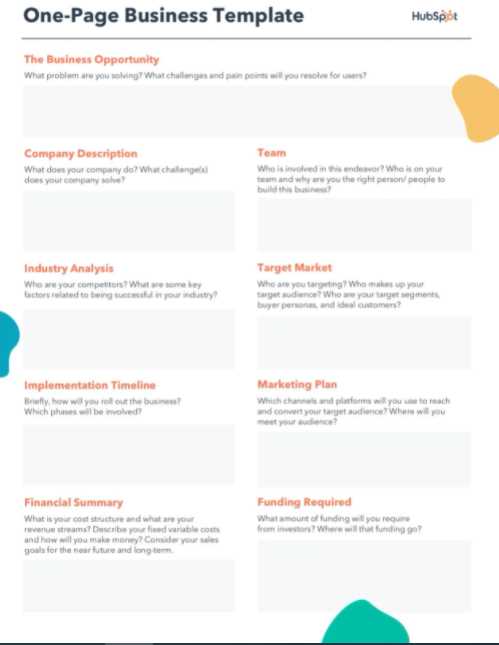

Key Components of a Business Plan

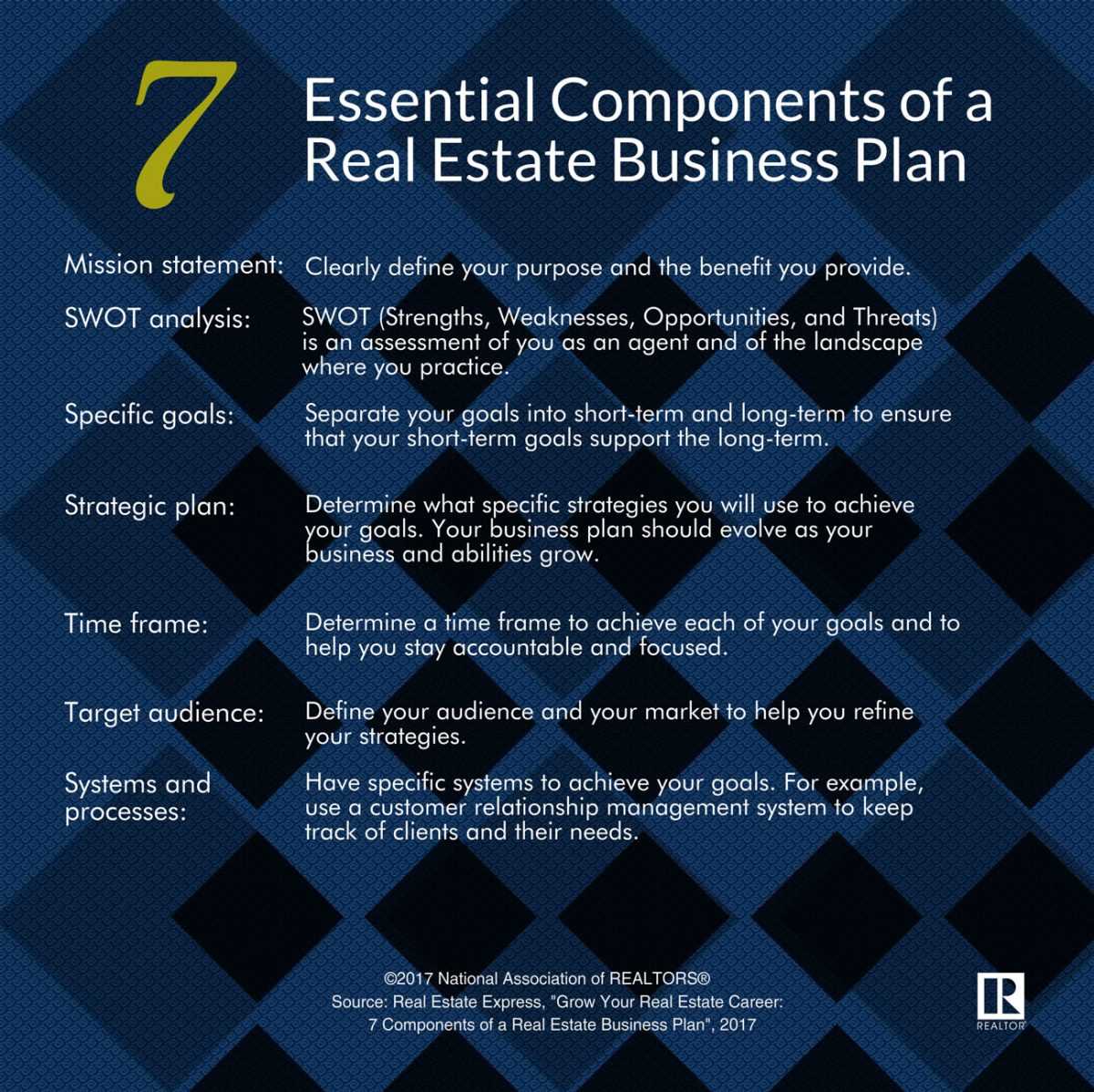

A business plan is a comprehensive document that outlines the goals, strategies, and financial projections of a business. It serves as a roadmap for the company, providing guidance and direction for its future growth and success. To create an effective business plan, there are several key components that should be included:

1. Executive Summary

The executive summary is a brief overview of the entire business plan. It should provide a summary of the company’s mission, vision, and key highlights. This section is important as it is often the first part of the plan that potential investors or lenders will read, so it should be concise and compelling.

2. Company Description

The company description provides detailed information about the business, including its legal structure, industry, and target market. It should also highlight the unique selling proposition of the company and explain why it is well-positioned to succeed in the market.

3. Market Analysis

4. Organization and Management

This section should outline the organizational structure of the company and provide information on the key members of the management team. It should also highlight any strategic partnerships or advisory board members that the company has in place.

5. Product or Service Line

The product or service line section should provide a detailed description of the products or services that the company offers. It should highlight the unique features and benefits of the offerings and explain how they meet the needs of the target market.

6. Marketing and Sales Strategy

The marketing and sales strategy section should outline how the company plans to market and sell its products or services. It should include information on pricing, distribution channels, promotional strategies, and customer acquisition plans.

7. Financial Projections

The financial projections section should include detailed financial forecasts for the business, including income statements, balance sheets, and cash flow statements. It should also include assumptions and explanations for the projections, as well as a break-even analysis and return on investment calculations.

8. Funding Request

If the business plan is being used to seek funding, this section should outline the amount of funding needed and how it will be used. It should also provide information on the company’s current funding sources and any previous funding rounds.

9. Appendix

The appendix is an optional section that can be used to include additional information, such as market research data, product brochures, or resumes of key team members. It should only include information that is relevant and supports the content of the business plan.

By including these key components in your business plan, you will create a comprehensive and effective document that will help guide your business towards success.

Importance of a Business Plan

One of the key reasons why a business plan is important is that it helps to attract investors and secure funding. Investors want to see a well-thought-out plan that demonstrates the potential for growth and profitability. A comprehensive business plan can help to instill confidence in investors and convince them that the business is worth investing in.

