Growth Fund Definition

A growth fund is a type of investment fund that focuses on investing in companies with high growth potential. These funds typically invest in stocks of companies that are expected to experience rapid growth in earnings and revenue. The primary objective of a growth fund is to provide investors with capital appreciation over the long term.

Characteristics of Growth Funds

Growth funds often have a higher expense ratio compared to other types of funds due to the active management involved in identifying and investing in high-growth companies. The fund managers of growth funds conduct extensive research and analysis to identify companies with strong growth potential.

Performance of Growth Funds

However, during economic downturns and bear markets, growth funds can experience significant declines in value as investors become more risk-averse and focus on preserving capital. It is important for investors to carefully consider their risk tolerance and investment objectives before investing in growth funds.

What Are Growth Funds?

Growth funds are a type of mutual fund that focuses on investing in companies with high growth potential. These funds typically invest in stocks of companies that are expected to experience significant growth in their earnings and stock prices.

The investment strategy of growth funds is to identify companies that have the potential to grow at an above-average rate compared to the overall market. These companies are typically in industries that are expected to experience rapid growth, such as technology, healthcare, and consumer goods.

Growth funds are managed by professional fund managers who conduct extensive research and analysis to identify companies with strong growth prospects. These managers use various strategies, such as fundamental analysis and quantitative analysis, to select stocks for the fund’s portfolio.

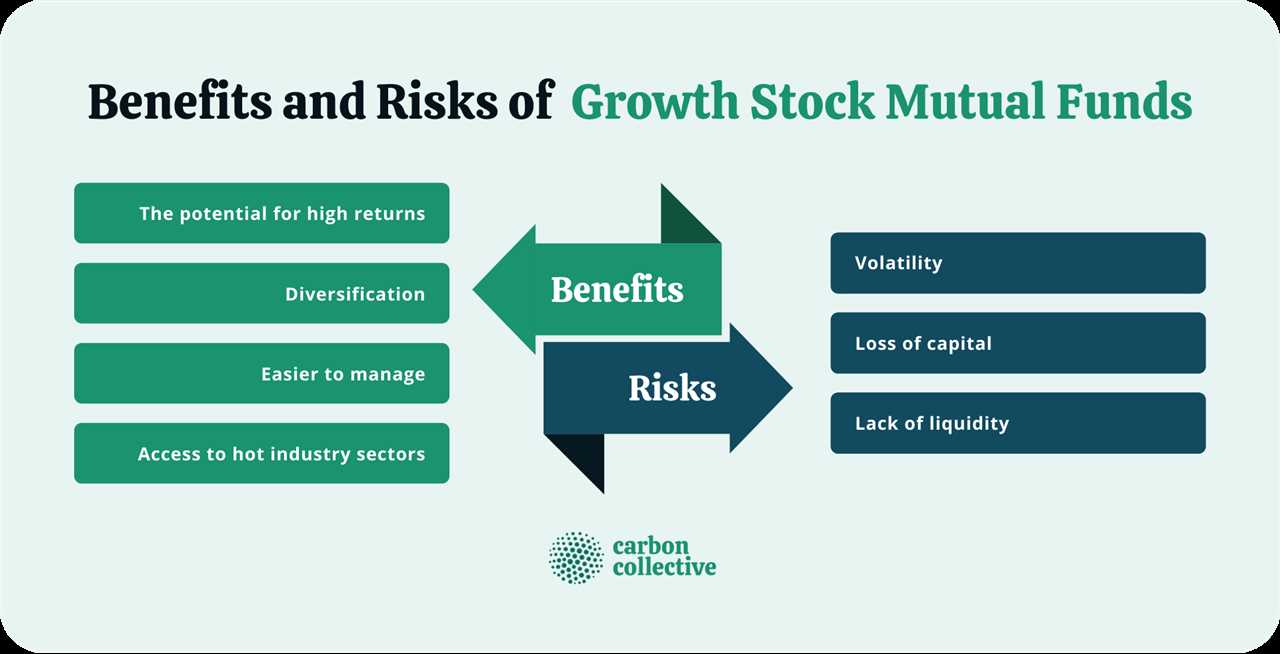

Investors in growth funds can benefit from the potential for high returns if the companies in the fund’s portfolio perform well. However, it is important to note that growth funds can also be subject to higher volatility and potential losses, especially during market downturns.

Overall, growth funds can be a suitable investment option for investors who are willing to take on higher risk in exchange for the potential for higher returns. It is important for investors to carefully consider their investment goals, risk tolerance, and time horizon before investing in growth funds.

Types and Performance of Growth Funds

Growth funds are a type of mutual fund that focuses on investing in stocks of companies with high growth potential. These funds aim to provide investors with long-term capital appreciation by investing in companies that are expected to experience significant growth in their earnings and stock prices.

There are several types of growth funds, each with its own investment strategy and risk profile:

- Large-cap growth funds: These funds invest in large, well-established companies that have a history of strong earnings growth. They typically focus on companies with market capitalizations above $10 billion.

- Mid-cap growth funds: These funds invest in medium-sized companies that have the potential for significant growth. They typically focus on companies with market capitalizations between $2 billion and $10 billion.

- Small-cap growth funds: These funds invest in small, emerging companies that have the potential for rapid growth. They typically focus on companies with market capitalizations below $2 billion.

- International growth funds: These funds invest in companies outside of the United States that have the potential for significant growth. They provide investors with exposure to international markets and diversification benefits.

- Sector-specific growth funds: These funds focus on specific sectors or industries that are expected to experience above-average growth. Examples include technology, healthcare, and consumer discretionary sectors.

The performance of growth funds can vary significantly depending on the market conditions and the investment strategy employed by the fund manager. In general, growth funds have the potential to deliver higher returns compared to other types of funds, but they also come with higher risks.

Investors should carefully consider their investment goals, risk tolerance, and time horizon before investing in growth funds. It is important to conduct thorough research and analysis of the fund’s historical performance, investment strategy, and fees before making an investment decision.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.