What is a Backdoor Roth IRA?

A Backdoor Roth IRA is a strategy that allows high-income earners to contribute to a Roth IRA, even if their income exceeds the limits set by the IRS. It involves making a non-deductible contribution to a Traditional IRA and then converting it to a Roth IRA.

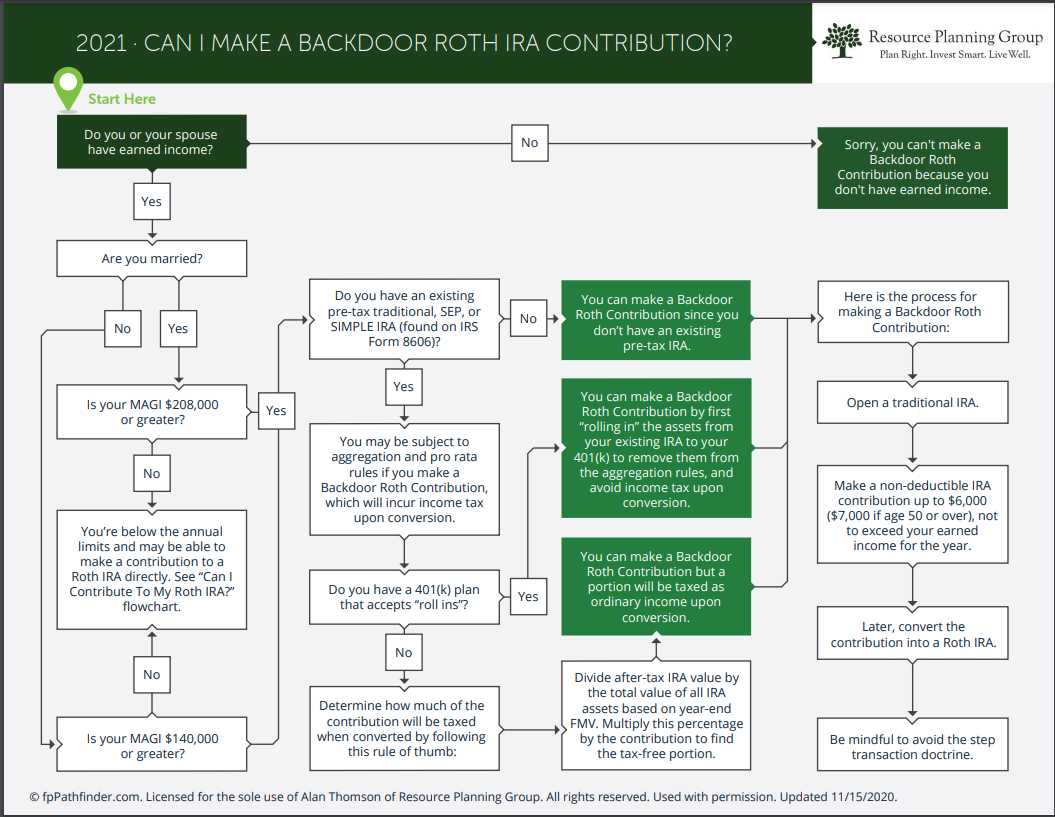

The Roth IRA is a retirement savings account that offers tax-free growth and tax-free withdrawals in retirement. However, there are income limits for contributing to a Roth IRA. In 2021, the income limit for single filers is $140,000 and for married couples filing jointly, it is $208,000. If your income exceeds these limits, you are not eligible to contribute directly to a Roth IRA.

That’s where the Backdoor Roth IRA comes in. By making a non-deductible contribution to a Traditional IRA, which has no income limits, you can then convert it to a Roth IRA. This conversion is not subject to income limits, allowing high-income earners to take advantage of the benefits of a Roth IRA.

| Advantages of a Backdoor Roth IRA |

|---|

| 1. Tax-Free Growth: With a Roth IRA, your contributions grow tax-free over time. This can result in significant savings, especially if you have many years until retirement. |

| 2. Tax-Free Withdrawals: Unlike Traditional IRAs, withdrawals from a Roth IRA in retirement are tax-free. This can provide a significant advantage, as you won’t have to pay taxes on your withdrawals, potentially saving you thousands of dollars. |

| 3. No Required Minimum Distributions (RMDs): Roth IRAs are not subject to RMDs during the account owner’s lifetime. This means you can leave the funds in your Roth IRA to continue growing tax-free for as long as you like, providing more flexibility in retirement planning. |

| 4. Estate Planning Benefits: Roth IRAs can be an excellent tool for passing on wealth to your heirs. Since withdrawals are tax-free for beneficiaries, a Roth IRA can provide a tax-efficient way to transfer assets. |

Overall, a Backdoor Roth IRA can be a valuable strategy for high-income earners who want to take advantage of the benefits of a Roth IRA. It allows them to save for retirement with tax-free growth and tax-free withdrawals, even if their income exceeds the limits for direct contributions to a Roth IRA.

A Backdoor Roth IRA is a strategy that allows high-income earners to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. By utilizing this strategy, individuals can take advantage of the tax benefits offered by a Roth IRA, such as tax-free growth and tax-free withdrawals in retirement.

Advantages of a Backdoor Roth IRA

There are several advantages to using a Backdoor Roth IRA:

- Tax-Free Growth: Contributions made to a Roth IRA are made with after-tax dollars, meaning that any investment gains within the account can grow tax-free. This can result in significant savings over time, especially if the investments experience substantial growth.

- Tax-Free Withdrawals: Unlike traditional IRAs, which require individuals to pay taxes on withdrawals in retirement, Roth IRAs allow for tax-free withdrawals. This can be especially beneficial for individuals who anticipate being in a higher tax bracket in retirement.