Another important aspect of a business plan is that it helps to identify potential risks and challenges that the business may face. By conducting a thorough analysis of the market and the competition, a business plan can help to identify potential threats and develop strategies to mitigate them. This can help the business to be better prepared and increase its chances of success.

A business plan also plays a crucial role in guiding the day-to-day operations of a business. It provides a framework for decision-making and helps to ensure that all activities are aligned with the overall goals and objectives of the business. It also helps to track progress and measure success, allowing the business to make adjustments and improvements as needed.

Key Components of a Business Plan

Executive Summary

Company Description

The company description provides detailed information about the business, including its legal structure, history, and mission statement. It should also highlight the products or services offered by the business, target market, and competitive advantage. This section helps investors and stakeholders understand the nature of the business and its potential for growth.

Market Analysis

The market analysis section involves conducting thorough research on the target market and industry. It should include information about the size of the market, target demographics, customer needs, and competitive landscape. This analysis helps identify opportunities and challenges that the business may face and allows for the development of effective marketing strategies.

Organization and Management

Product or Service Line

The product or service line section describes the specific products or services offered by the business. It should provide detailed information about the features, benefits, and pricing of each product or service. This section helps investors and customers understand the value proposition of the business and its competitive advantage in the market.

Marketing and Sales Strategy

The marketing and sales strategy outlines how the business plans to attract and retain customers. It should include details about the target market, pricing strategy, promotional activities, and distribution channels. This section helps investors understand how the business plans to generate revenue and achieve its sales targets.

Financial Projections

The financial projections section provides an overview of the expected financial performance of the business. It includes projected income statements, balance sheets, and cash flow statements for a specific period, usually three to five years. This section helps investors assess the financial viability of the business and its potential for profitability.

Risk Analysis

The risk analysis section identifies potential risks and challenges that the business may face and outlines strategies to mitigate them. It should include an assessment of market risks, operational risks, financial risks, and legal and regulatory risks. This section demonstrates the business’s ability to identify and manage potential threats and provides reassurance to investors and lenders.

