What is a Level III Quote and How Levels are Used in Stocks

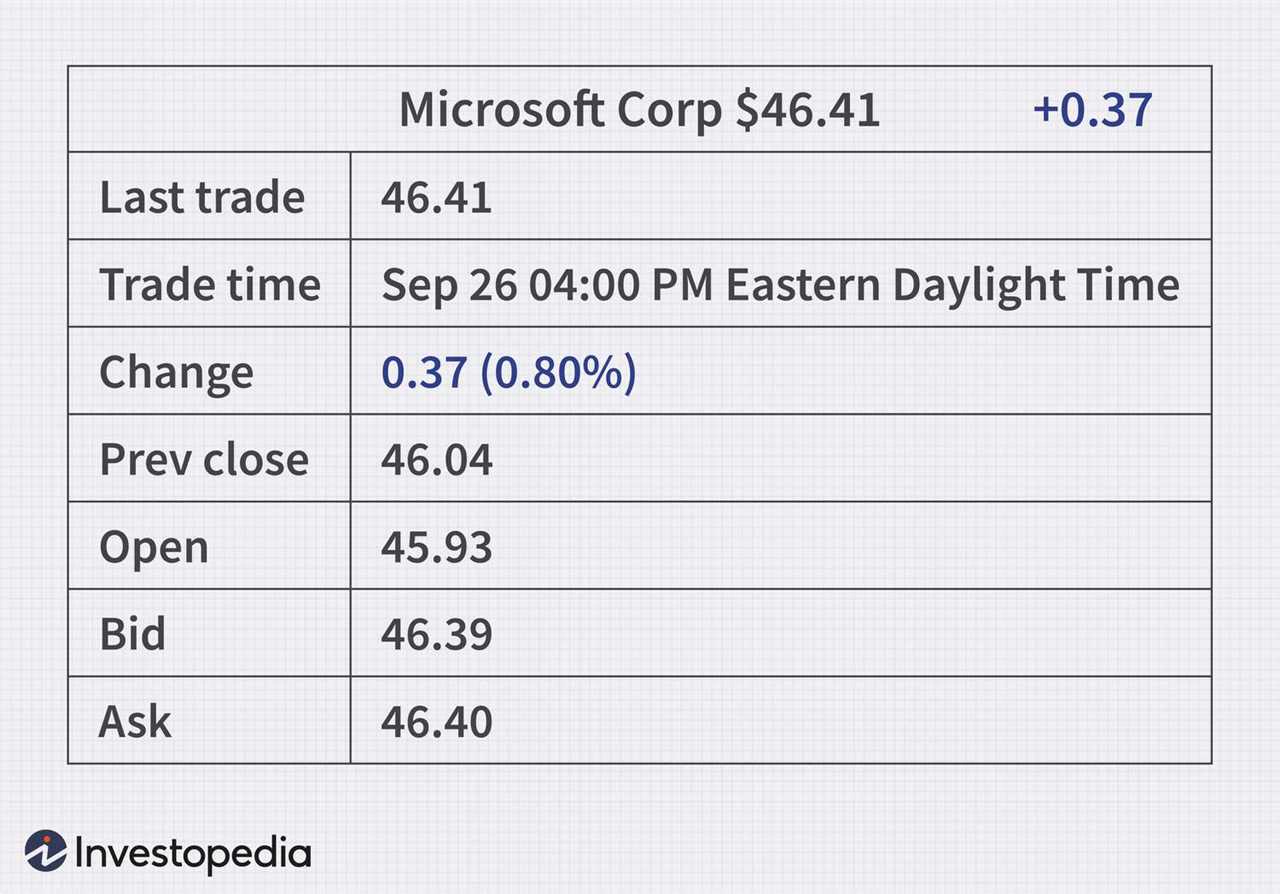

A Level III quote is a type of stock quote that provides detailed information about the bid and ask prices for a particular security. It is commonly used by professional traders and market makers to assess the supply and demand dynamics of a stock.

Level III quotes go beyond the basic bid and ask prices that are displayed in Level I and Level II quotes. They provide additional information about the market depth, showing the number of shares available at each bid and ask price level.

By analyzing Level III quotes, traders can gain insights into the liquidity of a stock and identify potential buying or selling opportunities. For example, if there are a large number of shares available at the current bid price, it may indicate strong buying interest and suggest that the stock price could increase.

What are Level I and Level II Quotes?

Level II quotes, on the other hand, provide traders with more detailed information about the order book for a stock. These quotes show the bid and ask prices from multiple market makers or exchanges, allowing traders to see the depth of the market and the liquidity available at different price levels.

What is a Level III Quote?

Level III quotes are typically used by professional traders and market makers who require a higher level of market data to make informed trading decisions. These quotes allow traders to see the complete picture of supply and demand for a stock, which can help them identify potential trading opportunities.

Using Level III Quotes

Some common uses of Level III quotes include:

- Identifying support and resistance levels: By analyzing the bid and ask prices at different levels, traders can identify key support and resistance levels for a stock.

- Monitoring market depth: Traders can track the liquidity available at different price levels to gauge the strength of buying or selling pressure in the market.

- Detecting hidden orders: Level III quotes can help traders identify hidden orders that are not displayed in Level II quotes, which may indicate the presence of large institutional buyers or sellers.

- Spotting market manipulation: By analyzing the identities of market participants, traders can detect any potential manipulation or coordinated trading activities in the market.

Using Levels in Stocks

One common level that traders pay attention to is the previous high or low of a stock. If a stock is approaching its previous high, it may encounter resistance, as traders who bought at that level in the past may be looking to sell and take profits. On the other hand, if a stock is approaching its previous low, it may find support, as traders who missed out on buying at that level in the past may be looking to enter the market.

Another important level to consider is the 50-day or 200-day moving average. These moving averages are calculated by taking the average price of a stock over a specific time period. Many traders use these moving averages as indicators of the overall trend of a stock. If the stock is trading above its moving averages, it is considered to be in an uptrend, while trading below the moving averages indicates a downtrend.

Traders can also use levels to identify potential breakout opportunities. A breakout occurs when a stock price moves above a significant resistance level or below a significant support level. This indicates a shift in market sentiment and can lead to a strong move in the direction of the breakout. By identifying these levels and monitoring price action, traders can position themselves to take advantage of potential breakouts.

It is important to note that levels are not foolproof and should be used in conjunction with other technical analysis tools and indicators. They should also be adjusted and updated as new price data becomes available. Traders should always be mindful of market conditions and use proper risk management techniques when trading based on levels.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.