Overview of Income Tax

Income tax is calculated based on the income earned during a specific period, such as a calendar year or a fiscal year. The calculation of income tax involves determining the taxable income, applying the applicable tax rates, and deducting any eligible deductions or credits.

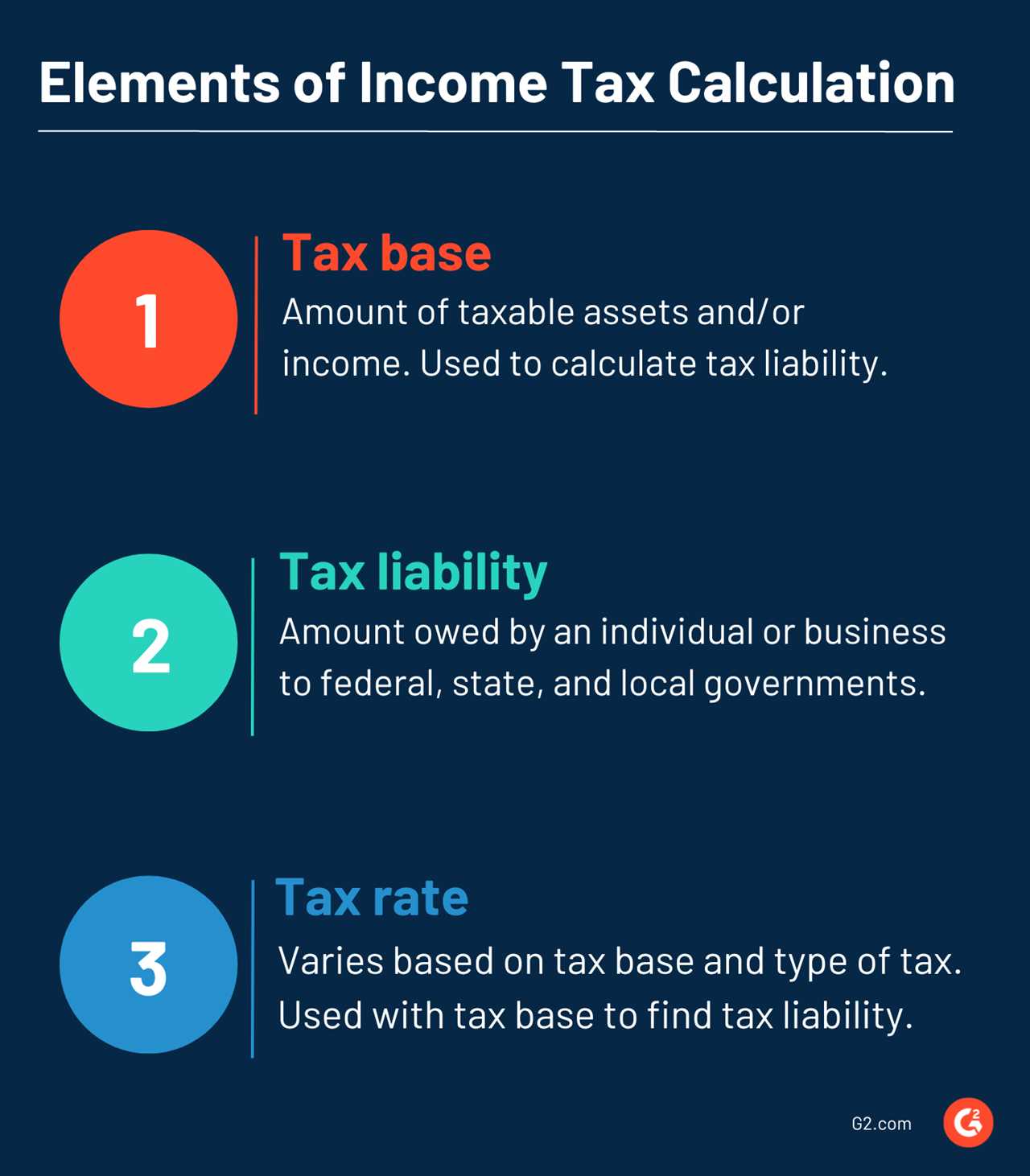

The taxable income is the amount of income that is subject to tax after accounting for any allowable deductions or exemptions. It includes various types of income, such as wages, salaries, dividends, interest, rental income, and capital gains. Different countries have different rules and regulations regarding what types of income are taxable and what deductions or exemptions are allowed.

The applicable tax rates vary depending on the income level and the tax bracket in which an individual or business falls. Tax brackets are typically structured in a progressive manner, meaning that higher income levels are subject to higher tax rates. This progressive tax system is designed to ensure that individuals and businesses with higher incomes contribute a larger proportion of their earnings in taxes.

In addition to the calculation of income tax, there are also various types of income tax that individuals and businesses may be subject to. These include personal income tax, corporate income tax, capital gains tax, and withholding tax, among others. Each type of income tax has its own rules and regulations regarding the calculation and payment of taxes.

Paying income tax is important for several reasons. Firstly, it is a legal obligation for individuals and businesses to pay their fair share of taxes. Failure to do so can result in penalties, fines, and even legal consequences. Secondly, income tax revenues are used by governments to fund essential public services, such as healthcare, education, infrastructure, and social welfare programs. By paying income tax, individuals and businesses contribute to the overall well-being of society.

Methods of Calculating Income Tax

1. Marginal Tax Rate

The marginal tax rate is the percentage of tax that is applied to the last dollar of income earned. This method uses a progressive tax system, where tax rates increase as income levels rise. The tax brackets determine the applicable rate for each income level. Individuals or businesses can use tax tables or online calculators to determine their marginal tax rate.

