Deferred Income Tax: Definition, Purpose, and Examples

Deferred income tax is a concept in accounting that refers to the difference between the taxes that a company has already paid and the taxes it will owe in the future. It is a liability that arises when there is a temporary difference between the tax basis of an asset or liability and its carrying amount in the financial statements.

The purpose of deferred income tax is to ensure that a company accurately reflects its tax obligations in its financial statements. This is important because taxes can have a significant impact on a company’s profitability and cash flow. By accounting for deferred income tax, companies can provide a more accurate picture of their financial performance and position.

There are several examples of deferred income tax. One common example is when a company has accelerated depreciation for tax purposes, but straight-line depreciation for financial reporting purposes. This creates a temporary difference between the tax basis and the carrying amount of the asset, resulting in a deferred income tax liability.

Another example is when a company has recognized revenue for tax purposes, but has not yet recognized it for financial reporting purposes. This can occur when a company receives advance payments for goods or services that will be delivered in the future. The difference between the tax basis and the carrying amount of the revenue creates a deferred income tax asset.

Accounting for deferred income tax is important because it ensures that a company’s financial statements are in compliance with accounting standards and provide a true and fair view of its financial position. It also helps investors and other stakeholders make informed decisions about the company’s performance and prospects.

Deferred income tax is a concept in accounting that refers to the difference between the amount of taxes a company reports on its financial statements and the amount of taxes it actually pays to the government. It arises due to the timing difference between when revenue and expenses are recognized for tax purposes and when they are recognized for financial reporting purposes.

When a company earns revenue or incurs expenses, it must determine the amount of taxable income or deductible expenses for tax purposes. This is done based on the tax laws and regulations in the jurisdiction where the company operates. However, for financial reporting purposes, revenue and expenses are recognized based on the generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

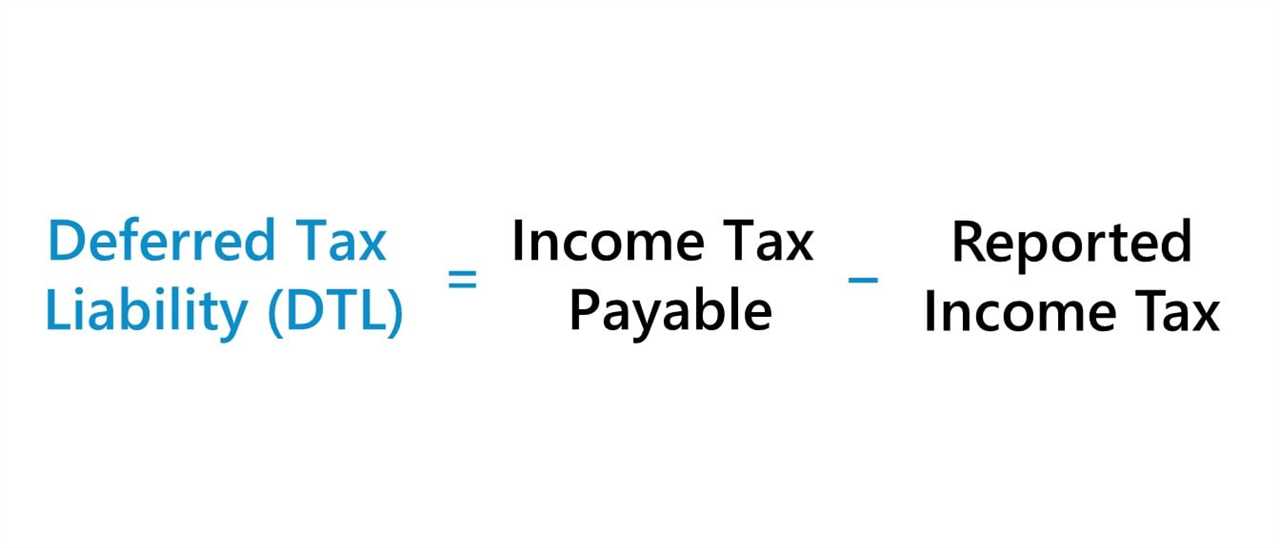

The timing difference between tax recognition and financial reporting recognition leads to deferred income tax. If the taxable income is higher than the income reported on the financial statements, the company will have a deferred tax liability. On the other hand, if the taxable income is lower than the income reported on the financial statements, the company will have a deferred tax asset.

Deferred income tax is important because it affects the financial statements of a company. It is recorded as a liability or an asset on the balance sheet, depending on whether it is a deferred tax liability or a deferred tax asset. This means that it has an impact on the company’s overall financial position and can affect its ability to meet its financial obligations.