By including these key components in a business plan, entrepreneurs can create a comprehensive and effective document that showcases the potential of their business. It provides a roadmap for success and helps attract investors and lenders who are confident in the business’s ability to achieve its goals.

Conducting Market Research for Your Business Plan

Market research is a crucial step in creating an effective business plan. It involves gathering and analyzing information about your target market, competitors, and industry trends. By conducting thorough market research, you can gain valuable insights that will help you make informed decisions and develop a successful business strategy.

Identify Your Target Market

Analyze Your Competitors

Another important aspect of market research is analyzing your competitors. This involves identifying who your competitors are, what products or services they offer, and how they position themselves in the market. By studying your competitors, you can identify gaps in the market that you can exploit, as well as potential threats to your business.

Study Industry Trends

Market research also involves studying industry trends. This includes analyzing factors such as market growth, customer preferences, technological advancements, and regulatory changes. By staying up-to-date with industry trends, you can identify opportunities for growth and innovation, as well as potential challenges that may arise.

Furthermore, studying industry trends can help you assess the viability of your business idea and determine whether there is a demand for your products or services in the market. This information is crucial for developing a realistic and achievable business plan.

Financial Projections and Analysis in Your Business Plan

When creating a business plan, one of the most critical components is the financial projections and analysis. This section provides a detailed overview of the financial aspects of your business, including revenue forecasts, expense estimates, and profit projections.

Why are Financial Projections Important?

Financial projections are essential for several reasons:

- Attracting Investors: Investors want to see a clear financial plan that demonstrates the potential profitability of your business. Accurate and realistic financial projections can help convince investors to provide funding.

- Planning and Budgeting: Financial projections allow you to plan and budget for the future. By forecasting your revenue and expenses, you can make informed decisions about resource allocation and business growth strategies.

- Evaluating Viability: Financial projections help you assess the viability of your business idea. By analyzing the projected profitability and return on investment, you can determine if your business has a sustainable future.

Key Components of Financial Projections

When creating financial projections for your business plan, consider including the following key components:

- Sales Forecast: Estimate the expected sales revenue for your products or services. This can be based on market research, historical data, or industry benchmarks.

- Expense Projections: Identify and estimate the various expenses associated with running your business, such as rent, salaries, marketing costs, and utilities.

- Profit and Loss Statement: Create a projected profit and loss statement that outlines your expected revenue, expenses, and net profit over a specific period, typically one year.

- Cash Flow Statement: Prepare a cash flow statement that tracks the inflows and outflows of cash in your business. This helps you understand your cash position and identify potential cash flow issues.

- Break-Even Analysis: Conduct a break-even analysis to determine the point at which your business will cover all its costs and start generating a profit.

Financial Analysis

In addition to financial projections, your business plan should include a comprehensive financial analysis. This analysis involves interpreting and evaluating the financial data to gain insights into your business’s performance and potential.

Some key aspects of financial analysis include:

- Ratios and Metrics: Calculate and analyze financial ratios and metrics, such as gross profit margin, return on investment (ROI), and debt-to-equity ratio. These ratios provide valuable insights into your business’s financial health and efficiency.

- Comparison to Industry Standards: Compare your financial performance to industry benchmarks and standards to assess how well your business is performing relative to competitors.

- Identifying Trends and Patterns: Analyze financial data over time to identify trends and patterns that can help you make informed decisions and adjust your business strategies accordingly.