2. Effective Tax Rate

The effective tax rate is the average percentage of tax paid on total income. It is calculated by dividing the total tax paid by the total income earned. This method provides a more accurate representation of the overall tax burden. It takes into account deductions, exemptions, and credits that may reduce the taxable income.

For example, if an individual has a total income of $50,000 and pays $10,000 in taxes, the effective tax rate would be 20% ($10,000 divided by $50,000).

3. Withholding Tax

Withholding tax is a method used by employers to deduct income tax from employees’ wages or salaries. The amount withheld is based on the employee’s income and the tax rates applicable to their income level. The withheld tax is then remitted to the government on behalf of the employee. This method ensures that taxes are paid throughout the year, rather than in a lump sum at the end of the year.

It is important for individuals to review their withholding tax amounts to ensure they are not overpaying or underpaying their taxes. Adjustments can be made by submitting a new Form W-4 to the employer.

Types of Income Tax

1. Personal Income Tax: Personal income tax is levied on the income earned by individuals. This includes income from employment, self-employment, investments, and other sources. The rate of personal income tax varies based on the income level and tax brackets set by the government.

2. Corporate Income Tax: Corporate income tax is imposed on the profits earned by businesses. It is calculated based on the net income of the company after deducting allowable expenses. The rate of corporate income tax also varies depending on the jurisdiction and the size of the business.

3. Capital Gains Tax: Capital gains tax is applied to the profit earned from the sale of assets such as stocks, real estate, and other investments. The tax rate for capital gains may differ from the rates for personal and corporate income tax.

4. Dividend Tax: Dividend tax is a tax imposed on the dividends received by shareholders from a company’s profits. The rate of dividend tax may vary depending on the jurisdiction and the type of dividend received.

5. Inheritance Tax: Inheritance tax is levied on the assets and properties inherited by individuals after the death of a person. The tax rate for inheritance tax may differ based on the relationship between the deceased and the heir.

6. Gift Tax: Gift tax is imposed on the transfer of assets or properties as gifts. The tax rate for gift tax may vary depending on the value of the gift and the relationship between the giver and the recipient.

7. Sales Tax: Sales tax is a consumption tax imposed on the sale of goods and services. It is usually calculated as a percentage of the purchase price and is collected by the seller on behalf of the government.

8. Value Added Tax (VAT): Value Added Tax is a type of sales tax that is applied at each stage of the production and distribution process. It is calculated based on the value added by each business in the supply chain.

9. Property Tax: Property tax is levied on the value of real estate properties owned by individuals or businesses. The tax rate for property tax may vary depending on the location and value of the property.

10. Excise Tax: Excise tax is a tax imposed on specific goods such as alcohol, tobacco, gasoline, and luxury items. The tax is usually included in the price of the goods and is collected by the seller.

Importance of Paying Income Tax

Paying income tax is a crucial responsibility for individuals and businesses. It plays a vital role in the functioning of a country’s economy and the provision of public services. Here are some reasons why paying income tax is important:

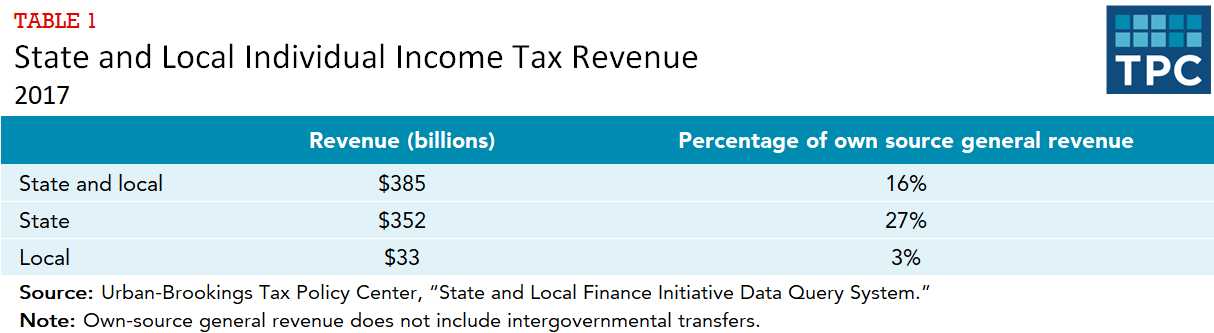

1. Funding Public Services: Income tax is a major source of revenue for governments. It helps fund essential public services such as healthcare, education, infrastructure development, and social welfare programs. These services benefit the entire population and contribute to the overall well-being of society.

2. Redistributing Wealth: Income tax helps to reduce income inequality by redistributing wealth from high-income individuals and businesses to those with lower incomes. This progressive tax system ensures that the burden of taxation is shared more equitably, promoting social justice and reducing poverty.

3. Maintaining Law and Order: Income tax revenue is used to support law enforcement agencies and maintain public safety. It helps fund the police force, judicial system, and other essential services that ensure the rule of law and protect citizens’ rights. Without adequate funding, these institutions would struggle to function effectively.

4. Economic Development: Income tax plays a crucial role in stimulating economic growth and development. The revenue generated can be used to invest in infrastructure projects, create job opportunities, and support small businesses. By providing a stable source of funding, income tax contributes to a thriving economy and improved living standards.

5. Compliance and Fairness: Paying income tax is a legal obligation that ensures fairness and compliance with the tax laws of a country. It helps maintain a level playing field for businesses and individuals, preventing tax evasion and promoting transparency. By fulfilling their tax obligations, taxpayers contribute to a fair and functioning tax system.

6. Social Responsibility: Paying income tax is a form of social responsibility. It demonstrates a commitment to the well-being of society and a willingness to contribute to its development. By paying their fair share of taxes, individuals and businesses actively participate in the collective effort to build a better future for all.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.