Tax Rate Definition

Types of Tax Rates

There are different types of tax rates that individuals and businesses may encounter:

- Income Tax Rate: This is the rate at which individuals are taxed on their income. It can be progressive, meaning that the tax rate increases as income increases, or it can be a flat rate, where everyone pays the same percentage regardless of income.

- Corporate Tax Rate: This is the rate at which businesses are taxed on their profits. Like income tax rates, corporate tax rates can also be progressive or flat.

- Sales Tax Rate: This is the rate at which goods and services are taxed at the point of sale. Sales tax rates can vary by state or even by city.

- Capital Gains Tax Rate: This is the rate at which individuals are taxed on the profits they make from selling assets such as stocks or real estate.

How Tax Rates Are Determined

Tax rates are determined by the government through legislation. They are typically set by the legislative body, such as Congress, and can be changed periodically. The government considers various factors when determining tax rates, including the need for revenue, economic conditions, and social policies.

Tax rates can also be influenced by political factors, as different political parties may have different views on taxation. Changes in tax rates can have significant impacts on individuals and businesses, affecting their disposable income, investment decisions, and overall financial planning.

It is important for individuals and businesses to stay informed about tax rate changes and understand how they may be affected. This can help them make informed financial decisions and take advantage of any tax planning opportunities that may arise.

What are Tax Rates?

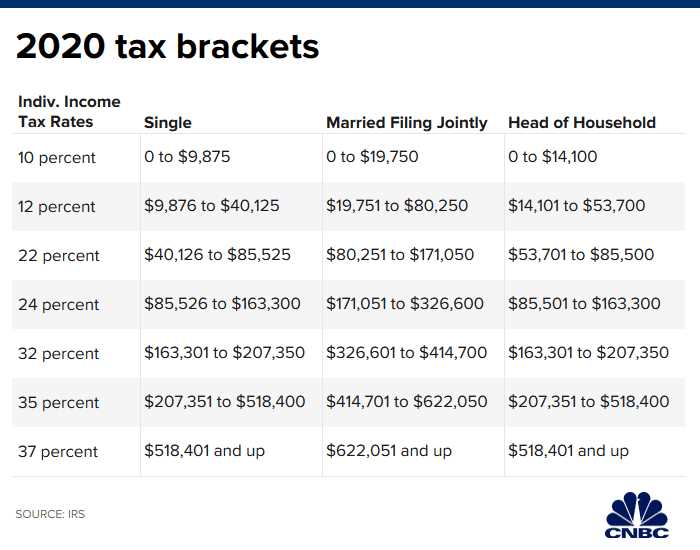

Tax rates refer to the percentage of your income that you are required to pay in taxes. These rates are set by the government and vary depending on your income level and filing status. The tax rates are typically divided into different brackets, with each bracket corresponding to a specific range of income.

For example, let’s say there are three tax brackets: 10%, 20%, and 30%. If your income falls within the first bracket, you would pay 10% of your income in taxes. If your income falls within the second bracket, you would pay 20% of your income in taxes, and so on.

How are Tax Rates Determined?

How Do Tax Rates Impact Your Taxes?