Purpose of Deferred Income Tax

The purpose of deferred income tax is to ensure that a company’s financial statements accurately reflect its tax obligations. By recognizing the timing difference between tax recognition and financial reporting recognition, deferred income tax helps to provide a more accurate picture of a company’s financial performance and position.

Deferred income tax also helps to ensure that companies pay their fair share of taxes over time. By deferring the recognition of certain tax benefits or liabilities, companies can avoid large fluctuations in their tax expenses from year to year. This allows for a more stable and predictable tax environment, both for the company and for the government.

Importance of Accounting for Deferred Income Tax

Accounting for deferred income tax is important for several reasons. First, it helps to ensure compliance with accounting standards and regulations. Companies are required to report their deferred income tax liabilities and assets on their financial statements in accordance with GAAP or IFRS.

Purpose of Deferred Income Tax

Deferred income tax is an accounting concept that relates to the timing difference between when a company recognizes revenue or expenses for tax purposes and when it recognizes them for financial reporting purposes. The purpose of deferred income tax is to ensure that a company’s financial statements accurately reflect its tax obligations and to provide transparency to investors and stakeholders.

Deferred income tax also serves as a tool for managing a company’s tax liabilities. By deferring the recognition of certain expenses or income, companies can strategically time their tax payments and potentially reduce their overall tax burden. This can be particularly beneficial during periods of economic uncertainty or when companies are experiencing fluctuations in their financial performance.

Additionally, deferred income tax allows companies to accurately reflect the future tax consequences of certain transactions or events. For example, if a company has a tax loss carryforward, it can defer recognizing the tax benefit until it is more likely than not that the benefit will be realized. This ensures that the company’s financial statements reflect the potential tax savings that may arise in the future.

Overall, the purpose of deferred income tax is to align a company’s tax obligations with its financial reporting and to provide a more accurate representation of its financial position and performance. By accounting for the timing differences between tax and financial reporting, companies can ensure transparency and compliance with accounting standards, while also managing their tax liabilities effectively.

| Key Points |

|---|

| – Deferred income tax relates to the timing difference between tax and financial reporting. |

| – The purpose is to ensure accurate financial statements and manage tax liabilities. |

| – It accounts for temporary differences and future tax consequences. |

| – It provides transparency and compliance with accounting standards. |

Examples of Deferred Income Tax

Deferred income tax refers to the taxes that a company will pay in the future on income that has already been recognized but not yet received. This concept is important in accounting as it helps to accurately reflect a company’s financial position and performance.

Here are some examples of deferred income tax:

1. Depreciation

When a company purchases an asset, such as a building or equipment, it is required to depreciate the asset over its useful life. Depreciation expense reduces the company’s taxable income, resulting in lower taxes paid in the current period. However, the company will eventually have to pay taxes on the depreciation expense when the asset is sold or disposed of. This creates a deferred income tax liability.

2. Revenue Recognition

3. Bad Debt Expense

When a company extends credit to its customers, there is a risk that some customers may not pay their debts. In such cases, the company may record a bad debt expense to account for the potential loss. This expense reduces the company’s taxable income, resulting in lower taxes paid in the current period. However, if the company later recovers some or all of the bad debt, it may have to pay taxes on the recovered amount, creating a deferred income tax liability.

These are just a few examples of how deferred income tax can arise in accounting. It is important for companies to properly account for deferred income tax to ensure accurate financial reporting and compliance with tax regulations.

Importance of Accounting for Deferred Income Tax

Accounting for deferred income tax is crucial for businesses as it allows them to accurately reflect their financial position and performance in their financial statements. Deferred income tax arises when there is a difference between the tax basis of an asset or liability and its carrying amount for financial reporting purposes. This difference can result in either a deferred tax asset or a deferred tax liability.

One of the main reasons why accounting for deferred income tax is important is because it helps businesses comply with accounting standards and regulations. International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) require businesses to recognize and measure deferred income tax assets and liabilities based on the expected future tax consequences of temporary differences.

By properly accounting for deferred income tax, businesses can provide users of financial statements with a more accurate picture of their financial position. This is important for investors, creditors, and other stakeholders who rely on financial statements to make informed decisions. Without accounting for deferred income tax, financial statements may not reflect the true economic substance of a business.

Furthermore, accounting for deferred income tax allows businesses to properly account for the timing differences between when income or expenses are recognized for tax purposes and when they are recognized for financial reporting purposes. This ensures that businesses accurately reflect their tax obligations and liabilities in their financial statements.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.