Education IRA: Definition, Rules and Limits, Vs 529 Plan

The funds in an Education IRA can be used to pay for qualified education expenses, including tuition, fees, books, supplies, and certain room and board expenses. These expenses can be incurred at any eligible educational institution, from elementary school through college and beyond.

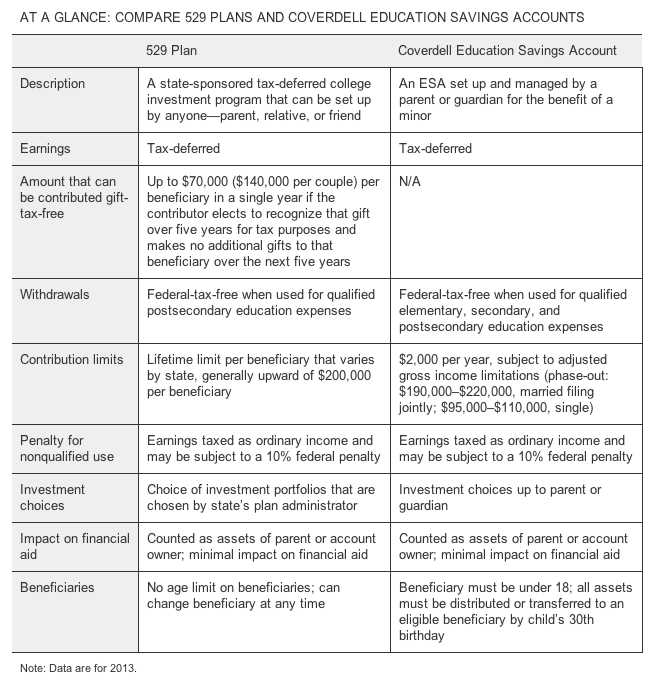

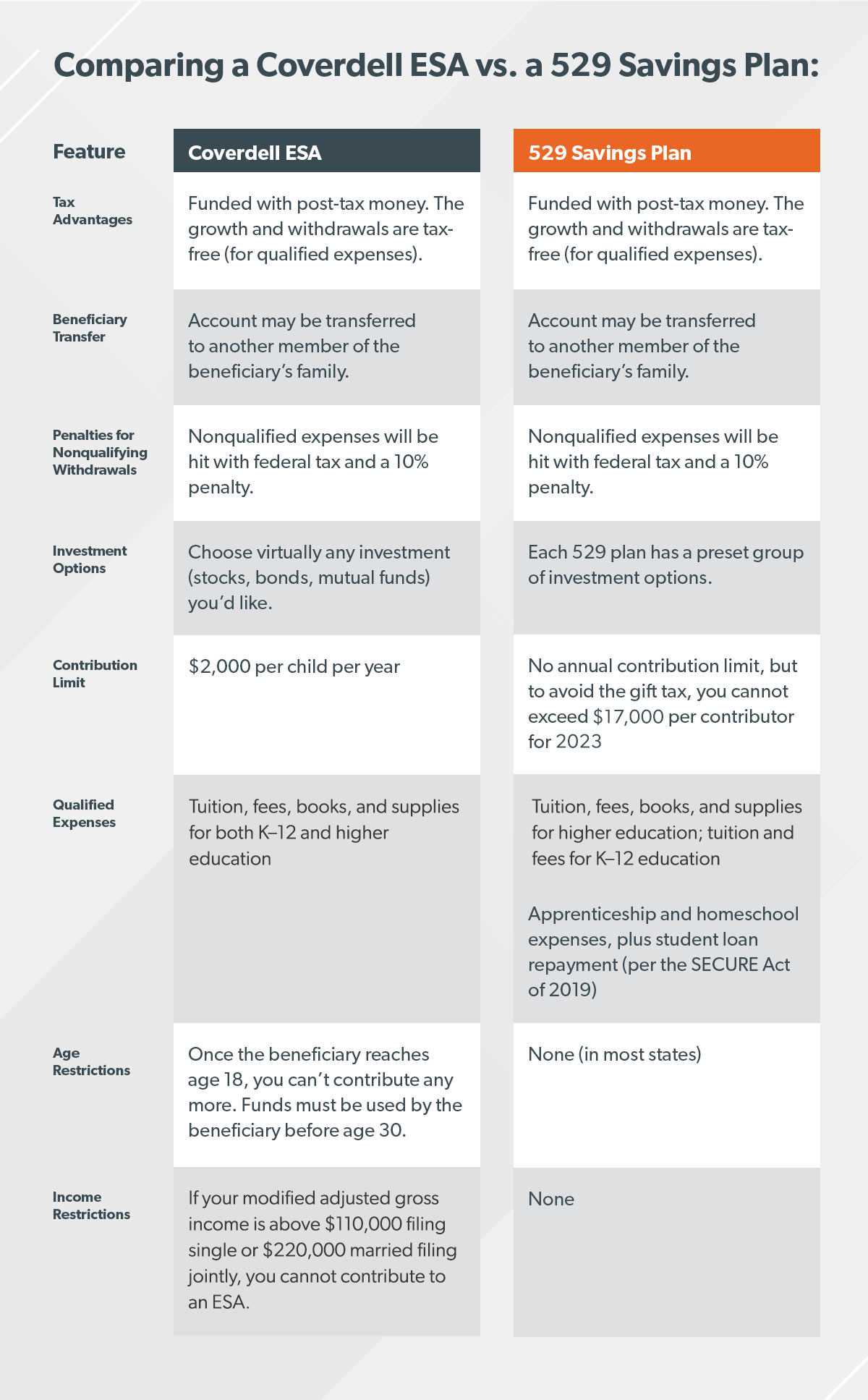

Unlike a 529 plan, which is state-sponsored, an Education IRA is not limited to a specific state and can be opened by anyone, regardless of income level. Additionally, the funds in an Education IRA can be used for K-12 education expenses, whereas a 529 plan is typically limited to higher education expenses.

