What is Interest Rate Differential (IRD)? Examples and Explanation

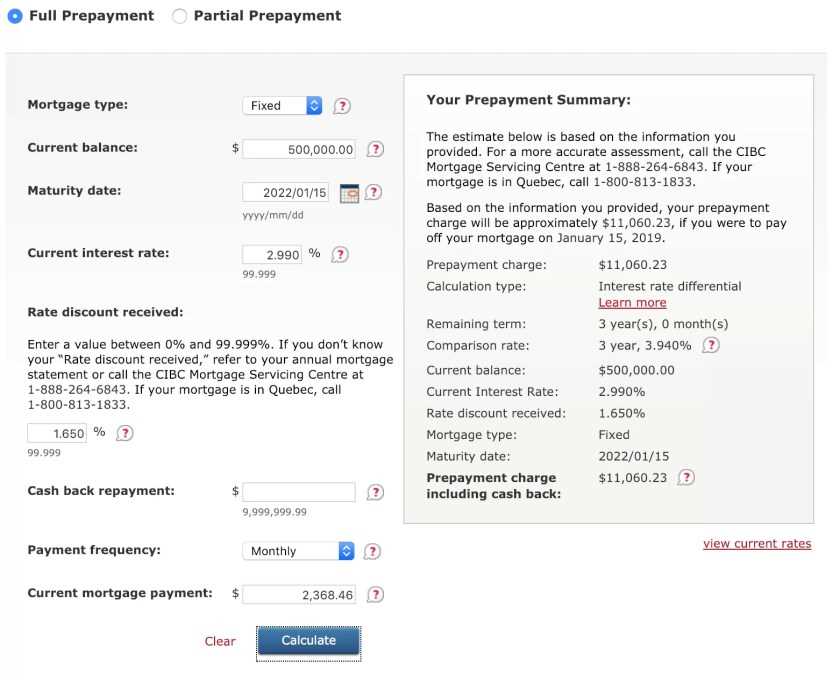

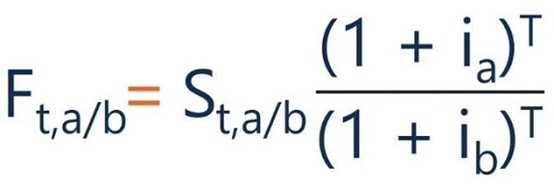

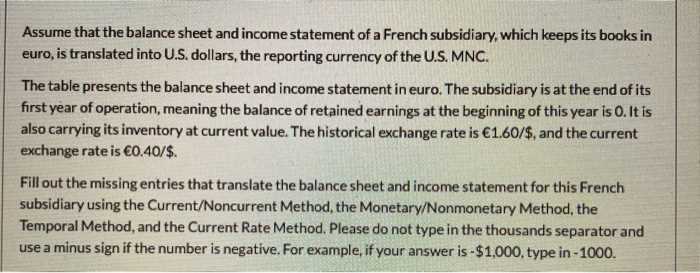

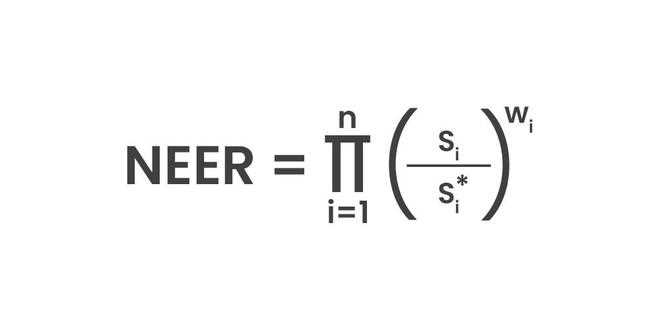

What is Interest Rate Differential (IRD)? Interest Rate Differential (IRD) refers to the difference in interest rates between two currencies in a foreign exchange market. It is an important concept in forex trading as it affects the value of a currency pair and can impact trading decisions. The IRD is … …