What is Book Value Per Share (BVPS)?

Book Value Per Share (BVPS) is a financial ratio that measures the net worth of a company per outstanding share of common stock. It represents the value that shareholders would receive if a company were to liquidate its assets and pay off all its liabilities.

Book value per share is calculated by dividing the total shareholder’s equity by the number of outstanding shares. It provides investors with an idea of the underlying value of a company’s shares and can be used as a basis for determining the intrinsic value of a stock.

Definition of Book Value Per Share

Book Value Per Share is a financial metric that represents the net worth of a company per outstanding share of common stock. It is calculated by dividing the total shareholder’s equity by the number of outstanding shares.

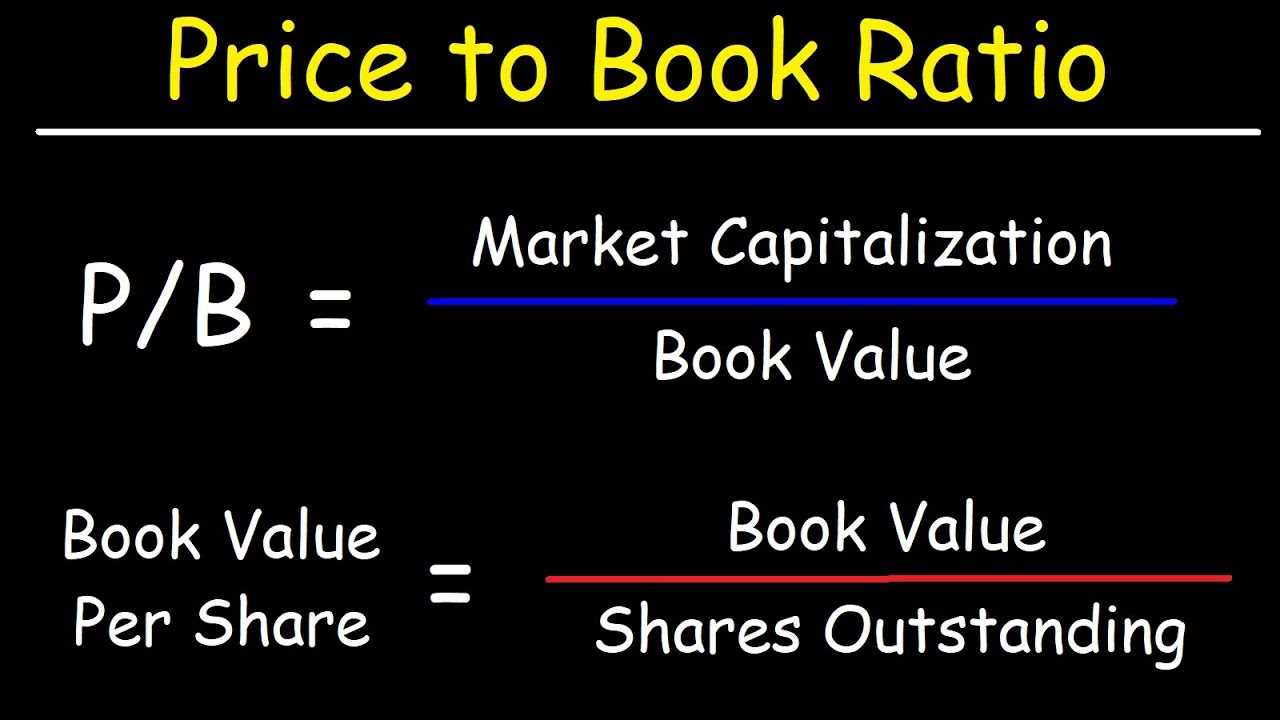

Formula for Calculating Book Value Per Share

The formula for calculating Book Value Per Share is as follows:

| Book Value Per Share (BVPS) | = | Total Shareholder’s Equity | / | Number of Outstanding Shares |

|---|

How to Calculate Book Value Per Share

To calculate the Book Value Per Share, you need to know the total shareholder’s equity and the number of outstanding shares. The total shareholder’s equity can be found on the company’s balance sheet, while the number of outstanding shares can be obtained from the company’s financial statements or stock exchange filings.

Once you have the necessary information, you can use the formula mentioned above to calculate the Book Value Per Share.

Example of Book Value Per Share Calculation

Let’s say Company XYZ has a total shareholder’s equity of $10 million and 1 million outstanding shares. To calculate the Book Value Per Share, we can use the formula:

| Book Value Per Share (BVPS) | = | $10,000,000 | / | 1,000,000 |

|---|---|---|---|---|

| Book Value Per Share (BVPS) | = | $10 |

Therefore, the Book Value Per Share for Company XYZ is $10.

Investors can compare the Book Value Per Share of a company to its market price per share to determine if the stock is undervalued or overvalued. If the market price per share is lower than the Book Value Per Share, it may indicate that the stock is undervalued and could be a good investment opportunity.

Definition of Book Value Per Share

Book Value Per Share (BVPS) is a financial ratio that measures the net worth of a company on a per-share basis. It is calculated by dividing the total shareholders’ equity by the number of outstanding shares of common stock.

Book value represents the value of a company’s assets after deducting its liabilities. It is an important metric for investors as it provides insight into the intrinsic value of a company’s shares.

Book Value Per Share is a useful indicator for investors to assess the financial health and value of a company. It helps investors determine if a stock is undervalued or overvalued in the market.

