types of Off-Balance Sheet Activities

Off-balance sheet activities refer to the financial transactions and obligations that are not recorded on a company’s balance sheet but still have an impact on its financial position and performance. These activities are typically disclosed in the footnotes of the financial statements or in separate disclosures.

There are several types of off-balance sheet activities that companies engage in:

1. Operating Leases

An operating lease is a type of lease agreement where the lessee (the company) rents an asset from the lessor (the owner) for a specific period of time. The asset is not recorded on the lessee’s balance sheet, and the lease payments are expensed over the lease term. Examples of assets commonly leased through operating leases include office space, vehicles, and equipment.

2. Joint Ventures

A joint venture is a business arrangement where two or more companies come together to form a new entity to pursue a specific project or objective. The joint venture is typically a separate legal entity and is not consolidated on the balance sheets of the participating companies. Instead, the financial results and obligations of the joint venture are disclosed in the footnotes of the financial statements.

3. Special Purpose Entities

4. Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset or benchmark. Common types of derivatives include futures contracts, options, and swaps. Companies often use derivatives to manage risks, such as interest rate or currency fluctuations. The value of derivatives is typically disclosed in the footnotes of the financial statements, but they are not recorded on the balance sheet unless they qualify for hedge accounting.

5. Contingent Liabilities

Contingent liabilities are potential obligations that may arise in the future, depending on the outcome of uncertain events. Examples of contingent liabilities include pending lawsuits, warranties, and guarantees. These liabilities are not recorded on the balance sheet but are disclosed in the footnotes or in separate disclosures, providing information about the nature of the contingency and the potential impact on the company’s financial position.

Examples of Off-Balance Sheet Activities

Off-balance sheet activities refer to financial transactions or obligations that are not recorded on a company’s balance sheet but can still have a significant impact on its financial position. These activities can be used by companies to manage risks, raise capital, or engage in certain business activities without directly affecting their reported financial statements. Here are some examples of off-balance sheet activities:

1. Operating Leases:

Companies often enter into operating lease agreements to acquire the use of assets, such as real estate or equipment, without having to record the leased assets as assets or the lease obligations as liabilities on their balance sheet. The lease payments are typically treated as operating expenses and are disclosed in the footnotes of the financial statements.

2. Joint Ventures:

A joint venture is a business arrangement in which two or more companies come together to undertake a specific project or activity. The joint venture is typically structured as a separate legal entity, and the assets, liabilities, revenues, and expenses associated with the joint venture are not consolidated on the balance sheet of the participating companies. Instead, the financial results of the joint venture are reported separately in the financial statements.

3. Guarantees and Contingent Liabilities:

Companies may provide guarantees or assume contingent liabilities on behalf of other parties. These obligations are not initially recorded on the balance sheet but are disclosed in the footnotes to the financial statements. If the contingent liability becomes probable and estimable, it is then recognized as a liability on the balance sheet.

4. Derivatives:

Derivatives are financial instruments whose value is derived from an underlying asset, index, or reference rate. Companies often use derivatives, such as futures, options, or swaps, to manage risks related to interest rates, foreign exchange rates, or commodity prices. The fair value of derivatives is disclosed in the footnotes to the financial statements, but the actual derivative contracts are not recorded on the balance sheet.

5. Sale and Leaseback Transactions:

In a sale and leaseback transaction, a company sells an asset, such as real estate or equipment, to another party and then leases it back for continued use. This allows the company to free up capital while still retaining the use of the asset. The sale proceeds are typically not recorded as revenue, and the lease payments are treated as operating expenses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.