- No Required Minimum Distributions (RMDs): Traditional IRAs require individuals to start taking required minimum distributions (RMDs) once they reach a certain age. With a Roth IRA, there are no RMDs, allowing individuals to maintain control over their retirement savings and potentially pass on a larger inheritance to their beneficiaries.

Tax Implications of a Backdoor Roth IRA

| Contributions | Tax Treatment |

|---|---|

| Pre-Tax Contributions | Taxed at the time of withdrawal |

| After-Tax Contributions | Tax-free at the time of withdrawal |

When utilizing a Backdoor Roth IRA, individuals must first make a non-deductible contribution to a traditional IRA. This contribution is made with after-tax dollars and is not tax-deductible. Once the contribution is made, individuals can then convert the traditional IRA to a Roth IRA, which allows for tax-free growth and tax-free withdrawals in retirement.

Advantages of a Backdoor Roth IRA

A Backdoor Roth IRA offers several advantages for individuals looking to save for retirement:

1. Tax-Free Growth:

One of the main advantages of a Backdoor Roth IRA is the potential for tax-free growth. Unlike traditional IRAs, which are funded with pre-tax dollars and taxed upon withdrawal, Roth IRAs are funded with after-tax dollars and offer tax-free growth. This means that any earnings within the account can grow tax-free over time, allowing individuals to potentially accumulate more wealth for retirement.

2. Tax-Free Withdrawals:

Another advantage of a Backdoor Roth IRA is the ability to make tax-free withdrawals in retirement. Since contributions to a Backdoor Roth IRA are made with after-tax dollars, individuals are not required to pay taxes on withdrawals in retirement. This can be especially beneficial for individuals who expect to be in a higher tax bracket in retirement or who want to have more control over their tax liabilities.

3. No Required Minimum Distributions (RMDs):

4. Flexibility and Control:

A Backdoor Roth IRA offers flexibility and control over investments. Individuals can choose how to invest their contributions, whether it be in stocks, bonds, mutual funds, or other investment options. This allows individuals to tailor their investment strategy to their specific goals and risk tolerance. Additionally, individuals can also choose when and how much to contribute to their Backdoor Roth IRA, giving them the ability to maximize their savings and take advantage of any potential tax benefits.

5. Estate Planning Benefits:

A Backdoor Roth IRA can also provide estate planning benefits. Since Roth IRAs do not have RMDs and offer tax-free withdrawals, individuals can use these accounts to pass on tax-free wealth to their beneficiaries. This can be advantageous for individuals who want to leave a legacy for their loved ones or who want to minimize the tax burden on their heirs.

How a Backdoor Roth IRA Can Help You Save for Retirement

A Backdoor Roth IRA can be a valuable tool to help you save for retirement. Here are some ways it can benefit you:

- Tax-free growth: One of the main advantages of a Backdoor Roth IRA is that any earnings within the account grow tax-free. This means that you won’t have to pay taxes on the growth of your investments, allowing your savings to potentially grow faster over time.

- Higher contribution limits: With a Backdoor Roth IRA, you can contribute up to $6,000 per year (or $7,000 if you’re age 50 or older) as of 2021. This is higher than the contribution limits for traditional IRAs, allowing you to save more for retirement.

- No required minimum distributions (RMDs): Unlike traditional IRAs, which require you to start taking minimum distributions at age 72, Backdoor Roth IRAs have no RMDs. This means that you can leave your money in the account to continue growing tax-free for as long as you like.

- Tax-free withdrawals: When you retire and start taking withdrawals from your Backdoor Roth IRA, the money is tax-free, as long as you meet certain requirements. This can be a significant advantage, as it allows you to potentially reduce your tax burden in retirement.

- Flexibility: A Backdoor Roth IRA offers flexibility in terms of investment options. You can choose from a wide range of investment vehicles, such as stocks, bonds, mutual funds, and ETFs, allowing you to create a diversified portfolio that aligns with your risk tolerance and financial goals.

Tax Implications of a Backdoor Roth IRA

It’s also important to consider the pro-rata rule when converting funds to a Roth IRA. The pro-rata rule states that if you have both pre-tax and after-tax funds in your traditional IRA, the conversion will be subject to taxes based on the proportion of pre-tax funds in your account. This means that if you have a significant amount of pre-tax funds in your traditional IRA, the tax implications of a Backdoor Roth IRA conversion may be higher.

It’s also worth noting that once funds are converted to a Roth IRA, they are subject to certain rules and restrictions. For example, there is a five-year waiting period before you can withdraw earnings from a Roth IRA tax-free. Additionally, early withdrawals before the age of 59 1/2 may be subject to penalties and taxes.

What You Need to Know About Taxes and Contributions

Tax Implications

Contributions to a Backdoor Roth IRA are made with after-tax dollars, meaning you have already paid taxes on the money you contribute. This is different from a traditional IRA, where contributions are made with pre-tax dollars.

One of the main advantages of a Backdoor Roth IRA is that qualified distributions are tax-free. This means that when you withdraw money from your Roth IRA during retirement, you won’t have to pay any taxes on the earnings.

Contribution Rules

- There are income limits for contributing directly to a Roth IRA. However, there are no income limits for converting a traditional IRA to a Roth IRA.

- There is no limit on the amount you can convert from a traditional IRA to a Roth IRA.

- You can contribute to a Backdoor Roth IRA at any age, as long as you have earned income.

It’s worth noting that tax laws and regulations can change, so it’s always a good idea to consult with a tax professional or financial advisor before making any decisions regarding a Backdoor Roth IRA.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.