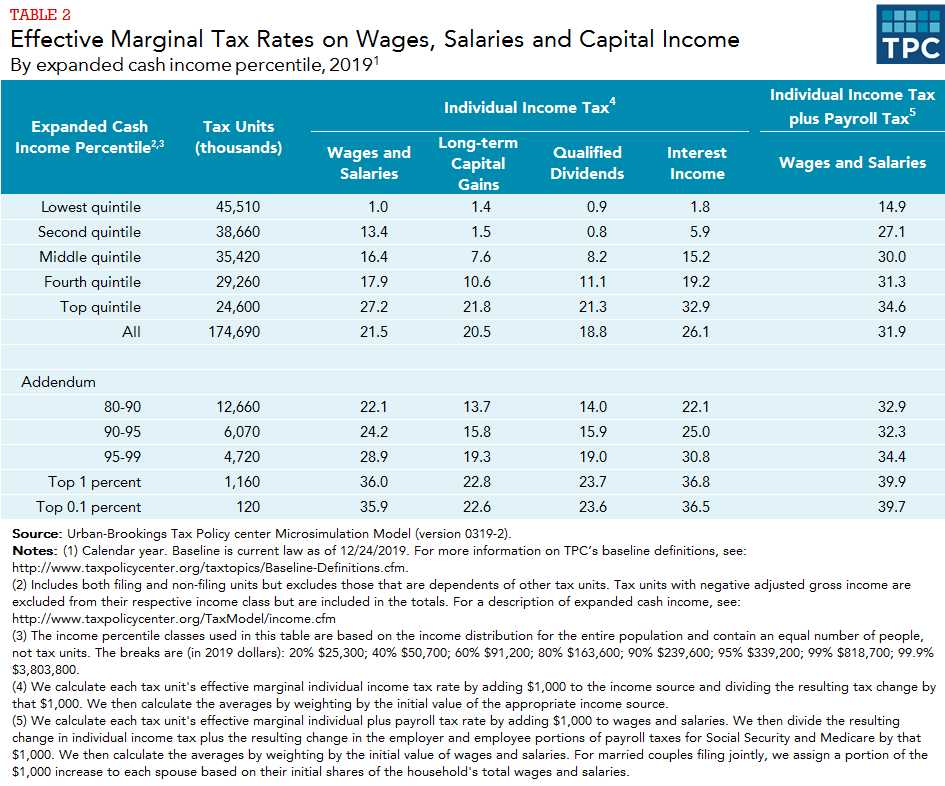

Effective Tax Rates

The effective tax rate takes into account all applicable taxes and deductions to provide a more accurate representation of the actual tax burden. It is calculated by dividing the total tax paid by the taxable income.

For example, if an individual has a taxable income of $50,000 and pays $10,000 in taxes, their effective tax rate would be 20% ($10,000 / $50,000 x 100). This means that, on average, they are paying 20% of their income in taxes.