Formula for Calculating Book Value Per Share

The formula for calculating Book Value Per Share is:

Book Value Per Share = Total Shareholders’ Equity / Number of Outstanding Shares

Total Shareholders’ Equity is calculated by subtracting a company’s total liabilities from its total assets. The number of outstanding shares refers to the total number of shares issued by the company that are held by investors.

How to Calculate Book Value Per Share

To calculate Book Value Per Share, you need to gather the necessary financial information from a company’s balance sheet and divide the total shareholders’ equity by the number of outstanding shares.

- Obtain the company’s balance sheet.

- Identify the total shareholders’ equity.

- Determine the number of outstanding shares.

- Divide the total shareholders’ equity by the number of outstanding shares.

The result will be the Book Value Per Share of the company.

Example of Book Value Per Share Calculation

Let’s consider an example to illustrate the calculation of Book Value Per Share:

Company XYZ has total shareholders’ equity of $1,000,000 and 100,000 outstanding shares. To calculate the Book Value Per Share:

Book Value Per Share = $1,000,000 / 100,000 = $10

Therefore, the Book Value Per Share of Company XYZ is $10.

Investors can use this information to compare the Book Value Per Share of different companies in the same industry and make informed investment decisions.

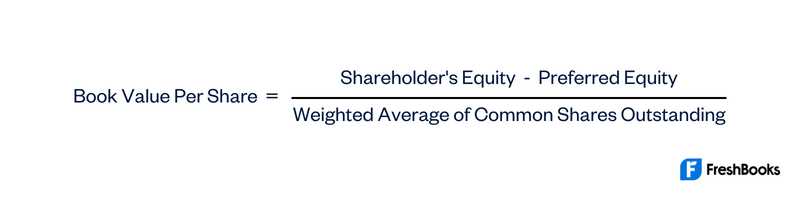

Formula for Calculating Book Value Per Share

Book Value Per Share (BVPS) is a financial ratio that measures the net worth of a company per outstanding share of common stock. It is an important metric used by investors to assess the intrinsic value of a company’s shares.

The formula for calculating Book Value Per Share is:

This formula takes into account the total shareholders’ equity, which includes the company’s assets minus its liabilities, and subtracts any preferred stock that may be outstanding. The result is then divided by the total number of outstanding shares to determine the book value per share.

By calculating the book value per share, investors can gain insights into the company’s financial health and the value of its shares. A higher book value per share indicates that the company has more assets than liabilities and may be undervalued in the market. On the other hand, a lower book value per share may suggest that the company is overvalued or has a significant amount of debt.

Example:

Let’s say a company has a total shareholders’ equity of $10 million and no preferred stock outstanding. The company also has 1 million outstanding shares. To calculate the book value per share, we use the formula:

Book Value Per Share = $10

It is important to note that book value per share is just one metric used by investors to evaluate a company’s financial health. It should be used in conjunction with other financial ratios and analysis to make informed investment decisions.

How to Calculate Book Value Per Share

Calculating the book value per share is a straightforward process that involves dividing the total shareholder’s equity by the number of outstanding shares.

Step 1: Determine Total Shareholder’s Equity

The first step in calculating the book value per share is to determine the total shareholder’s equity. This can be found on the company’s balance sheet, which provides a snapshot of the company’s financial position at a specific point in time. The shareholder’s equity is typically listed under the “equity” section of the balance sheet.

Step 2: Determine the Number of Outstanding Shares

The next step is to determine the number of outstanding shares. This information can be found in the company’s financial statements or annual report. The number of outstanding shares represents the total number of shares that have been issued by the company and are held by investors.

Step 3: Divide Total Shareholder’s Equity by Number of Outstanding Shares

Once you have determined the total shareholder’s equity and the number of outstanding shares, you can calculate the book value per share by dividing the total shareholder’s equity by the number of outstanding shares. The formula is as follows:

Book Value Per Share = Total Shareholder’s Equity / Number of Outstanding Shares

For example, if a company has a total shareholder’s equity of $1,000,000 and 100,000 outstanding shares, the book value per share would be:

Book Value Per Share = $1,000,000 / 100,000 = $10

This means that each share of the company’s stock has a book value of $10.

Calculating the book value per share can provide investors with valuable insights into the financial health and value of a company. It is important to note that the book value per share is just one metric to consider when evaluating a company’s stock. Other factors, such as earnings per share, price-to-earnings ratio, and future growth prospects, should also be taken into account.

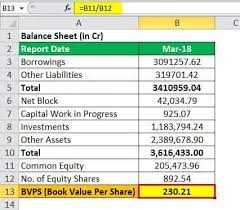

Example of Book Value Per Share Calculation

Let’s consider a hypothetical company called XYZ Inc. to understand how to calculate the book value per share (BVPS).

- Total assets: $1,000,000

- Total liabilities: $500,000

- Total preferred stock: $100,000

- Total common stock: $200,000

- Total treasury stock: $50,000

To calculate the book value per share, we need to subtract the total liabilities, preferred stock, and treasury stock from the total assets. Then, we divide the result by the total common stock.

Using the formula:

Let’s calculate the book value per share for XYZ Inc.:

BVPS = $350,000 / $200,000

BVPS = $1.75

Therefore, the book value per share for XYZ Inc. is $1.75.

Investors and analysts use the book value per share as an indicator of a company’s intrinsic value. If the market price per share is lower than the book value per share, it may indicate that the stock is undervalued and potentially a good investment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.