Issued Shares: Definition, Example, and Importance in Stock Trading

Definition of Issued Shares

When a company issues shares, it essentially sells a portion of its ownership to investors. Each issued share represents a fractional ownership interest in the company. For example, if a company has issued 1,000 shares and an investor owns 100 shares, they would own 10% of the company.

Example of Issued Shares

Let’s consider an example to better understand the concept of issued shares. Company XYZ decides to go public and offers an IPO to raise capital. The company’s board of directors authorizes the issuance of 1,000,000 shares. During the IPO, 500,000 shares are sold to investors at a price of $10 per share.

After the IPO, the total number of issued shares for Company XYZ would be 1,000,000, with 500,000 shares held by the public investors. These issued shares can now be freely traded on the stock market.

Importance of Issued Shares in Stock Trading

Additionally, the number of issued shares can impact a company’s stock price. If a company has a large number of issued shares, each share represents a smaller ownership stake, which can dilute the value of existing shares. Conversely, a company with a smaller number of issued shares may experience greater price volatility.

| Issued Shares | Outstanding Shares |

|---|---|

| Represents the total number of shares authorized and distributed by a company | Represents the total number of shares held by shareholders, including institutional investors and insiders |

| Includes both publicly traded shares and shares held by insiders | Includes only publicly traded shares |

| Can be higher or lower than outstanding shares | Always equal to or lower than issued shares |

What are Issued Shares?

Issued shares refer to the total number of shares that a company has authorized and distributed to its shareholders. These shares represent the ownership stake in the company and are typically bought and sold on the stock market.

When a company decides to go public and offer shares to the public, it goes through a process called an initial public offering (IPO). During this process, the company determines the number of shares it wants to issue and sets an initial price for each share. These shares are then offered to investors who can purchase them on the stock exchange.

Issued shares are different from outstanding shares, which represent the total number of shares held by shareholders, including institutional investors and company insiders. While issued shares include both outstanding shares and shares held by the company itself, outstanding shares only include shares held by shareholders.

Importance of Issued Shares in Stock Trading

For example, if a company has a large number of issued shares, it may indicate that the stock is highly liquid and easily tradable. On the other hand, if a company has a limited number of issued shares, it may result in higher volatility and potential price fluctuations.

Furthermore, the number of issued shares can also affect a company’s market capitalization, which is calculated by multiplying the stock price by the number of outstanding shares. A higher number of issued shares can lead to a larger market capitalization, indicating a larger company size.

Example of Issued Shares

Issued shares refer to the total number of shares that a company has authorized and distributed to its shareholders. These shares represent ownership in the company and are typically issued during the initial public offering (IPO) or through subsequent stock offerings.

Let’s consider an example to understand the concept of issued shares better. ABC Corporation, a fictional company, decides to go public and offers 1 million shares to the public. These shares are authorized by the company and are available for purchase by investors. The company sets the initial price of each share at $10.

During the IPO, investors show interest in buying ABC Corporation’s shares, and all 1 million shares are sold. As a result, the company has now issued 1 million shares to its shareholders.

The number of issued shares can have implications for a company and its shareholders. A larger number of issued shares can dilute the ownership stake of existing shareholders and potentially decrease the value of each share. On the other hand, a smaller number of issued shares can increase the value of each share and potentially attract more investors.

Issued Shares vs Outstanding Shares: Key Differences

Issued Shares

Issued shares refer to the total number of shares that a company has authorized and distributed to its shareholders. These shares can be held by both institutional and individual investors. When a company decides to go public and offer its shares to the public for the first time, it issues a certain number of shares based on its capital structure and valuation.

Issued shares represent the ownership stake in a company and grant shareholders certain rights, such as voting rights and the right to receive dividends. However, not all issued shares are necessarily outstanding shares.

Outstanding Shares

Outstanding shares, on the other hand, are the actual shares that are currently held by investors, excluding any shares that the company has repurchased. These shares are actively traded on the stock market and are available for purchase or sale by investors.

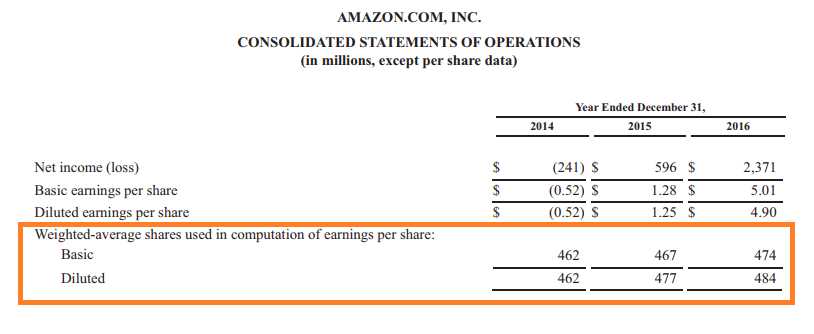

Outstanding shares represent the number of shares that are in the hands of shareholders and are used to calculate various financial ratios and metrics, such as earnings per share (EPS) and market capitalization. They are a key indicator of a company’s market value and investor sentiment.

It is important to note that the number of outstanding shares can change over time due to stock buybacks, stock splits, or the issuance of new shares through secondary offerings. These events can impact the ownership structure of a company and potentially dilute the value of existing shares.

Key Differences

The main differences between issued shares and outstanding shares can be summarized as follows:

- Definition: Issued shares are the total number of shares authorized and distributed by a company, while outstanding shares are the actual shares held by investors.

- Ownership: Issued shares represent the ownership stake in a company, while outstanding shares reflect the shares currently held by shareholders.

- Trading: Issued shares may or may not be actively traded on the stock market, while outstanding shares are actively traded and can be bought or sold by investors.

- Calculation: Issued shares are used to calculate the ownership percentage of shareholders, while outstanding shares are used to calculate financial ratios and metrics.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.