Another important aspect of an Education IRA is that the account must be used by the time the beneficiary reaches the age of 30, unless the beneficiary has special needs. If the funds are not used by the deadline, they must be distributed and may be subject to taxes and penalties.

Overall, an Education IRA can be a valuable tool for saving for education expenses. It offers tax advantages and flexibility in terms of eligible expenses and educational institutions. However, it is important to carefully consider the rules and limits associated with an Education IRA and compare it to other education savings options, such as a 529 plan, to determine the best fit for your individual circumstances.

What is an Education IRA?

Unlike a 529 plan, which is state-sponsored, an Education IRA is a self-directed account that can be opened at a bank, brokerage firm, or other financial institution. This gives individuals more control over how their contributions are invested.

Contributions to an Education IRA are not tax-deductible, but the earnings grow tax-free. The maximum annual contribution limit is $2,000 per beneficiary, and contributions can be made until the beneficiary reaches the age of 18.

One of the unique features of an Education IRA is that it can be used for both primary and secondary education expenses, as well as higher education. This includes expenses for public, private, and religious schools.

Overall, an Education IRA provides individuals with a tax-advantaged way to save for education expenses. It offers flexibility in terms of investment options and can be used for a wide range of educational expenses. However, it is important to note that there are income limitations for contributing to an Education IRA, and contributions may be subject to penalties if not used for qualified education expenses.

Education IRA Rules and Limits

Contributions:

Contributions to an Education IRA can be made by anyone, including parents, grandparents, and other family members. The maximum annual contribution limit is $2,000 per beneficiary. However, this amount is subject to income limitations. For single filers, the ability to contribute begins to phase out at a modified adjusted gross income (MAGI) of $95,000 and is completely phased out at $110,000. For joint filers, the phase-out range is $190,000 to $220,000.

Qualified Expenses:

The funds in an Education IRA can be used to pay for qualified education expenses, which include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Qualified expenses also include certain expenses for special needs beneficiaries.

Withdrawals:

Transfer and Rollover:

An Education IRA can be transferred or rolled over to another Education IRA for the same beneficiary or a member of the beneficiary’s family. The transfer or rollover must be completed within 60 days to avoid taxes and penalties.

Age Limit:

The funds in an Education IRA must be used by the time the beneficiary reaches age 30, unless the beneficiary has special needs. In the case of special needs beneficiaries, there is no age limit for using the funds.

Non-Deductible Contributions:

Contributions to an Education IRA are not tax-deductible, meaning they are made with after-tax dollars. However, the earnings on the contributions grow tax-free, and qualified withdrawals are also tax-free.

It is important to carefully consider the rules and limits of an Education IRA before opening one. Consulting with a financial advisor or tax professional can help ensure that you are making the most of this tax-advantaged savings account for education expenses.

Benefits of an Education IRA

1. Tax Advantages:

2. Flexible Use of Funds:

The funds in an Education IRA can be used for a wide range of qualified education expenses, including tuition, fees, books, supplies, and even certain room and board expenses. This flexibility allows account holders to cover various educational needs, from elementary school to college and beyond.

3. Control over Investments:

With an Education IRA, the account holder has control over how the funds are invested. This means that they can choose from a variety of investment options, such as stocks, bonds, mutual funds, and certificates of deposit, based on their risk tolerance and investment goals.

4. Transferability:

If the beneficiary of an Education IRA does not use all the funds for education expenses, the remaining balance can be transferred to another eligible family member without incurring any penalties. This allows for flexibility in distributing the funds among siblings or other relatives who may also have educational needs.

5. Lower Impact on Financial Aid:

Compared to other types of college savings accounts, Education IRAs have a relatively low impact on financial aid eligibility. This is because the funds in an Education IRA are considered an asset of the account holder, rather than the student, which can result in a lower expected family contribution (EFC) when applying for financial aid.

Education IRA Vs 529 Plan

On the other hand, a 529 Plan is a state-sponsored investment account specifically designed for education savings. There are two types of 529 Plans: prepaid tuition plans and college savings plans. Prepaid tuition plans allow you to prepay tuition at today’s rates for future use, while college savings plans allow you to invest in a variety of investment options, similar to a retirement account.

One major difference between an Education IRA and a 529 Plan is the contribution limits. For an Education IRA, the maximum annual contribution is $2,000 per beneficiary. In contrast, 529 Plans have much higher contribution limits, typically in the hundreds of thousands of dollars.

Another difference is the flexibility of funds. With an Education IRA, the funds can be used for a wide range of education expenses, including tuition, books, supplies, and even certain room and board expenses. 529 Plans, on the other hand, are typically limited to qualified higher education expenses.

Additionally, Education IRAs have income limits for contributors. To contribute to an Education IRA, your modified adjusted gross income (MAGI) must be below a certain threshold. This limit varies depending on your filing status. 529 Plans do not have income limits, so anyone can contribute regardless of their income level.

It’s also important to consider the impact on financial aid eligibility. Both Education IRAs and 529 Plans are considered assets of the account owner, which means they can have an impact on financial aid eligibility. However, the impact may be different depending on the type of account and the specific financial aid formula used by the institution.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.