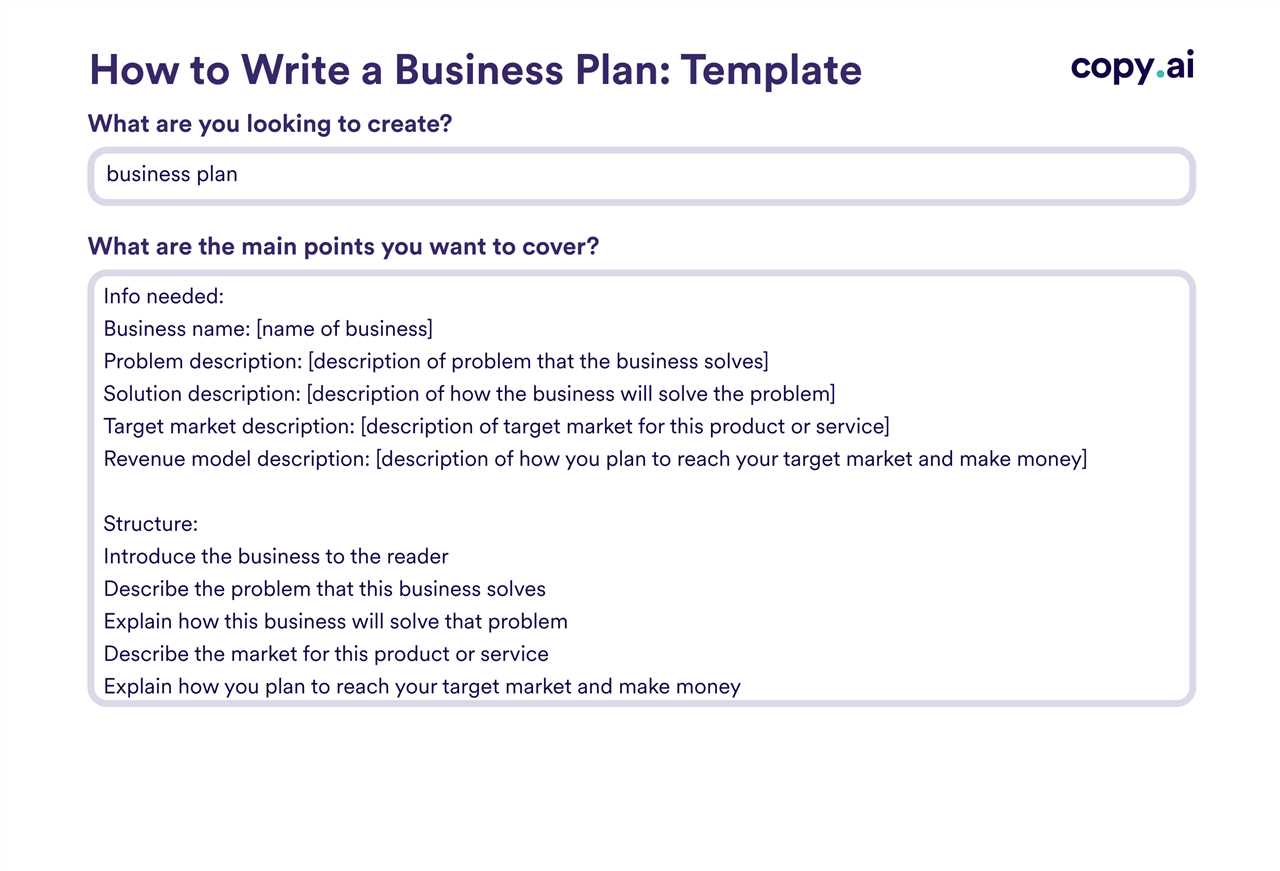

Tips for Writing an Effective Business Plan

Writing an effective business plan is essential for the success of any business venture. A well-crafted business plan serves as a roadmap, outlining the goals, strategies, and financial projections of the business. Here are some tips to help you write an effective business plan:

1. Clearly define your business concept

Start by clearly defining your business concept and what sets it apart from competitors. Explain the problem your business solves and how your product or service addresses that problem. This will help investors and stakeholders understand the value proposition of your business.

2. Conduct thorough market research

Before writing your business plan, conduct thorough market research to understand your target market, industry trends, and customer needs. This will help you identify your target audience, assess the competition, and determine the potential demand for your product or service.

3. Set realistic goals and objectives

Set realistic and achievable goals and objectives for your business. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Clearly outline your short-term and long-term goals, and explain how you plan to achieve them.

4. Develop a comprehensive marketing strategy

A strong marketing strategy is crucial for the success of any business. Outline your marketing plan, including your target audience, pricing strategy, distribution channels, and promotional activities. This will demonstrate to investors that you have a clear plan to reach and attract customers.

5. Include a detailed financial analysis

Provide a detailed financial analysis in your business plan, including projected revenue, expenses, and cash flow. This will help investors assess the financial viability of your business and understand the potential return on investment.

6. Keep it concise and focused

Avoid unnecessary jargon and keep your business plan concise and focused. Use clear and concise language to convey your ideas and avoid overwhelming readers with excessive information. Focus on the key points and highlight the most important aspects of your business.

7. Review and revise

Once you have completed your business plan, review and revise it multiple times. Seek feedback from trusted advisors, mentors, or industry experts to ensure that your plan is comprehensive, realistic, and well-written. Continuously update and refine your business plan as your business evolves.

By following these tips, you can create an effective business plan that will impress investors, guide your business decisions, and increase your chances of success.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.