What is Property Tax?

Property tax is a type of tax that is levied on the value of a property. It is usually imposed by local governments, such as municipalities or counties, and is used to fund various public services and infrastructure projects.

Definition and Explanation

Property tax is a recurring tax that property owners are required to pay based on the assessed value of their property. The assessed value is determined by the local government and is usually a percentage of the property’s market value. This tax is different from other types of taxes, such as income tax or sales tax, as it is directly tied to the ownership of property.

Property tax is an ad valorem tax, meaning that it is based on the value of the property. The tax rate is typically expressed as a percentage of the assessed value. For example, if the tax rate is 2% and the assessed value of a property is $100,000, the property tax owed would be $2,000.

Uses of Property Tax

The revenue generated from property tax is used to fund a wide range of public services and infrastructure projects. Some common uses of property tax include:

- Funding local schools and education programs

- Maintaining and improving public roads and transportation systems

- Supporting public safety services, such as police and fire departments

- Providing funding for parks, libraries, and other community facilities

Property tax is an important source of revenue for local governments, and it plays a crucial role in supporting the development and maintenance of communities.

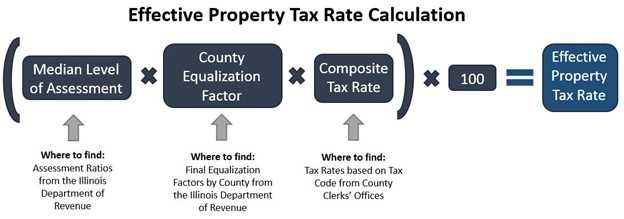

Calculating Property Tax

The calculation of property tax varies depending on the local government and its tax policies. Generally, it involves multiplying the assessed value of the property by the tax rate. However, there may be additional factors, such as exemptions or deductions, that can affect the final tax amount.

It is important for property owners to understand how property tax is calculated in their specific jurisdiction to ensure they are paying the correct amount. Local tax authorities or assessors can provide guidance and information on the calculation process.

Definition and Explanation

Property tax is a type of tax that is levied on real estate or immovable property, such as land, buildings, and homes. It is a form of ad valorem tax, which means that it is based on the value of the property. The tax is typically imposed by local governments, such as municipalities or counties, and is used to fund various public services and infrastructure projects.

The property tax rate is determined by the local government and is usually expressed as a percentage of the assessed value of the property. The assessed value is an estimation of the property’s market value, which is determined by a tax assessor or appraiser. The tax rate may vary depending on the location and type of property.

Property tax is considered a stable source of revenue for local governments because it is typically collected annually and is less susceptible to economic fluctuations. It is also considered a progressive tax, as it is based on the value of the property, which tends to be higher for more valuable properties.

Property tax revenue is used to fund a wide range of public services, including education, public safety, infrastructure maintenance, and social welfare programs. It helps to support the operation of schools, police and fire departments, road maintenance, parks and recreation facilities, and other essential services that benefit the community as a whole.

Property owners are responsible for paying property taxes based on the assessed value of their property. Failure to pay property taxes can result in penalties, such as fines or even the loss of the property through a tax lien or foreclosure. Property tax payments are typically due annually or semi-annually, and property owners may have the option to pay in installments or in a lump sum.

Uses of Property Tax

Property tax is a significant source of revenue for local governments and is used to fund various public services and infrastructure projects. Here are some of the key uses of property tax:

Funding Education

One of the primary uses of property tax is to fund education. A portion of the property tax revenue is allocated to public schools, colleges, and universities to ensure that students have access to quality education. This funding helps in hiring teachers, providing resources, and maintaining educational facilities.

Maintaining Public Infrastructure

Property tax is also used to maintain and improve public infrastructure such as roads, bridges, parks, and public transportation systems. The revenue generated from property tax helps in repairing and upgrading existing infrastructure and building new facilities to meet the needs of the growing population.

Providing Public Safety Services

Another important use of property tax is to fund public safety services such as police and fire departments. The revenue generated from property tax helps in hiring and training police officers and firefighters, purchasing equipment and vehicles, and maintaining public safety facilities. This ensures the safety and well-being of the community.

