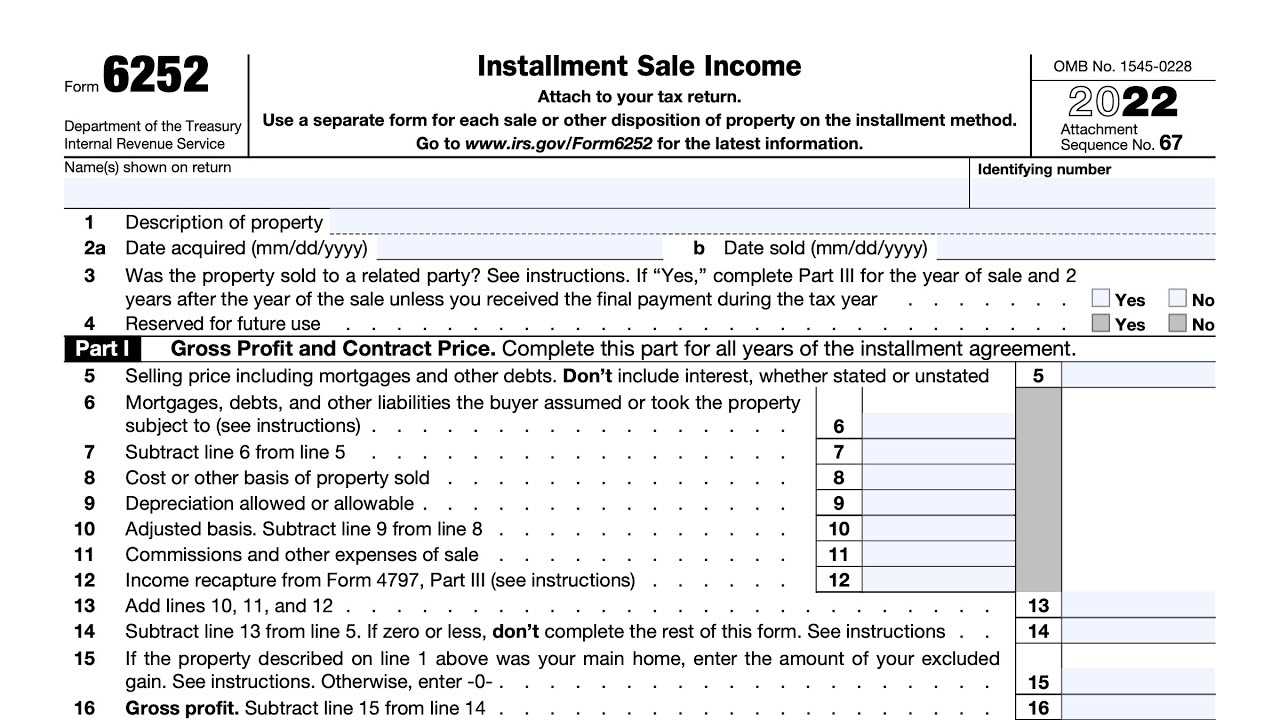

Form 6252: Installment Sale Income Explained

What is Form 6252? Form 6252 is an IRS tax form used to report income from the sale of property or assets on an installment basis. When a taxpayer sells property and receives payments over a period of time, rather than receiving the full amount upfront, they may be required … …