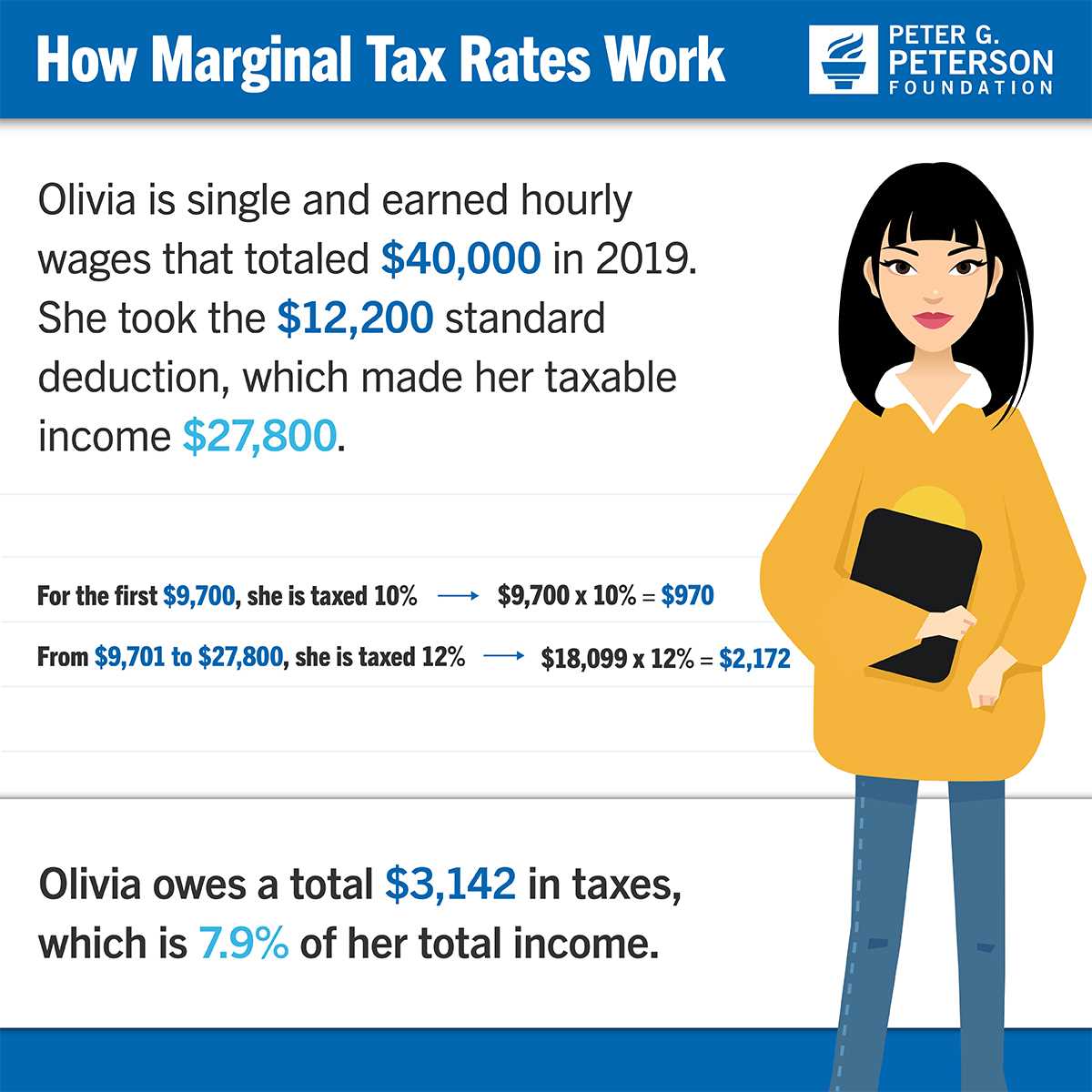

The effective tax rate is often lower than the marginal tax rate, which is the rate at which the last dollar earned is taxed. This is because the marginal tax rate is based on tax brackets, where different income levels are taxed at different rates.

It is important to note that the effective tax rate can vary significantly depending on individual circumstances, such as income level, deductions, and credits. It is always recommended to consult with a tax professional or use tax software to accurately calculate your effective tax rate.

Calculating Your Effective Tax Rate

To calculate your effective tax rate, you need to determine your total tax liability and your total income. Your total tax liability is the amount of taxes you owe based on the tax brackets and rates that apply to your income. Your total income is the sum of all your taxable income sources, such as wages, self-employment income, and investment income.

Once you have your total tax liability and total income, you can calculate your effective tax rate by dividing your total tax liability by your total income and multiplying by 100. The result will be your effective tax rate as a percentage.

| Total Tax Liability | Total Income | Effective Tax Rate |

|---|---|---|

| $10,000 | $100,000 | 10% |

| $20,000 | $150,000 | 13.33% |

| $30,000 | $200,000 | 15% |

For example, if your total tax liability is $10,000 and your total income is $100,000, your effective tax rate would be 10%. This means that you are paying 10% of your total income in taxes.

Calculating your effective tax rate can help you understand how different tax brackets and rates impact your overall tax burden. It can also help you make informed decisions about your finances and tax planning strategies.

Tax Brackets

How Tax Brackets Work

For example, let’s say there are three tax brackets: 10%, 20%, and 30%. The first tax bracket may apply to income up to $50,000 and have a tax rate of 10%. The second tax bracket may apply to income between $50,001 and $100,000 and have a tax rate of 20%. The third tax bracket may apply to income above $100,000 and have a tax rate of 30%.

How Tax Brackets Work

In most countries, including the United States, tax brackets are progressive, meaning that the tax rate increases as income or profits increase. This progressive system is designed to ensure that individuals and businesses with higher incomes pay a higher percentage of their income in taxes.

Each tax bracket has a range of income or profits and a corresponding tax rate. For example, the first tax bracket might be for income up to $50,000 and have a tax rate of 10%. The next tax bracket might be for income between $50,001 and $100,000 and have a tax rate of 15%. This means that individuals or businesses in the second tax bracket would pay a higher tax rate on the portion of their income that falls within that bracket.

Tax Rate vs. Tax Bracket

What is a Tax Rate?

A tax rate is the percentage of income that individuals or businesses are required to pay in taxes. It is determined by the government and can vary depending on the level of income or the type of income being taxed. Tax rates can be progressive, meaning they increase as income increases, or they can be flat, meaning they remain the same regardless of income level.

What is a Tax Bracket?

A tax bracket, on the other hand, is a range of income within which a specific tax rate applies. Tax brackets are used to determine how much tax an individual or business owes based on their income. The tax bracket system is often progressive, with higher income levels being subject to higher tax rates.

For example, let’s say there are three tax brackets: 10%, 20%, and 30%. If an individual’s income falls within the first bracket, they would pay a 10% tax rate on that portion of their income. If their income falls within the second bracket, they would pay a 20% tax rate on that portion, and so on.

The key difference between tax rates and tax brackets is that tax rates refer to the percentage of income being taxed, while tax brackets refer to the range of income within which a specific tax rate applies. Tax rates determine how much tax is owed overall, while tax brackets help determine how much tax is owed on each portion of income within the bracket.

Conclusion

| Tax Rate | Tax Bracket |

|---|---|

| 10% | |

| 20% | |

| 30% | $50,001 and above |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.