Supporting Health and Social Services

Property tax revenue is also utilized to support health and social services in the community. It helps in funding healthcare facilities, clinics, and programs that provide essential services to the residents. Additionally, property tax revenue is used to support social welfare programs, including assistance for low-income individuals and families.

Preserving and Enhancing the Environment

Property tax is often used to preserve and enhance the environment. The revenue generated from property tax is allocated to initiatives aimed at protecting natural resources, conserving open spaces, and promoting sustainable practices. This helps in creating a cleaner and healthier environment for current and future generations.

| Uses of Property Tax |

|---|

| Funding Education |

| Maintaining Public Infrastructure |

| Providing Public Safety Services |

| Supporting Health and Social Services |

| Preserving and Enhancing the Environment |

How Property Tax is Utilized

Property tax is a crucial source of revenue for local governments and is utilized in various ways to fund public services and infrastructure projects. Here are some of the key ways in which property tax is utilized:

Funding Local Services

One of the primary uses of property tax is to fund local services such as schools, police and fire departments, parks, libraries, and public transportation. Property tax revenue is an essential source of funding for these services, ensuring that they can operate effectively and provide necessary resources to the community.

Investing in Infrastructure

Property tax revenue is often used to invest in infrastructure projects that benefit the community as a whole. This includes the construction and maintenance of roads, bridges, public buildings, and utilities. By utilizing property tax funds for infrastructure, local governments can improve the quality of life for residents and attract businesses and economic development to the area.

Supporting Social Programs

Property tax revenue can also be allocated to support social programs aimed at assisting vulnerable populations and promoting community welfare. This may include funding for affordable housing initiatives, healthcare services, youth programs, senior citizen centers, and other social welfare programs. Property tax plays a crucial role in ensuring that these programs have the necessary resources to provide assistance and support to those in need.

Emergency Services

Property tax revenue is vital for funding emergency services such as police, fire, and ambulance services. These services are essential for maintaining public safety and responding to emergencies effectively. By utilizing property tax funds, local governments can ensure that emergency services are adequately staffed, equipped, and able to provide timely assistance to residents in times of need.

Maintaining Public Spaces

Another important use of property tax is to maintain and improve public spaces within the community. This includes parks, recreational facilities, community centers, and green spaces. By allocating property tax funds to the maintenance and enhancement of these public spaces, local governments can provide residents with access to recreational opportunities, promote community engagement, and enhance the overall quality of life in the area.

Calculating Property Tax

Calculating property tax involves several factors that vary depending on the jurisdiction and the specific property being assessed. It is important to understand the process in order to accurately determine the amount of property tax owed.

Assessment Value

The assessment value can be determined through various methods, such as a physical inspection of the property, analysis of recent sales of similar properties in the area, or using a computer-assisted mass appraisal system. The goal is to determine a fair and accurate value that reflects the current market conditions.

Tax Rate

For example, if the assessment value of a property is $200,000 and the tax rate is 1.5%, the property tax owed would be $3,000 ($200,000 x 0.015).

Exemptions and Deductions

In some cases, property owners may be eligible for exemptions or deductions that can reduce the amount of property tax owed. These can include exemptions for senior citizens, veterans, or properties used for certain purposes such as agriculture or non-profit organizations.

It is important to check with the local government or assessor’s office to determine if any exemptions or deductions apply to your property. This can help reduce the overall tax burden and save money.

Additionally, some jurisdictions may offer payment plans or discounts for early payment of property taxes. These options can provide further opportunities for savings and should be explored.

Appeals Process

If a property owner disagrees with the assessment value or believes there are errors in the calculation of their property tax, they may have the option to appeal the decision. This typically involves providing evidence or documentation to support their claim and presenting it to the appropriate authority.

The appeals process can vary depending on the jurisdiction, so it is important to understand the specific requirements and deadlines. Consulting with a tax professional or attorney may be beneficial in navigating this process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.